Big winners in China-US tariff truce: supply chain managers using FTZ's to build stocks, buy time

This is a transcript, for the YouTube video found here:

Bullets:

Supply chain executives use just-in-time inventory management systems to carefully balance forecasted demand, against the high costs of stocking goods.

But the escalation of tariffs between the US and China compelled them to fill all available warehouse space, in the hope that a resolution would be reached before tripling prices at the retail level.

Foreign Trade Zones were a valuable tool to this end. FTZ's are scattered throughout the United States, and serve vast areas of the country. Wholesalers can legally import and stockpile product in bonded warehouses in FTZ's, and delay paying tariffs until the goods are withdrawn for sale or use.

Supply chain executives took an expensive gamble that the tariffs would come down before their shelves emptied, and even directed Chinese shipments to warehouses in Canada to further build out available stock.

With the tariff rates dropping from 145%-plus, to 30%, products can come out of the FTZ facilities and into stores, with sufficient additional stock pending the arrival of new shipments from Asia.

Report:

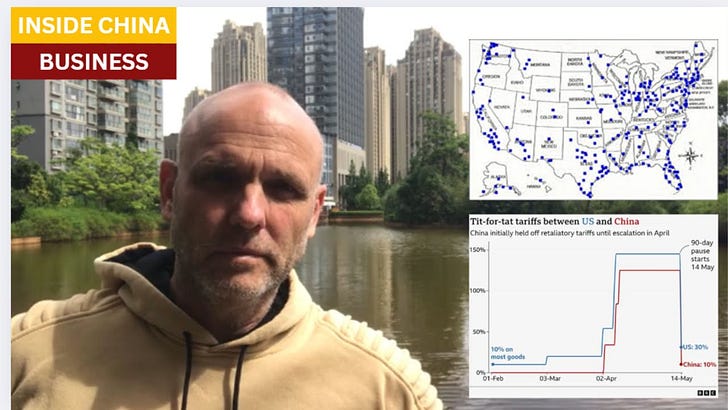

Good morning. Supply chain management is supposed to be boring. When the system is working, either for a company or for an economy, nobody even knows it’s there. But when stresses come, or major unforeseen events hit markets, the system can break down, and products may be available only at prohibitively high prices, or maybe not at all.

It was widely expected that the new Trump administration would announce new tariffs on imports, especially from China, and supply chain executives planned accordingly.

But the size and scale of the new tariffs were not expected. So supply chain managers, inventory management executives, and logistics companies deployed other tools to buy them some time, and put off big price increases that would have hurt their customers and their companies.

Just-in-time is famous in manufacturing. It’s what made Toyota rich, and Toyota’s super-lean parts ordering and manufacturing process dramatically sped up everything for them, while cutting costs. JIT has been copied by almost all the major manufacturers of capital equipment. But Just In Time is much more important in inventory management, and retailers and warehouse managers use JIT to keep their costs low.

This is all a careful balancing act. In previous years, retailers used a just-in-case approach. If a customer walked in and wanted something, we needed to have it in stock, just in case. We don’t want to lose a customer. But then companies got very good at predicting what customers will want, and predicting exactly how many of each product would be in demand over the short term. Better global logistics and the air freight industry made it even easier—merchants could place an order and have it arrive the next day, from anywhere in the world. Better demand forecasting, and global logistics that allow for next-day delivery, made just-in-time inventory management possible for businesses everywhere, in almost every industry.

The pandemic screwed up all of that. Consumers around the world weren’t allowed to even go outside, let alone to the mall. That was the demand side. The supply side was just as bad. Container ships weren’t being loaded in Asian ports, and then when they did, traffic jams formed outside our ports. There was a supply shock, followed by a bullwhip effect which blew up supply chains again.

Eventually things settled down, and by last year, companies were feeling more comfortable again, and moved back toward JIT systems. The focus is on re-ordering and shipping, replenishing products instead of stocking products.

This is the most important chart for warehouse and supply chain managers. The inventory-to-sales ratio shows how much merchandise is kept in warehouses, available for sale. It is the value of inventory, divided by monthly sales. These are monthly numbers then, on the Y-axis. During the pandemic it collapsed, to 1.15. 1.15 here means one month, and 4 days. So about 35 days of inventory available. Then came the glut, as ships were full of merchandise that nobody wanted anymore, like exercise pants and home gyms, so it went up to 45 days, or so. Now it’s trending back to the recent historical trend, 1.35, which is about 40 days.

These don’t seem like big differences, but they are. It costs a lot of money to build a warehouse, and staff it. Or to lease a warehouse, and hire security, and people to move merchandise around, insurance against fire and theft. Obsolescence is a major problem, especially in electronics and fashion. Big, bulky items take up a lot of space, and are usually low-profit margin as well, which explains why there was a run on toilet paper and stores literally had none of it sitting around—you don’t want an expensive warehouse full of cheap toilet paper at 15 cents a roll. The difference, economy wide, of that 5 days’ difference is tens of billions of dollars a year in cost savings.

“Companies are now able to predict shopper demand” . . . “amid fewer supply chain disruptions.” And that first part is true, but supply chain disruptions are by their nature unpredictable. Wars, major storms, major policy shifts, pandemics. But what is predictable is the cost of keeping merchandise that does not sell, or will not sell for 2 months. Those costs are knowable, and inventory managers are paid to keep those costs down. So last year they were cutting inventory levels. Major retailers like WalMart updated their forecasting, and shifted to smaller shipments. They can predict lead times better, and Wal Mart was cutting inventory even while growing sales.

Now these new tariffs are driving up the cost, a lot, of bringing new product in. It’s also become quite risky to do so, because as a merchant, you don’t want to place a large order and pay a high tariff, then have it go away. You’ll wait, unless it is something you must-have, and that you know you can turn at a huge markup that includes the tariff. So there is a lot of uncertainty, which is putting a big dent in production from factories that build for the US market

.But wholesales and the major retailers have a way around that, somewhat. And this is the second, powerful tool they have. Here is a map of Foreign Trade Zones in the United States. By taking delivery of products in an FTZ, merchants can postpone the payment of tariffs. An FTZ is considered outside the taxable jurisdiction of US Customs. Tariffs and duties are not paid until they leave the FTZ, and then are either sold or used outside the FTZ. Importers using a warehouse in a foreign trade zone have a choice of paying tariffs in whatever way is most advantageous to them.

Typically the facilities are just warehouses, which are designated as part of the free trade zone. And that map is a little bit misleading, because the areas designated as free trade zones are enormous.

This is a map of North Carolina. The gray areas are the parts of North Carolina that are NOT considered part of an FTZ.

Just one Foreign Trade Zone, in Illinois, takes up half the lower part of the state. For a company with its own warehouse, it costs just a few thousand dollars to apply for an FTZ designation for that particular location, and then the company can import merchandise without paying tariffs, by putting into that particular warehouse. When he takes a product out of the warehouse to sell it to a buyer, or use it himself--that is when the customs tariffs are paid.

It was worthwhile, then, for companies to stock up their own warehouses in Foreign Trade Zones, or to use a third-party bonded warehouse, to store their products, and when the tariffs come down they will have goods ready to sell.

And that is exactly what they did. Those warehouses in our Foreign Trade Zones were filled up, and we got news from Canada that companies were routing shipments there to stockpile goods, instead of in warehouses at home. 50% of consignments outbound China for the US were sent instead to Canada in April. Amazon and WalMart are the big names mentioned in that report, and their strategy was to wait until the tariffs fall, before releasing them to the market. In fact, companies told some of their suppliers here in China to resume production, after they forecasted – correctly – either that the tariffs would fall, or that demand would resume despite higher prices.

With the news of the steep reduction in tariffs, this was a high-risk, high-reward gamble that probably paid off. It cost these companies a lot of money to fill up their warehouses across all these FTZ’s, then fill up a bunch more up in Canada. Had the very high tariffs stayed on—at 145%, or more—these merchants soon would have faced customers looking for products that are not available on their shelves, but which are sitting in a warehouse just down the street in a Foreign Trade Zone. And at 145%, they would have had some painful decisions to make, as to what the retail price should be on products they pull out of their warehouses at 2.5 times the factory costs. Then, whether to reorder new inventory to restock product from those sales.

Now the tariffs are 30%. A 30% tariff is still high, and taxes on these Chinese-made goods still will be a hard hit to demand, and managers will have some hard decisions to make. But the good news is that products are there, right now, available for sale to their customers.

Resources and links:

Chinese-U.S. imports being diverted to Canada amid trade war

https://truenorthwire.com/2025/05/chinese-u-s-imports-being-diverted-to-canada-amid-trade-war/

America’s Central Port: Foreign Trade Zone 31

https://www.americascentralport.com/foreign-trade-zone-31

Zerohedge, Chinese-US Imports Being Diverted To Canada Amid Trade War

https://www.zerohedge.com/economics/chinese-us-imports-being-diverted-canada-amid-trade-war

2024 Top Free Trade Zones

https://siteselection.com/u-s-foreign-trade-zone-activity-in-gulf-states-leads-to-a-record-breaking-year/

Reuters, Big US retailers' 'just-in-time inventory' habit makes a comeback

Wall Street Journal, Retailers Return to Bringing in Inventory ‘Just in Time’

https://www.wsj.com/articles/retailers-return-to-bringing-in-inventory-just-in-time-4613e3ee

Plunging LA port volumes spell trouble for truckers

https://www.freightwaves.com/news/plunging-la-port-volumes-trouble-truckers

The trucking industry hits the brakes with tariffs set to dent imports

Chinese freight ship traffic to busiest U.S. ports, Los Angeles, Long Beach, sees steep drop

https://www.cnbc.com/2025/04/22/busiest-us-ports-see-big-drop-in-chinese-freight-vessel-traffic.html

Wall Street Journal, Pandemic-era shortages may return without trade-war deal with China, businesses warn

Walmart, Home Depot, Target Push Chinese Suppliers To Resume Shipments, Agree To Absorb Tariffs: Report

https://finance.yahoo.com/news/walmart-home-depot-target-push-204214166.html

South China Morning Post Exclusive | Walmart has told some Chinese suppliers to resume shipments: sources

An Introduction to Foreign-Trade Zones

Toyota Production System: Our world-famous lean manufacturing system

https://www.toyota-europe.com/about-us/toyota-vision-and-philosophy/toyota-production-system

How Toyota's Just-In-Time (JIT) System Revolutionized Manufacturing

https://www.ineak.com/how-toyotas-just-in-time-jit-system-revolutionized-manufacturing/

Just-in-Time (JIT) Production and Its Integration with Lean Concepts

https://www.qualitygurus.com/just-in-time-jit-production-and-its-integration-with-lean-concepts/

Just in case & Just in time.

https://www.linkedin.com/pulse/just-case-time-same-bernardo-butler-iccfc/

New York Times, The Floating Traffic Jam That Freaked Us All Out

https://www.nytimes.com/2024/06/02/business/economy/covid-pandemic-global-supply-chains.html

Understanding the Supply Chain Bullwhip Effect

https://www.truecommerce.com/blog/bullwhip-effect-supply-chain/

Carrying Costs in Inventory Management: A Guide to Reducing the Cost of Inventory in Your Business

Free Trade Warehouses, Directory

https://www.prologis.com/what-we-do/resources/what-is-a-free-trade-zone-warehouse

90-day tariff cut between U.S. and China may lead to import surge, temporary stability

Trump says US-China relations 'reset' as markets surge on tariff pause

https://www.bbc.com/news/live/cedy09wq25qt

That helps make what is happening so much easier to understand

Great knowledge. Thanks for sharing it.