China blows up diamond market and DeBeers with near-monopoly on superhard materials

Summary:

China produces 95% of the world's manmade diamonds.

Lab-grown diamonds are now vital components in industrial machinery, cutting tools, and even in semiconductors and electronics.

For decades, DeBeers has deftly manipulated the supply and pricing in the global diamond markets.

But China's booming production of manmade stones, including for jewelry, now has DeBeers struggling to maintain market positions.

After historic discounts, secondary markets for even natural stones are trading at levels far below DeBeers prices.

Report:

DeBeers historically has done an excellent job in manipulating world diamond markets, by restricting supply and carefully regulating the volume of diamonds that are available to buy, across the entire world. That strategy is collapsing, and so is DeBeers itself. And the reason is because of record artificial diamond production in China.

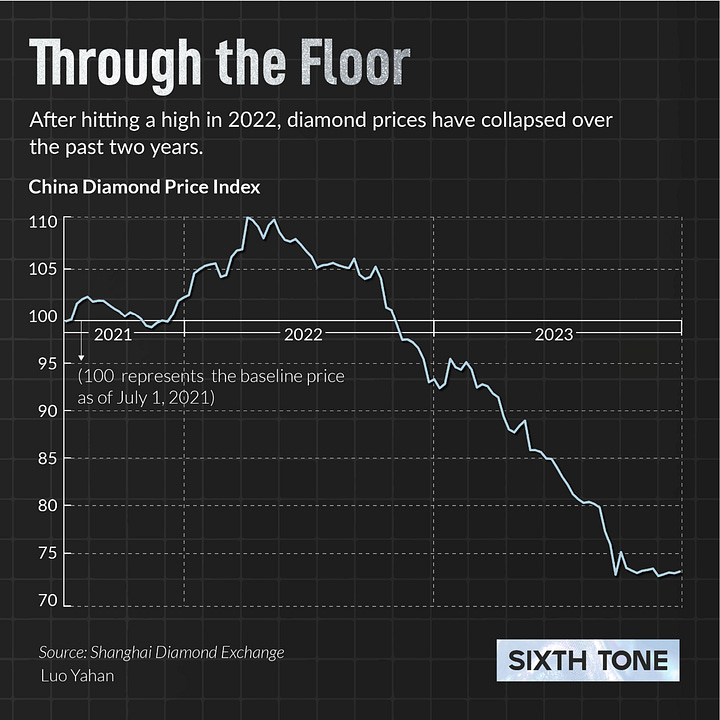

Bloomberg kicks us off, with this news that DeBeers cut diamond prices by over 10% as the company gave up their plans to put a floor under the global prices. Bloomberg points to two problems here: the collapse in China’s luxury market, and a boom in man-made diamonds. But it’s actually the same problem. China’s luxury market is shifting to man-made diamonds, and most of those are made here. And the reason the lab-grown diamond industry is booming in China is not so much because demands in jewelry markets, but as a result of new industrial applications for diamonds. And even after the big price cuts the DeBeers announced for their wholesale buyers, the world market is still far below that—the secondary market is trading diamonds far below where DeBeers pricing is.

This is from a report on industrial-use diamonds, where China has built out a huge supply chain in Henan province. Diamonds are the hardest known materials, so that makes them highly desirable in machine tools, and for wear-resistant coatings. Construction and mining equipment, of all kinds, oil drillers—operators who need to cut through metal or rock or concrete – these industries are using industrial diamonds to do all that work now.

China makes, by far, most of the diamonds for industry—the production of super hard materials is more than 85% of the global supply. But the most expensive products come from Europe, North America, Japan and Korea. Companies in Europe and North America buy industrial diamonds from China, to place on high-end machines and tools. This is a typical supply chain story, then, in 2 respects: Chinese companies serve a key part of the manufacturing process, and own that entire step of the supply chain. And on the value chain side, it tends to be foreign companies who make most of the profits on the products themselves.

Chinese companies that make the diamonds are always looking for new uses for them, for new markets, and recently discovered that the diamonds can be infused with nitrogen to make it even stronger, and by adding boron, can turn the diamonds into semiconductors.

Artificial diamonds then have lots of valuable applications in heavy industry and electronics. But they are also being successfully marketed as jewelry. Diamonds are still highly desirable as gifts, and women prefer natural diamonds to manmade ones. But there is a gap between what these consumers say they want, and what they actually buy:

In China, manmade diamond sales as jewelry is a boutique industry. A woman goes to a jeweler and has a diamond especially made—just for her personality and style—and it costs a lot less money than a natural diamond that is pulled out of the ground in Africa, especially after those stones go through DeBeers price cartels.

DeBeers got into the market for artificial diamonds as well, and the prices keep falling. But the demand wasn’t the problem—demand is still high, but China can just build the diamonds for less, and in large volumes. New technologies in China created a boom in synthetic diamond production, and sent prices crashing:

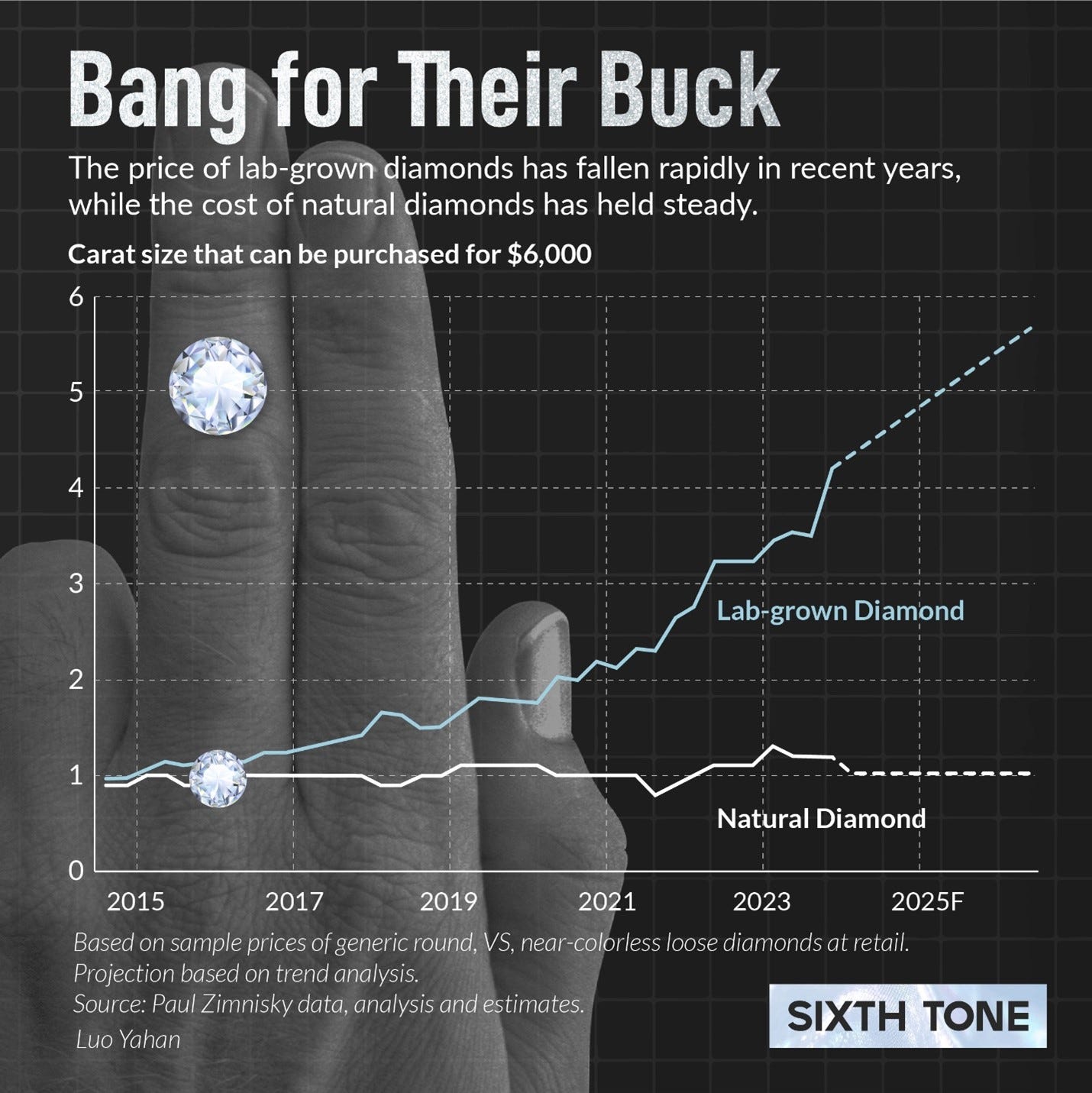

And this goes to why consumers say they want a natural stone, but then don’t follow through. Lab-grown diamonds cost a lot less, less than half what a natural stone does. The chart below shows how large a stone a buyer can get for $6000. Natural diamond pricing is holding steady—that’s DeBeers strategy at work to hold a floor on pricing, which isn’t working any more. Six thousand dollars can buy you about 1.25 carats of natural diamond, and over 4 carats of lab-grown diamond. A buyer with a ring on her finger can hide whether or not a stone is from a hole in Africa or a factory in Henan, but she can’t lie about the size of the thing—it’s there for everyone to see:

DeBeers is now trying to make a shift to produce industrial diamonds, but they’re already far behind China. This analysis from Western analysts, remember, admitted that China’s share of the lab-grown diamond market was at least 85%. China’s official estimates are 95%. The IDAC is the Industrial Diamond Association of China, which says that China has 95% of the global production of manmade diamonds, with 80 percent of that coming from Henan province.

The industrial diamonds are processed differently, depending on how they will be used. MP CVD is a process that uses microwave plasma, and it is ideal for making diamonds used in semiconductors, and in electronics that require high degrees of control and efficiency, such as in electric vehicles.

The links below go much more deeply into how the diamonds are made, and the uses for them. Lots of interesting stuff there, and you can read for yourself the problems that these companies present for DeBeers.

Resources and Links:

Global Super Hard Material Market 2024 by Manufacturers, Regions, Type and Application, Forecast to 2030

https://www.marketresearchguru.com/global-super-hard-material-market-26489356

Bloomberg, De Beers Capitulates on Diamond Strategy With Big Price Cuts https://www.bloomberg.com/news/articles/2024-12-02/de-beers-capitulates-on-diamond-strategy-with-big-price-cuts

Sixth Tone, Behind the Numbers: China’s Diamond Industry https://www.sixthtone.com/news/1015760

Daxue, Sparkling shift: China’s diamond market evolution and the rise of lab-grown gems https://daxueconsulting.com/china-diamond-market/

Artificial diamonds shine in Henan https://www.chinadaily.com.cn/a/202406/04/WS665e7160a31082fc043cabec.html

Zerohedge, De Beers Pulls "Last Resort" Price Cut As Diamond Price-Floor Crumbles https://www.zerohedge.com/commodities/de-beers-pulls-last-resort-price-cut-diamond-price-floor-crumbles

YouTube, China's influence in the synthetic diamond industry shines