"China Shock" in legacy semiconductor markets as Chinese foundries gobble up global market share

Bullets:

Chinese companies are aggressively taking market share in legacy semiconductors.

Most news media and investment analysis are devoted to our top companies' race with China in the newest-generation chips and Artificial Intelligence. But Chinese companies have quietly closed the gap with Korean and American chipmakers in mature and niche markets.

Chinese foundries easily supply their domestic markets with SiC chips, wafers, and controllers. They also lead the industry in advanced chip packaging and memory chips.

As a result, they are now moving aggressively into export markets, competing both on price and on quality, and taking large market share from established American, Japanese, and Korean companies.

Report:

Good morning.

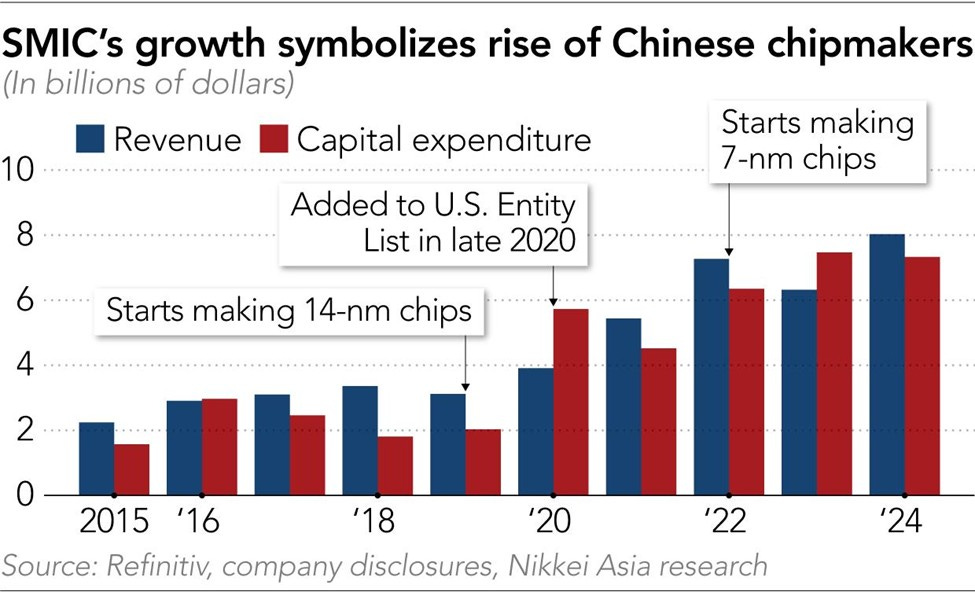

SMIC is the Semiconductor Manufacturing International Corporation, and they’re a company in Shanghai. They are a primary manufacturer of chips, and in 2020 SMIC was placed on the US sanctions list. The objective of our chips sanctions was to deny China further advances in chipmaking. Over time, it was believed, Chinese companies would fall further behind top Western firms and be uncompetitive and go out of business.

As we see, the opposite happened. In 2020, SMIC had revenues of just under 4 billion dollars, and was building 14 nanometer chips. Now they’re mass-producing 7 nanometer chips, with revenues last year of $8 billion dollars. In four years.

SMIC’s market cap now exceeds those other global chipmakers. And what happened at SMIC is typical of other Chinese chip firms in this space, as China is taking market share from established companies in Europe and Asia in legacy chips. The legacy chip market is also referred to as the mature semiconductor nodes. These are older technologies, but they’re used in everything—smart phones, home electronics, up to defense equipment. China’s mature chip capacity will be 28% of the global market this year, and will grow to 39% in the next two years.

Suppliers are already seeing a China shock in legacy chips, and it’s being driven by price. SiC here is Silicon Carbide, and Wolfspeed was the market leader for those chips. Two years ago a 6-inch wafer from Wolfspeed cost $1500, and Chinese companies are selling the same tech today for under $500.

Chinese suppliers are emerging quickly, and aggressively, grabbing market share. Wolfspeed shares are getting killed, off 96% from their 2021 high.

China has easily enough mature chips for domestic demand, that’s for their own markets, and have also created entire supply chains for the equipment and the materials to build them. They don’t need help from foreign companies anymore. The headlines and news coverage in semiconductors and AI tend to focus on the race between Taiwan Semiconductor and Nvidia vs Huawei, or DeepSeek and Qwen vs Chat GPT.

But China’s takeover of the legacy chips market is probably more important, because it’s the older chips, which already have found applications and wide use in cars and maps and phones and even weapons. The fastest chips is where the biggest profit margins are, but the legacy chips are where the sales volume is. It’s the mass market. This explains the difference. If you want support for the cutting edge semiconductors, TSMC has the best teams to build them for you. But for chip technology that is 2 years old, that’s where SMIC is. Foreign chipmakers in China are using Chinese foundries to make chips here, because it's cheaper and faster than doing it themselves.

China is a huge market for semiconductors, because China is such a huge consumer market. And China also manufactures so many of the consumer goods that use legacy chips. But China is now also a major exporter of legacy chips themselves. Through November of 2024, China exported $144 billion worth of them, 18.8 percent growth over the previous year. That’s the dollar volume. On a per piece basis, it was 11% higher, year over year, at over 271 billion units. Here is the word “aggressively” again, Chinese firms leveraging their cost advantages and ramping up exports.

And they’re not just competing on price, but on quality. Chinese semiconductor companies are now at par with or ahead of South Korea across 5 segment of semiconductor technology, and China is catching up with global leaders despite restrictions on advanced chips and chipmaking equipment. China has passed South Korea and is now ranked 2nd in memory chips, and now ahead of Samsung and SK Hynix. Advanced chip packaging is how chips are arranged to work together, to optimize speed and performance, and China is now equal to South Korea there.

In the area of high performance/low power AI, China passed the Koreans three years ago and is now behind just the US.

China has a whole-of-nation strategy to become self-sufficient in semiconductors. Looking at the first chart again, it’s hard to see exactly how SMIC was slowed down by sanctions at all. They’re finding the money to invest in R&D to develop the chips, they’re finding the people to build them, and they’re now building them at lower cost but of equal quality to the best foundries in Korea, and just a little behind the US, and now they’re putting our companies out of business.

Resources and links:

Chip war: South Korean think tank finds China ahead in key semiconductor technologies

Global tech industry braces for 'China shock' in mature chips

China’s Low-Cost SiC and Mature Chips Ignite Global Semiconductor Price War

China’s semiconductor firms cash in chips as export boom bucks overall trend

Wolfspeed stock chart

https://finviz.com/quote.ashx?t=WOLF&p=w