China's new export ban on tungsten shocks defense contractors as Pentagon races to find new supply

Bullets:

China recently announced a new ban on tungsten, a metal vital in heavy industry, semiconductors, construction, and aerospace.

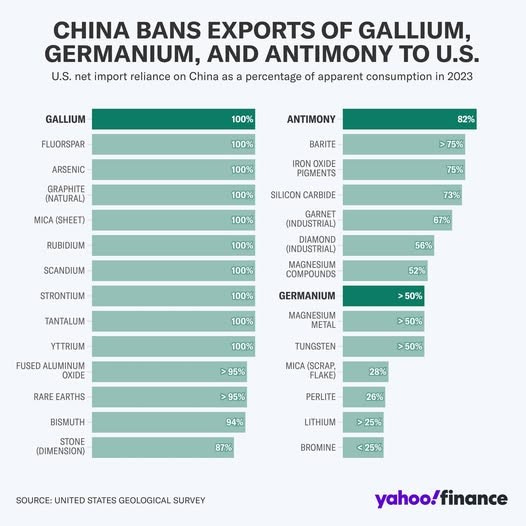

Tungsten is also a critical material in weapons systems, and China's trade restrictions for the metal follow similar bans on gallium, germanium, and antimony.

Market prices for tungsten are moving sharply higher, along with the stocks of the small handful of tungsten miners.

Insiders are gravely concerned, too, that China may relax its restrictions against imports of tungsten scrap. Were they to do so, massive volumes of scrap would head back to China, and drain Western markets of even these supplies.

Report:

Good morning. Most of the headlines we see for the trade wars concern tariffs. Almost every day there is news about the tariffs and how the ground is shifting under the feet of importers who have ships on the water, or packages in a warehouse, and they’ve just been informed that they need to pay more if they want them delivered. So there is a human interest aspect of the story that is always compelling, and journalists can easily find people to talk to, with strong opinions on both sides, who can fill up a news article or a few minutes of broadcast time.

Those stories and points of view are interesting, but they are much less important than what is happening at the top of the supply chain, on the raw materials side. China and the BRICS countries own the top of the supply chains, for just about everything. Tariffs don’t matter up there, and it’s they who decide whether, and where, anything gets made. It’s one of the most critical, existential issues today, and just a handful of journalists and researchers are paying attention, and those who are work in business and industry media exclusively.

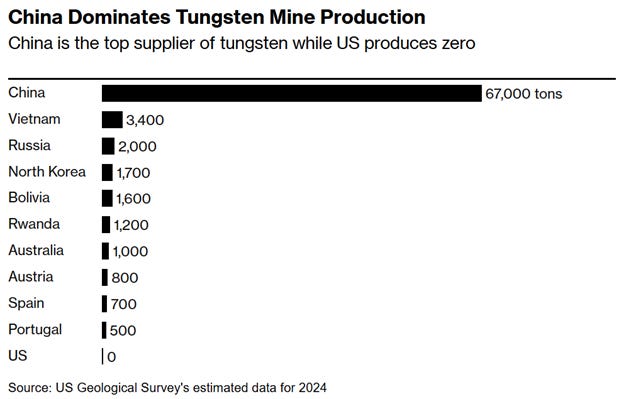

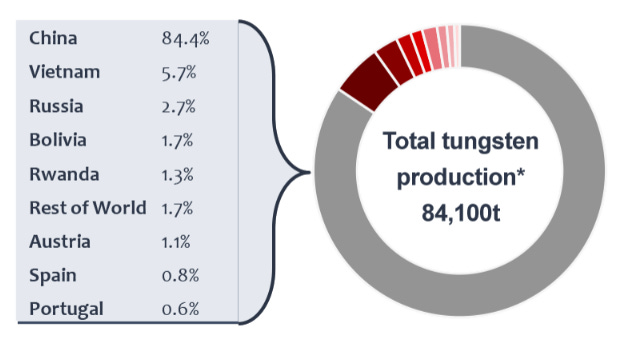

So here are two charts on tungsten, and which countries have it. The Bloomberg chart is by tonnage, the production estimate from the US Geological Survey dated last year. The bottom chart is the percentage breakdown, by country, but they took out North Korea and lumped it in with “Rest of World”. If you’re a North American or European, and you’re scrolling down the list, and considering how friendly these countries are---or if you’re an American defense contractor, and you’re looking for tungsten to build weapons systems, there’s no good news here at all.

Here's another that makes things worse, if you happen to be a Pentagon procurement official. It’s a chart of everyone else who is looking for Tungsten, besides you. 30% of all the tungsten goes to automotive sectors, then mining, then industrial, then energy, 8.% of it goes to construction. Aerospace is at 8%, and a good chunk of that is defense, and Defense as a stand-alone is at 10%. So there are lots of people in a lot of places who are looking for tungsten to build cars, or semiconductors, or industrial products.

Another challenge is here: the demand for tungsten is rising, fast, but the supply is not. And here’s where all the supply is, for now. China, Russia, Vietnam, and North Korea are neighboring countries, and friendly ones. Russia produces as much tungsten as Europe and the United States, combined, and China’s production is 33 times China’s.

China and its neighbors then have a near-total monopoly on tungsten. And just like with the other materials that are critical to high-end manufacturing, and semiconductors, and energy, and defense, China and the other BRICS can employ strategies in supply chains that make tariffs irrelevant. I mean that tariffs can be tit-for-tat. Country A raises their tariffs from 10% to 20%, so Country B can do the same. Or Country A puts a tariff on cars, hurting suppliers in Country B, and Country B responds by putting tariffs on whiskey, because Country A sells a lot of booze to B. But in these raw materials, other countries have no recourse—there is no answer. We don’t have tungsten, in this case, and neither do our friends.

Tungsten buyers in North America are shocked—those are their words—”in a state of disbelief”, after Beijing put tungsten on the export ban list. It’s the same policy that China previously announced for gallium, germanium, and antimony, and that caused prices on those to go vertical. Analysts believe here the same is coming for tungsten next.

China consumes here most of the tungsten it mines, and going back to the previous chart, it gives extra context. China’s the world’s biggest car market, the biggest factory sector, construction, huge in aerospace.

So China is now officially targeting exports of any of its tungsten that can be used in Western defense systems. “The recent announcement is surprising”---it says here—and I wonder why. Why was it surprising that they would do the same thing for tungsten that they’ve done in gallium, germanium, antimony, and graphite? That’s not a rhetorical question—I want to know why any supply chain research analyst is surprised, at this point? Anyway, he’s in good company. Almonty’s stock is up 41% in 2 days as investors are realizing we don’t have any tungsten, but everybody needs it. Our economy, manufacturing, defense, everything depends on tungsten.

Things are bad now that China has put on a new export ban, and we should assume that Beijing can call their friends in Moscow and Pyongyang and Hanoi and get their tungsten coming this direction, to China, instead of anywhere else.

But they have another arrow in their quiver, too. China currently has a ban on imports of tungsten scrap. The recycling and re-refining of titanium is a messy and dirty industry. But if China were to allow it again, China would suck in huge supplies of tungsten from global markets, overnight. There would be almost nothing left for buyers anywhere else, and it would create a situation where our companies would simply be unable to get any at all. This piece conclude with a question that is rhetorical for now, but probably won’t be next month: how much will China tighten the screws? The news today is bad, and he thinks tomorrow’s news is going to be worse.

The United States hasn’t mined tungsten for a decade, and we get most of our tungsten from China. There are mining projects here that may come online in the next 40 months or so, but the US lacks domestic supplies. This CEO is hoping for government funding to support more tungsten mining.

The Pentagon is partnering with a couple of Canadian companies, to develop projects there. Fireweed Metals was awarded $15 million for a mine in the Yukon, but it’s not far along. That funding will just go toward a feasibility study, to see if it can be mined there at all. There is other Pentagon funding which is promised, to other exploration companies.

But this is too little, too late. It takes tens of millions of dollars to build new mines, and years to get them surveyed, prospected, roads built, staffed, and producing. The government help that these tungsten company CEOs is looking for, that should have happened 10 years ago. Instead of building up our tungsten industry, we shut it down.

The trade wars are being fought where countries perceive their advantages to be. The US is the world’s largest consumer market, and so tariffs are employed or threatened, which means consumers in the United States will pay higher prices for products not made in the US.

But China and the BRICS are the world’s natural resources economies, and they are using outright export bans. And that means our companies and can’t get raw materials at all. The Pentagon is a money-no-object consumer, and defense contractors will have the first call on any gallium or germanium or tungsten they can get their hands on. But they can’t get it.

Resources and links:

Tungsten Miner Says Clients in Shock as China Chokes Supply

China Makes Most of Tungsten Clout in Opening Trade War Salvo

China Wields Commodities Leverage with LNG and Tungsten Curbs

Department of Defense Makes Investment to Strengthen the Tungsten Supply Chain

After steel and aluminum, Trump threatening tariffs on Canadian cars up to 100 per cent

https://nationalpost.com/news/trump-threatening-tariffs-canadian-cars

Tariffs take aim at Kentucky bourbon

https://spectrumnews1.com/ky/louisville/news/2025/02/02/bourbon-tariffs

China has banned exports to the United States of the critical minerals gallium, germanium and antimony

https://www.facebook.com/yahoofinance/posts/china-has-banned-exports-to-the-united-states-of-the-critical-minerals-gallium-g/954456146549164/

As usual, you have delivered another great analysis with supporting data / graphs. As you mentioned: "So China is now officially targeting exports of any of its tungsten that can be used in Western defense systems." I am thinking that China's ban on tungsten may be a good thing for global peace - even for a short time.

Superb and significant analysis. How much tungsten is in the US inventory today? Shanghai Metals Market prices little changed today. Surprising there isn’t more panic, but perhaps I overestimate how much the US manufactures using steel, versus recycled paper pulp.