Bullets:

BYD is a Chinese carmaker, and the recent surge in its stock price pushed its market cap past Ford, General Motors, and Volkswagen combined.

BYD stock soared after announcement of a new battery charging system, which dramatically reduces the charging time.

With a charging time of just five minutes, the new lineup of BYD models will have a charge time equal to that of filling up a regular car at the gas station. And it is far faster than other brands in the electric vehicle industry.

This development is another challenge for Tesla, who is already struggling to compete against BYD’s aggressive pricing, and deep selection of models across all consumer market segments.

Tesla is losing market share in China to BYD and domestic brands. The same can be said for other international brands competing in the Chinese market. But Tesla is also losing market share across international markets to BYD.

Report:

Good morning.

Market capitalization is the total market value of a publicly traded company. We take the number of shares outstanding, and multiply by the stock price. It’s a very important measure, because it’s the best assessment we’ve got on how investors value a company. And a company with a large, and rising, market cap can raise new capital much more easily. They can go into capital markets and sell more stock at higher prices, or borrow money at lower yields. That in turn can fuel even more growth, more research and development, open new factories and new product lines.

So this news here is very significant, that BYD, a Chinese carmaker, has a market capitalization that is bigger than Ford, plus General Motors, plus Volkswagen, combined. And it’s also taking big market share from Tesla, both here in China and across the world.

BYD shares trade in Hong Kong, and here is the 5-year chart for them, and their market cap is 1.3 trillion Hong Kong dollars. One HKD is worth $13 cents, so the market cap for BYD is about $169 billion dollars. Ford Motor’s cap is $40 billion, and GM is at 49 billion, so BYD is worth Ford plus GM times two, already.

And the good news for BYD just keeps coming. This recent spike in the stock price came after the announcement that they have developed a new battery and charging system that can charge an electric car in about the same time it takes for a regular car to fill up with gas. The system gives 400 kilometers, or 250 miles of range in 5 minutes of charge, and BYD will be selling cars with this new tech next month.

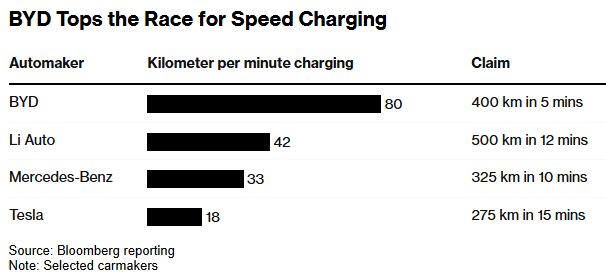

The new system puts BYD far in the lead, with respect to charging times. The metric used in the industry is KM per charging minute, and BYD’s 400KM in 5 minutes means each minute is good for 80 kilometers. Li Auto, another Chinese maker, can go 500km on a charge, which lasts 12 minutes, so their number is 42.

Tesla is at 18, or 275 km in 15 minutes, and that’s one of the problems Tesla faces now, in China. Tesla’s year-over-year sales from last month were down 49%, and at under 31,000 units was the lowest monthly sales number since mid-2022.

This is the trend for Tesla in China, with orders falling for 5 months in a row. But Tesla is in some good company. These charts are for the 12 top-selling car brands in China, by market share. And what we’re looking at here are the trend lines, growth in market share.

BYD is killing everyone, in the top spot. Tesla is in the eleventh position, and its chart is similar to most of the other international brands—trending down. VW, Toyota, and Honda are down sharply, where Mercedes, BMW and Audi down, but not crashing. Geely, #4, and Chery at #8 are other Chinese carmakers. Note here too that these numbers are for car sales in China or all engine types—gas, hybrid, or electric.

And BYD is also snapping up market share globally, selling over 67,000 cars last month, another record for the firm.

Tesla is one of the most innovative companies we’ve got, and they can’t keep up with BYD in price or in volume. The middle column is the price change since December 2023. Tesla’s Model Y and Model 3 have been discounted at 9% and 7%, but BYD is making money on their models, while giving even bigger discounts. The column at the right is the Chinese average price for these models in renminbi.

Converting to dollars, Tesla’s models average over $33,000 per vehicle in China. BYD’s Song with all the options is $21,000. The Seagull is also popular here, and when Detroit engineers tore down the Seagull last year they were so terrified by the quality and the price that they called up their friends in Washington to get Chinese cars banned. The Seagull costs under $10,000 here, and the concern back home is that even at twice that price the Seagulls will sell as fast as they can be unloaded from the ships.

On these new, fast-charging models, BYD is building a new charging infrastructure. And the price points on these vehicles are higher, at about $38,000. So on this product line, BYD is competing on a different field than for their other models. They’re not competing on price or on the newest bells and whistles, because their lower-cost models already have those. This new lineup is instead positioned to go directly at buyers who prefer gas-powered cars because of the convenience of charging time. They’re not budget-conscious, in other words. These buyers are willing to pay more if it means they’re not waiting around for their car to charge.

Two major points here to hit harder, then. Chinese companies are innovating fast and taking new market segments, just by figuring new ways to build things differently. In this case, BYD needs to also build new infrastructure for the charging of these new batteries. But once that’s done, they will compete on price. In three years, BYD will be discounting these and taking whatever market share is left. Same car, same charging time, but as soon as BYD recovers their capital spend on the new charging stations, they will cut the price. That’s their system.

Resources and links:

Fortune, BYD unveils battery system that charges EVs in five minutes

https://fortune.com/2025/03/17/byd-battery-system-charging-5-minutes-tesla-superchargers/

Bloomberg, BYD Shares Jump to Record on Five-Minute EV Battery Charging

https://www.bloomberg.com/news/articles/2025-03-17/byd-unveils-battery-system-that-charges-an-ev-in-five-minutes

Bloomberg, Cheap Chinese Cars Are Taking Over Roads From Brazil to South Africa

Bloomberg, Tesla Is Flailing in China and BYD’s Rapid Rise Is to Blame

https://www.bloomberg.com/news/articles/2025-03-09/tesla-is-flailing-in-china-and-the-rapid-rise-of-byd-is-to-blame

No idea. I only know that Teslas get a fortune in US subsidies

So the new swap out battery is now obsolete?