Bullets:

Western media outlets, Wall Street, and Silicon Valley are belatedly coming to the same conclusion: years of falling asset prices and cost of living has made China the most competitive economy in the world.

Our top government officials, industry leaders, and columnists were predicting a collapse in China, because they completely misunderstood the long-term policy implications of falling costs across a modern economy.

China was the only major economy to see long-term deflation in recent years, and the costs of housing, commercial rent, food, electricity, travel, and education were pushed lower because of soaring industrial productivity and efficiency gains.

Now China is reaping the benefits of building a ruthlessly cost-competitive economy that dominates in most areas of manufacturing, raw materials sourcing, high technology, logistics, education, and health.

Report:

Good morning.

One of the motivations for doing this YouTube channel, is that there were so few reliable sources of information about China in mainstream news media, and even on social media. There had to be an audience of people like me, in business, who needed to have a strong understanding of what is happening in Chinese industry, and that we felt, deep down, that our news media, and our political leadership, was either lying to us, or lying to themselves, or listening to people who think they know, but don’t really.

Now comes some news that our own media outlets are realizing they have completely misjudged China, and in doing so have misled their readers and subscribers. The South China Morning Post studied the biggest American and British news outlets since 2019. In 2019, 70% of the news stories involving the Chinese economy, tech sector, or environmental news had a negative slant. Now—in 2025, the negative stories are about 40%, with neutral or positive coverage going up.

They see a dramatic shift recently toward more nuanced and multifaceted coverage. Western news media are waking up today to what I have seen every day for the past 13 years when I looked out my window, here. The Chinese economy is booming, just about everywhere I go. Every family has a car. Most of them have a modern apartment, stuffed with all the latest — everything. They take two or more vacations a year. Their universities are racing up the global rankings.

The advances in the Chinese tech sector are astounding. The whole country is on 5G, and they’re building 6G as we speak. Now, these are all things we see, living here, which gives people like me an advantage, could say. But even if you’ve never been on an airplane at all, and you live on Main Street USA, you still have to notice how much stuff in the Home Depot or Costco comes from China. Same with the auto parts store, same with the local furniture store. And you figure that all the made-in-China stuff you see when you need a new muffler or coffee maker isn’t just in your town, it’s every single auto parts store or home improvements warehouse, in the whole world. But then you go home and turn on the TV and hear that China is falling apart, that the economy here is terrible, but that doesn’t square at all with the shopping trip you just took.

Imagine a poor guy who unfortunately gets all his news from the Washington Post.

Two weeks ago here was their headline, a single Chinese shipbuilding company—one company—built more ships last year, than the entire United States did since 1945. World War II ended 80 years ago. All the shipbuilders in the United States, all those ships over all those years from all those companies, and one company in China outbuilt them all, in one year.

Then you go back, because you’ve been reading the Washington Post for a long time. Last September the Post said that China’s economy is faltering, growth is slowing, and the government isn’t doing anything.

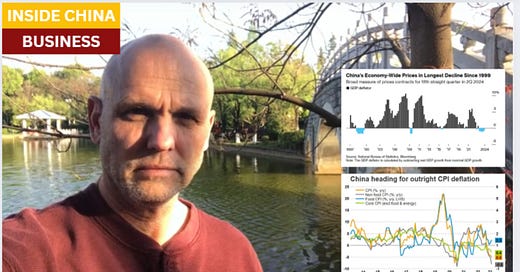

October of 2024: China is trying to fix its broken economy, but ignoring the real problem. China is in a “deflationary spiral.” Deflation means prices are falling—and they are. Housing prices are falling, car prices, medicine, food—and I have never, in my life, heard a single normal person complain about falling prices. But the front page of the Washington Post said last year that what China needs is a lot of inflation, and the Chinese government doesn’t want to do it.

September of 2023. China’s model is failing, and the world needs to pay attention. Two days before that one—China’s economic problems are enormous, and the good news for the US is that it won’t affect Americans at all.

This video would go all night if I posted links from the Washington Post from before 18 months ago, and would go all weekend if I quote other major papers, or our TV news networks.

So unless our sample Washington Post reader has Alzheimer’s and doesn’t remember anything farther back than five minutes ago, he’s wondering now if he’s been lied to all this time. Gallup does an annual survey of Americans’ trust in our institutions, and our confidence is mass media is at a record low. Republicans and Independents have the least confidence of all—”is the news being reported fully, fairly, and accurately?”— they say that this doesn’t happen very much, or not at all. This one is not by political party, 69% of respondents overall say our media doesn’t report news accurately very often, if at all. It’s also across all age groups, and younger people are especially skeptical that anything they’re seeing on TV or in the papers have any truth to it. Gulf Insider has a whole bunch of good reasons why our confidence in media is cratering, and that social media is playing a role in getting out news stories that are ignored elsewhere.

But the reason I’m singling out the Washington Post, is that this is the newspaper for establishment Washington. This is the paper our lawmakers read, and their staffs, and the people who run our federal departments and agencies. Our senior military officers at the Pentagon and our think tanks and the thousands of lobbyists, all these people who are drafting legislation and policy involving China, and it’s all been wrong. They all truly believed that China was collapsing, because house prices in China were falling, along with the cost of living. Everything was becoming less expensive in China, and that meant that the Chinese economy was in big trouble. They really thought that. That was the thesis, and our federal government believed it too.

Now the evidence is undeniable, China is ahead, everywhere. This was from Bloomberg two days ago, a story from China’s tech sector. And this is how the piece leads off—opening paragraph.

DeepSeek has completely blown up this thesis. It’s changed the way the whole world perceives China now. Concerns about Chinese deflation, debt, and demographics, now everyone realizes they had it wrong, and China is challenging the technological dominance of the United States.

China has the deepest pool of STEM talent in the world. The number of engineers here has more than tripled in the 20 years up to 2020, and has gone up a lot more in the past 5 years.

This part gets me, too. I was surprised that DeepSeek was the tipping point, when it could have been a hundred other things, the Chinese space station, or the growth in their Navy, or the control of the world’s raw materials and refinery supply chains, or the titanic trade surpluses they ring up, month after month after month. I didn’t think DeepSeek was a big deal compared to those others, I’ve been using Chinese AI for a long time, along with everyone else here. Anyway, about half of the world’s top AI researchers are from China.

When Chinese students go to grad school, they want to study the hard sciences. And another key driver of all that is the cost of China’s universities. All these Chinese engineers are going to school for a few thousand dollars a year, at the most. Our engineering schools cost at least 10 times as much.

Chinese kids are going on to university in record numbers, and none of them graduate with big loans to pay off.

China has a lot of engineers, there are hundreds of thousands more in the pipeline every year, and they don’t cost very much. A compensation package for top researchers in China is one-eighth that in the United States.

I’ll say again how frustrating it’s been for me, to read articles about China’s deflation—falling prices—and how that was somehow a huge problem for China, instead of being a huge problem for us. If you’re a tech investor, where will your money go farther? Silicon Valley, or Hangzhou? Boston, or Shenzhen? If you’re a small tech company with an engineering payrolls budget of a million dollars a year, you could hire 5 engineers in California, or 40 in China.

That’s payrolls. How about office rent? Get ready to pay 8 to 10 times in California or Massachusetts, compared to the tech hubs here. But if you’re a Washington Post subscriber, you’ve believed for years that Chinese deflation was a problem for their economy, and the Chinese government was too stupid to stop the deflation. Instead of concluding, instead, that the Chinese government was doing it on purpose. China’s costs were falling, for everything—for housing, for travel, for education, for household products, for transportation, for groceries. Every month, every year, the Chinese economy was becoming MORE efficient, more cost-competitive, compared to everywhere else. And our mass media, our government, actually believed that was a fatal flaw for China’s economy, instead of for ours.

All those delusions have consequences, big ones.DeepSeek was built for $6 million dollars, instead of the $6 billion that it costs our companies to build AI, and $600 billion in shareholder equity vanished the day after Wall Street found out about Deepseek.AI, medicine, shipbuilding, manufacturing, supply chains, space—now China owns all of it, and all the important people in all the important places are realizing they’ve been looking at China the wrong way. Better late than never, but still too late to make a difference.

Resources and links:

China’s economic woes may leave U.S. and others all but unscathed

https://www.washingtonpost.com/business/2023/09/04/china-global-economy/

China’s ‘Engineer Dividend’ Is Paying Off Big Time

https://www.bloomberg.com/opinion/articles/2025-03-24/china-s-engineer-dividend-is-paying-off-big-time

Opinion | China’s economic successes are reshaping the Western media narrative

Americans’ Trust In Mass Media Hits All-Time Low

https://www.gulf-insider.com/americans-trust-in-mass-media-hits-record-low/

Americans' Trust in Media Remains at Trend Low

https://news.gallup.com/poll/651977/americans-trust-media-remains-trend-low.aspx

Chinese naval modernization may be aided by foreign firms, report says

https://www.washingtonpost.com/world/2025/03/12/chinese-shipbuilding-military-national-security

The Chinese economy is faltering — and that means more trade tensions

https://www.washingtonpost.com/world/2024/09/20/chinese-economy-slowdown-real-estate-crisis/

China’s model is failing. The world should pay attention.

https://www.washingtonpost.com/opinions/2023/09/08/xi-jinping-china-economy-model-failing/

China is trying to fix its economy — except the real problem

https://www.washingtonpost.com/opinions/2024/10/16/china-deflation-consumption-economy/

China’s universities just grabbed 6 of the top 10 spots in one worldwide science ranking – without changing a thing

Why Is China Still the World’s Largest Auto Parts Production Base?

https://alsettevs.com/why-is-china-still-the-worlds-largest-auto-parts-production-base

Leading exporting countries of furniture worldwide in 2023

https://www.statista.com/statistics/1053231/furniture-leading-exporters-worldwide

Comparing College in China to US College Admissions

https://www.collegeadvisor.com/resources/college-in-china/

Shenzhen showers AI companies, workers with cash to boost local industry

Chinese Trade Surplus Soars to $1 Trillion Ahead of Trump Return

Falling prices signal bigger troubles ahead for China’s economy

https://apnews.com/article/china-economy-deflation-housing-congress-36d116f4657aa3064882af9b2dd57b14

"China has the deepest pool of STEM talent in the world. The number of engineers here has more than tripled in the 20 years up to 2020, and has gone up a lot more in the past 5 years.

This part gets me, too. I was surprised that DeepSeek was the tipping point, when it could have been a hundred other things,"

Here is the thing. Yes on almost all measures China overtakes USA soon or has done in the last 10 years. But there was always one last hope: AGI - the dreamt of point where AI can do what till now only a very smart person could do.

US gets strong AGI early, and then all those other Chinese advantages disappear and US can stay Top Dog. Unlikely I agree, but it really is the USA's last hope. Hence all those oligarchs switching from Dems to Trump, the $500bn computing infrastructure plans, the lauding of the power of NVIDIA.

The Last Chance depends wholly on 2 entry barriers: Hi quality NVIDIA chips and Investment barriers that capital requirements that could only be provided by US Private Equity.

DeepSeek blows away both those barriers. Chip manufacturing and investment sums.

DeepSeek was not the tipping point (that was 9 or 10 years ago), but it was The Last Chance.

To prolong the Tipping Point idiom, DeepSeek was the point where USA landed flat on its nose.

You are puzzled because you don't understand what America is about. American is about predatory Empire. It's about monopolistic corporations and predatory finance. It's about a rentier class that seeks not to create wealth, but to extract wealth. And the media serves them, is owned by them. Maybe you're a good guy. Maybe your company is trying to actually make good stuff. But you are not a player. You're another dupe to be lied to and exploited by the oil companies, the weapons makers and the financiers. And they, not you or the American people, run the show. Welcome to reality, Kevin. Hope you stay for a while.