China is solving cancer and building miracle drugs. Wall Street buys them and charges 100x.

Bullets:

China's biotech clusters are much larger, move much faster, and are much more innovative than in North America or Europe.

Western pharmaceutical companies and Wall Street venture capital are very active in China's biotech scene, investing billions for licensing rights to the most revolutionary drugs, to enjoy monopolistic profits outside China.

This business model is worth hundreds of billions of dollars a year, while even single drugs made in China are worth tens of billions annually after approved for the US market.

But China is opening up its hospital systems and medical tourism zones to foreigners. For many patients, it is already far less expensive and far faster to fly to China to receive world class medical care, than to use local hospital systems.

Report:

Good morning.

The business model for Western biotech and pharmaceutical companies is to let Chinese labs and researchers do the most innovative research and drug development. Then, our companies sign licensing deals with Chinese companies, get those medicines approved in the United States and Europe, then mark up the price over 50 times.

Then they discount those drugs that will be sold in Canada or Europe, so patients there think the Americans are getting ripped off, and sick people in Canada and Western Europe feel better about paying 30x what patients in Asia pay.

The only value-add that our pharmaceutical companies offer is the packaging, and their know-how to work the bureaucracies at the FDA or in Europe to get made-in-China drugs approved there. Then the drugs go into a box with their brand name on it. It’s really as simple as that, and that model is worth hundreds of billions of dollars a year.

This system will work until Chinese companies can offer their treatments to patients directly. China is opening up its system as we speak, here in Mainland China, and later on Hainan island. It is happening, now, that patients come to China because they can get the latest treatments available, without waiting for the FDA or European regulators to green-light a drug a few years from now. Or, if they don’t want to wait a year to get an MRI or an appointment to see a specialist at home.

Wealthy patients in Asia have been using Chinese medical centers for years, but soon enough they will be joined by middle-class patients will come for the same reasons rich people do, while also saving money. It is cheaper to fly to China and stay in a luxury hotel, get treatment, then fly home, than it is to pay our doctors and drug companies at a local hospital. Faster too. This is to say that as China fully opens up their hospitals here, then on Hainan Island, to patients from around the world, the Western business model for healthcare delivery will fall apart.

Until that time comes, here is the system now. This explains it best, a feature in BioPharma Dive. David Li is head of a startup company that was looking for a biotech partner who could do the research on a few drugs they believed would have big market potential. “Drug targets”, as they’re called, and he learned that Chinese biotechs were already working on them. He went to Shanghai and Suzhou—those cities are really close, about an hour by car. And there are many biotech companies there—hundreds of them. It’s ruthlessly competitive, they’re trying to just stay alive, creating more value than the companies next door.

He figured out in a few minutes the same thing that our biggest drug companies did, that it’s easier and faster and cheaper for them just to hire Chinese to do all the work, then sign licensing deals. No need to talk to sick patients, or spend a lot of time in labs—just fly to Shanghai with a suitcase full of money and set up meetings with Chinese companies who are working with patients and doing lab work.

JP Morgan, the big investment bank, hosted a big Healthcare Conference—make of that what you will—and everyone there agreed that this is the how the industry works now, and it’s growing fast. One CEO said that our Western labs are losing their edge, and it’s Chinese innovation which is driving the industry forward now.

Here’s an example. Keytruda is from Merck, it’s an immunotherapy drug and the most profitable drug industry wide. A Chinese company, Akeso Therapeutics, built a drug that performed better than Keytruda, and it was snapped up by another company, Summit Therapeutics.

Here are the prices for Keytruda. Each dose costs either $11,795, or $23,590. That is for a single dose, depending on whether the patient goes once every three weeks, or once in six weeks. That continues until things get worse, or get much worse, or for two years, is what I think this means. Hope you have an expensive house you can sell.

But this new Chinese drug works better than Keytruda, so now Summit is going to be setting prices, probably even higher than Merck does for Keytruda. And investment analysts have a strong buy on Summit shares, based on what’s possible now with this Chinese drug. “Annual sales in the double-digit billions”, and the company could make a strong takeover target from other companies, like Merck, ironically. That’s the system.

Chinese biotechs move faster, at lower costs. Clinical trials can begin in under 18 months, compared to several times that in the US. China has a lot more people doing the research, and China has the supply chains, so everything costs less. Chinese firms pay just a fraction of what US companies do, and they have better access to a lot more patients.

Chinese companies are also very strong at “me too better”—this is taking existing drugs that are already on the market, like Keytruda, and making more effective ones. For anything that is being done anywhere, come to China and there are dozens of versions of it.

Chinese labs are also more innovative, and tackling the more difficult drugs and therapies. This is all expensive though, even in China, so they are motivated to get licensing deals with the big Western names. And our biggest drugmakers are motivated to get cheap medicines that they can get approved, so new patent protections and price guarantees are secured in our home markets. Venture capital is moving in, nine-figures is one hundred million up to a billion, and these companies are raising money to buy cheap drugs developed in China, to do the same thing Summit just did.

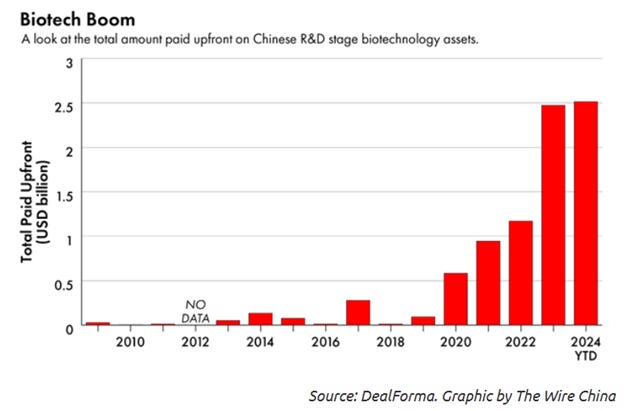

These red lines going straight up is how much our companies are paying upfront to license Chinese-made drugs, basically from zero to over 2.5 billion in a year, with a lot more coming.

This piece was written by David Li, instead of about him. China’s biotech sector is bearing fruit as a result of being part of China’s “Made in 2025” plan 10 years ago. Now the industry is thriving, and China’s science parks are many times bigger than Boston or Silicon Valley. There is a massive shift in global biotech underway, and China sets a new standard of Research and Development. Capital will flow to China, because this is where the highest productivity is.

Here is the problem for China, today: Second paragraph. China biotech is fast, but they are limited in their understanding of the commercial value of their drugs in the Western market. Without access to the key opinion leaders and the treatment gap, the Chinese struggle with how to pick targets and product molecule profiles. And I’ll be honest that I don’t understand that part. I think what he’s saying is that China is building super drugs and don’t appreciate how valuable they are until a hedge fund shows up and gives them a hundred million dollars in exchange for licensing rights. And as a normal person, it also doesn’t sound like they’re doing a lot of work to earn tens of billions of dollars every year. What’s more, I don’t know why they’re writing this down, publishing it in the public domain, so normal people can read it and learn how we’re all being screwed over.

But here is one place US and European companies have a comparative advantage—they know how much they can sell the drugs for, to patients, and how to make all the money.

Here are three ways that all works, Number one, license drugs, or “assets”, as they call them. Then, buy the licensing rights for the drug after the Chinese clinics have done all the hard work of “derisking the assets”. A normal human being wouldn’t use this language, and instead say “making sure the medicine is safe”.

Anyway, strategy number two: venture capitalists can partner up with Chinese companies doing early-stage work, which can be sold off to one of the giants after the treatment is proven. Here is an example where investors put in $245 million and -- more than quadrupled their money after Glaxo SmithKline bought them out.

Big money maker number three, set up an umbrella of several Chinese companies that will do the research and patient testing here in China, and the umbrella company, NEWCO, will own all the IP rights for all that research outside China. So I guess this is all how our top doctors talk to each other now, and what our best and brightest learn when they head off to medical school, how to think like an investment bank.

And I agree, these are clever, trillion-dollar ideas and strategies. But they are preconditioned on the idea that Chinese researchers are smart enough to develop lifesaving drugs, but too stupid to figure out how to directly work with sick people outside China. Because when they do figure out that part, all these venture capitalists go away, along with all their giant profit margins. And that day is inevitable, because Wall Street, venture capital, is the only constituency that benefits from the system that we do have.

South China Morning Post has a good roundup with this lede, which is that cancer treatments literally cost 100 times more in Western markets, than here. And headlines like this are routine, in Mainland China, it’s just hard to find them translated into English. An experimental therapy to shrink cancer cells is this one, the world’s first advanced clinical trials on liver cancer patients, which doubled life expectancy. A modified virus infiltrated and blew up drug-resistant liver tumors, while building up immune systems. The trials were on 40 patients where doctors had given up, basically, they had no more available treatments. Survival rates are poor, fewer than one in five live longer than five years after diagnosis. The problem is that once the tumors become resistant to the treatments, it’s just a matter of time.

Here are the results, the patients in this study were able to return to immunotherapy treatment, and survival rates went up. Four patients saw their tumors shrink immediately. Overall survival times nearly doubled, from nine months to seventeen, and the docs think that this same therapy will work on other advanced cancers.

Here’s another one that doesn’t even sound real. Chinese researchers disguised cancer cells as foreign pig tissues, causing the patient’s immune system to go crazy to get rid of them. Staggering success, they call it here, because the testing was done on patients with advanced cancers that are beyond treatment. But the tumors either stopped growing, or even shrank. Twenty patients in this study, all with untreatable tumors. After 8 to 12 weeks of treatment, tumors stopped growing in 18 of them. One with stage four cervical cancer was cured, with 6 more going into remission.

Just my summary, but here’s what it sounds like: A cancerous tumor grows because our immune systems don’t know it’s a problem. These researchers in China figured out how to trick the patients’ immune systems into thinking it’s a piece of bacon growing inside their body, and the immune system kicks into overdrive to kill the thing.

So if you have cancer, and you read what China is doing, what are you really hoping for? That some investors from JP Morgan’s healthcare conference finds one of the companies doing this research, pays a billion dollars for it, and gets it approved so you can pay them a million dollars in your local hospital, assuming you live that long?

Or would you rather buy a plane ticket to “China’s Hawaii” and hang out there for 8 to 12 weeks, and go to a Chinese hospital there in Hainan once a week for an infusion and spend the rest of the time sitting on the beach?

Everyone on Wall Street, and all the six-figure doctors that hand out drugs in the US and European hospital systems—they need all of us to wait on them, and then to sell everything we have, to pay them. Soon we won’t have to.

Resources and links:

Chinese scientists turn tumours into ‘pork’ in radical cancer treatment

https://www.scmp.com/news/china/science/article/3302422/chinese-scientists-turn-tumours-pork-radical-cancer-treatment

How the US can continue to lead as China rises

https://timmermanreport.com/2025/01/china-is-here-to-stay-as-a-leader-on-the-global-biotech-stage/

‘The bar has risen’: China’s biotech gains push US companies to adapt

https://www.biopharmadive.com/news/biotech-us-china-competition-drug-deals/737543/

Keytruda, COST, INSURANCE & FINANCIAL HELP

https://www.keytruda.com/financial-support/

What if curing cancer could cost 99% less in China?

Tumour meltdown in China therapy tests offers hope to late-stage cancer patients

Summit Therapeutics Inc. (SMMT): Among the Stocks That Will Go to the Moon According to Analysts

https://finance.yahoo.com/news/summit-therapeutics-inc-smmt-among-181432743.html

How Drug Prices Differ in the U.S. Versus Other Countries

https://www.biospace.com/how-drug-prices-differ-in-the-u-s-versus-other-countries

China’s Hainan wins global acclaim as medical tourism hub

https://www.macaubusiness.com/chinas-hainan-wins-global-acclaim-as-medical-tourism-hub/

Hainan, China, becomes a hub for international patients and medical innovation

Hainan to expand healthcare facilities

https://global.chinadaily.com.cn/a/202503/21/WS67dcb98fa310c240449dc067.html

Canada’s median health-care wait time hits 30 weeks—longest ever recorded

https://www.fraserinstitute.org/studies/waiting-your-turn-wait-times-for-health-care-in-canada-2024

England's hospital waiting lists rise to 7.57m

https://www.bbc.com/news/articles/cn448j3z7ggo

Dear KW, whilst I appreciate your thorough technical and financial analysis, on this one, you are just off. The "cures" for cancer have been long known and practiced in the West - for over 100 years. Largely the methods are criminalized. See Gerson, Rick Simpson, G Edward Griffin, Massimo Mazzucco, William Donald Kelley, Burzynski, et alia. I even found that childhood cancer is perfectly and positively correlated with mass vaccination.

The costs of allopathic poison (think AZT) are not a function of cure, they are a function of desperation and disposable income. See Joel Wallach.

Putting byproducts of aluminum smelting in public water and calling that "sodium chloride" does little more than convince the public that cancer is fate. See the Fluoride Deception. Eric Coppolino demonstrated that dioxin and superfund clean up sites SPREAD cancer. In the 1950s, when America was radiating the skies and her own troops - cancer rates soared. Same in places like Australia. Conversely, antioxidants and clean water, and fresh air, and NO vaccines are negatively correlated with death rates and cancer. Go figure. The price of my cancer drugs is ZERO. I got my mom to abandon the idea of blasting her breasts with X-rays (qua mammograms) and AMAZING, 30 years later, NO lumps in her breasts.

I could continue, but ...

Best wishes, from Shanghai

In the same sense that 'culture is upstream from politics' material reality is upstream from culture. This is why I reject the notion that ideology (any ideology) is sufficient to correct the ills of society and generate a lasting prosperity.

The reality I'm talking about is human nature, which nature has conditioned to be short-term self-seeking and not above cheating to achieve its goals. I would argue that any economic or political ideology is bound to fail that doesn't take this into account.

I'm not offering a solution (if there even is one) but to find one you have to first identify the problem.