China, Russia building NatGas pipelines for energy previously headed to Europe.

China also will pay far lower prices for new Russian energy supplies, further cementing cost advantages for China's industrial sectors.

Bullets:

Massive new natural gas pipelines are in construction in the Russian East, connecting China to vast energy fields in Siberia and on Sakhalin.

When completed, Russia’s exports to China will replace their markets in Western Europe, who have turned to more expensive LNG sourced from the United States.

China will also pay far lower prices for Russian natural gas, compared to Western Europeans now, and even for current European customers of Russian gas.

All this trade will naturally be outside the US dollar and Western banking systems, and therefore cannot be sanctioned or restricted by European regulators.

This is a transcript, for the YouTube video found here:

Report:

Good morning.

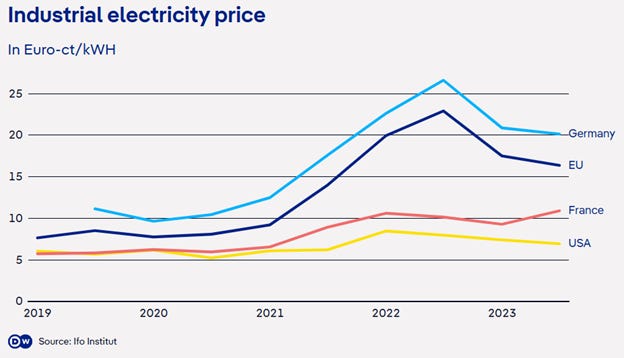

Low-cost electricity is a key driver of China’s industrial productivity, and a major competitive advantage that Chinese-based factories have over manufacturers in the United States, and especially in Europe. This is a serious challenge for German companies in particular, who pay some of the highest prices in the world.

Per kilowatt hour, companies in Germany pay nearly twice as much as France, which is next door, and almost three times what American factories pay. Three hundred large companies in Germany were surveyed last year, and nearly half planned production cuts because of high energy costs.

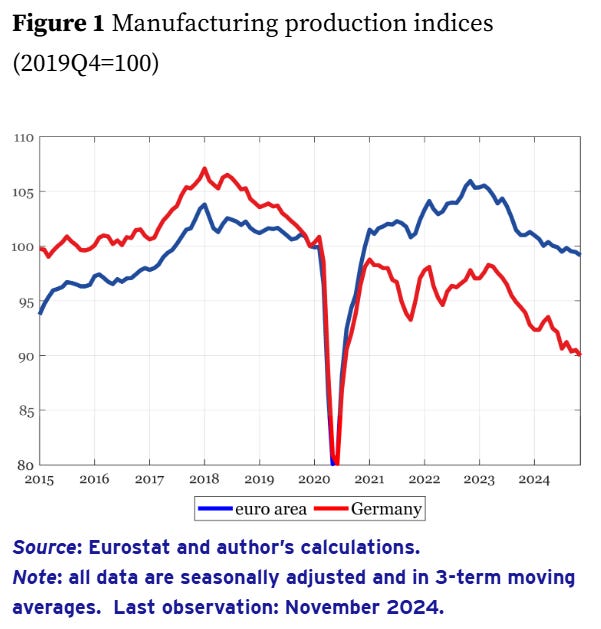

And they’re already following through. Last quarter of 2019 is the 100 level. In the Eurozone, industrial production is down slightly six years later. In Germany, it’s down 10%. The numbers get worse when for manufacturing is more energy-intensive. For heavy industry, Germany is down 17% since 2019, and Europe overall off 14%:

So things are already bad for manufacturers in Europe, and they’re about to get much worse. There simply is no low-cost substitute for European consumers who previously got lots of natural gas from Russian suppliers. And it’s here we see the problem for Germany, again.

Before the Ukraine War, Russia was the source of 49% of Germany’s natural gas. That’s twice as high as France, which again puts this data set for costs into better perspective: Germany’s cost to replace Russian energy are far higher than in other manufacturing centers.

Europe has turned to the United States for a lot of the natural gas previously sourced from Russia, and exports of LNG from the US to jumped 20% year over year in the first few months of 2025, and most of that was from increased volumes to Europe. That’s great for natgas suppliers in the United States, but LNG costs a lot more than natural gas coming through a pipeline. So these higher costs get passed along to European customers, and to European factories competing against Chinese companies.

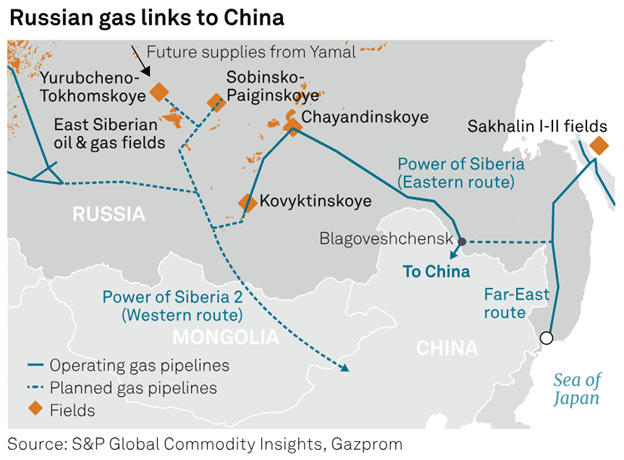

China is stepping in to snap up almost all of the natural gas that was going to Europe, and they will get it at a lower price. Russia and China just signed a 30-year gas export deal, which includes construction of a new pipeline, the Power of Siberia 2. Some US lawmakers are pushing for huge sanctions on countries that source energy from Russia, and this deal sends a strong message that nobody is paying attention to Washington anymore.

The details are here from Interfax. The new pipeline will be 50 billion cubic meters of gas per year, and will cut through Mongolia. The existing Power of Siberia pipeline will see a big jump of 6 billion cubic meters per year, to 44 bcm. Last week we learned of a new project, Sakhalin-3, which will also supply gas to China beginning in 2028.

So this map is helpful now, with the Power of Siberia 2, the new one transiting Mongolia. Power of Siberia Eastern route will be expanded, and the Far East Route that runs from Sakhalin Island to East China will add a third field that will come online in three years.

This is from a Chinese wire, dated earlier this month, and add all those numbers up and the total supply of Russian gas to China is at least 100 billion cubic meters a year. And maybe more, depending on how much comes out of Sakhalin-3.

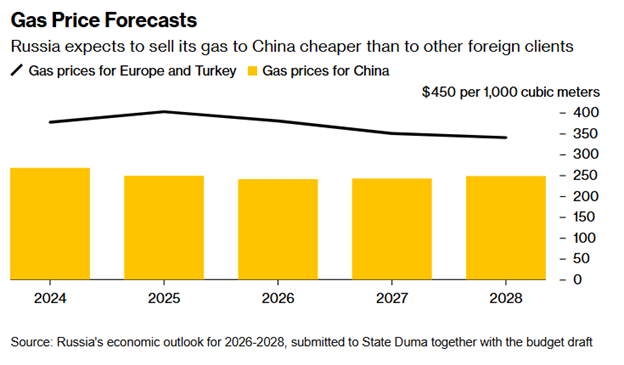

All this business will of course be done outside the US dollar, and outside Western banking systems. But China is also going to be getting lower prices. China is closer to Russia’s natural gas fields than customers elsewhere, so the gas doesn’t have nearly as far to go. Prices for Russian natural gas will cost China at least 27% less, compared to customers in Turkey or in the small handful of countries in Europe that gets it now. This year it’s at a 38% discount to gas heading West.

These are the forecast costs per thousand cubic meter, with Europe and Turkey running over $350, compared to China at under $250. For this year, Western markets will pay over $400, while Chinese buyers are at $248.

If your company runs factories anywhere in Europe, there’s no good news on this chart. You’re simply not competitive with factories in China, already. But the energy problem in Europe makes it a lot worse, and it will stay that way. But the situation for factories in China just got a lot better, and it will also stay that way.

Be Good.

Resources and links:

Zerohedge, 30-Year Gas Export Deal, Power of Siberia 2, Belatedly Inked Between Russia & China

Interfax, Binding memorandum on Power of Siberia 2 signed, Russia to increase gas exports to China via existing and new routes

https://interfax.com/newsroom/top-stories/113563/

Russia clinches major new gas pipeline deal with China as West shuns supplies

Russia Signals Lower Gas Prices For China Compared With Europe And Turkey

https://www.zerohedge.com/energy/russia-signals-lower-gas-prices-china-compared-europe-and-turkey

Russia Signals Lower Gas Prices for China Compared With Europe and Turkey

Bloomberg, Russia Expects to Sell Natural Gas to China at Lower Prices Than Europe and Turkey

普京:中国伙伴将获得合理价格,不像欧元区虚高

https://www.guancha.cn/internation/2025_09_04_788933.shtml

Reuters, US LNG exports surge to new highs on strong buying by Europe

Are high electricity prices a threat to Germany’s industry?

https://www.dw.com/en/high-electricity-prices-a-threat-to-germanys-industry/a-71644198

Reuters, Russia expects new Sakhalin-3 gas project to start operations in 2028

High Energy Costs and German Industry in 2024–2025: Challenges and Prospects

https://www.linkedin.com/pulse/copy-high-energy-costs-german-industry-20242025-challenges-prospects-w8b1e/