De-dollarization: Are China and the BRICS building a gold-standard trading system?

Bullets:

Massive volumes of gold are being moved from Western countries, to vaults outside the SWIFT system and Western regulation.

Even for the world's top gold mining countries, such as China and Kazakhstan, their central banks are buying, instead of selling, despite record high gold prices.

It is possible that countries are depositing gold into vaults located in friendly countries, as a form of "mutual hostage-taking". In so doing, the gold on deposit can collateralize hundreds of billions of dollars in real goods trading, and thereby replace Treasury bonds and dollars in that role.

Western sanctions against Russia have supercharged other governments' urgency to build an alternative trading system, free of political coercion and foreign oversight.

Report:

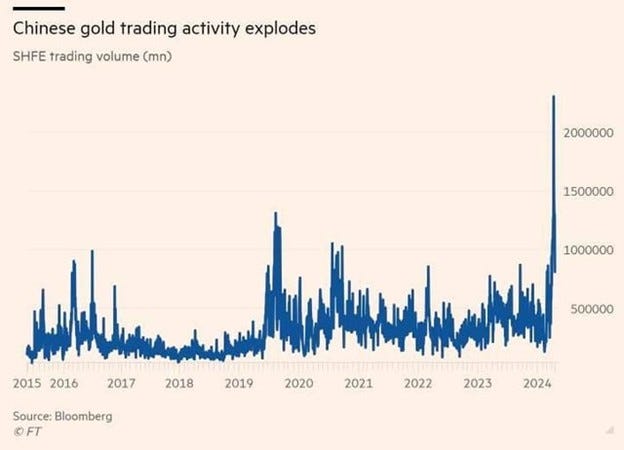

Good morning. China and the rest of the BRICS countries are clearly up to something big, and our analysts are trying to get a handle on just what. Consider this chart, here:

The SHFE is the Shanghai Futures Exchange, and we see that in the fourth quarter of 2024, last year, there was an explosion in gold futures trading. For some reason, thousands of people were trading gold contracts, using Shanghai gold futures. Why? Why the sudden interest for new buyers and sellers, here in China and around the world, to use gold futures on the Shanghai exchange? Maybe it’s speculation by investors? Or, maybe it’s hedging of long or short position—but Chinese regulators don’t allow short positions anyway, usually—not longer than overnight, and that’s just for their own banks’ trading desks. This isn’t speculators, then, and probably not retail investors. So what is this, line going straight up?

This is another. Central banks are buying gold in record volumes, 80 tons per month at $8.5 billion, led by China and a bunch of others we can’t even identify for sure. Most of the buying is secret, but China is the elephant here, and they are routing a lot of their global buys through Switzerland.

China is already the biggest gold miner in the world. And yet China is the biggest central bank buyer of foreign gold, as well. All told, 1,000 tons a year, which is over a fourth of everything that comes out of the ground across the world. A survey of 72 central banks says that there are no gold sellers—nobody plans to sell--and a third of them will increase their gold buying this year.

The National Bank of Kazakhstan was a net seller of gold, now they’re buying. There’s Kazakhstan, right under China at 130 tons a year of production. Instead of selling that gold to buyers abroad, and collecting billions of dollars, they’re keeping it instead. That’s another good question to ask, why Kazakhstan flipped the switch from net seller to net buyer, even at record high gold prices.

Kazakhstan is at least admitting publicly what some of their plans are. Most of the central bank buying is undeclared. The blue bar here is declared gold purchases by central banks, compared to the black, which is estimated purchases. It’s an estimate because nobody really knows the number, but analysts can watch the funds coming in and the gold is moving out, but governments and central banks aren’t informing the traders in Western systems.

This helps to explain countries like Kazakhstan who are buying instead of selling, and why countries are doing it as quietly as possible: Central banks were sellers of gold, going back decades. Nobody wanted to store gold when they had better ways to borrow and lend. But Western sanctions on Russia changed all the thinking about that, fast. None of the central banks are selling gold anymore, and many of the ones that are buying aren’t reporting it. The “dollar is being used as a weapon”, reserves can be frozen or just seized, so every central banker in the world outside our own Fed or the EU is strongly incentivized to get their dollar reserves moved to different banks, and their gold reserves moved to different vaults.

That’s what the global market players strongly suspect now. Actual net buying by the Chinese is much larger than what their official data say.

Large deposits of European gold are in London. This is a chart of Chinese buying of 400oz bars, most of that is probably brought back to vaults in China, but nobody outside China can really say for sure. Some of the gold is moved from vaults in the UK to vaults in Switzerland, again, we know that gold that is bought by China’s central bank is leaving the UK and going to Switzerland, but the Swiss don’t report separately gold buys by central banks—so this is all an educated guess too:

But here is the biggest question of all. China’s domestic mining production, which is the biggest in the world, plus China’s recycling, plus all this foreign central bank buying—as huge as those volumes are, it’s not enough to explain all the new demand. There’s a big hole, the difference between demand and supply. There is a lot of gold demand, and it is rising, which we see reflected in the gold price, but nobody knows where it’s going.

The guys at Goldfix have a thesis, which is very compelling. They put the pieces together, and believe that the BRICS countries are setting up a financial system, based on a gold standard. Gold is being used as collateral, right now, and China is leading the expansion of the whole system.

Key to that is an international gold custody network. Vaults in China, Saudi, Southeast Asia, and Africa will serve as the plumbing of a new settlement system. Gold will be used as the underlying collateral, instead of US Treasury bonds and dollars.

In the SWIFT system today, it’s dollars that serve as the pools of liquidity, to make global trade happen. But a growing number of countries no longer view the dollar or US Treasury bonds as safe investments, and most certainly not if they can be seized or frozen by Western regulators. They need, instead, a new form of collateral that is free of politics, cannot be printed or inflated away, and recognized by everyone as a store of value.

Gold has always enjoyed those features, but there are big problems. How to verify the other party has gold?—that’s the trust issue. It also takes a long time to move gold. The SGEI in Shanghai is already set up to solve all those problems. China’s currency is the renminbi, or yuan, and in this system, renminbi will be the medium of exchange, backed by gold. Buyers and sellers in the new system don’t have to use renminbi in their trades, and probably will choose not to in bilateral trading with countries not China, but they can do so if they want.

So China will solve the trust and verification problem by opening vaults in friendly countries across the world. In Saudi, the appeal for China and Saudi Arabia is that oil trades can be quickly settled outside the dollar. In Southeast Asia, central banks there can pledge their gold for RMB credit lines, for their purchases of manufactured goods from Mainland China. In Africa and the Middle East, their gold can be used to finance new infrastructure. And this is an important wrinkle—respective BRICS members put some of their gold in the vaults of other countries. Your gold is here, my gold is there—you can go to your bank and count my gold, and I can do the same for your gold here.

That helps explain what’s happening in Singapore, we think. Vaults in Singapore are being used to custody gold deposits from China, India, Indonesia, and Gulf States. China, India and Indonesia are BRICS countries, and the question is why they would park their gold in Singapore instead of bringing it home. And that’s the answer: Singapore banks are highly regarded and trusted, and provide auditing and verification of the ownership of the gold in their vaults. Then blockchain systems make all the transactions happen very fast, in seconds. The gold sits still, but ownership of the gold can change instantly to finance trade, and change back upon settlement.

That feature-- instant convertibility, from renminbi to gold, or back—that is new. And it means that this gold is replacing the guarantees for global trade. It is not US Treasury bonds anymore—dollars—but gold. A lot of the gold moving in and out of China goes through Shanghai, in this case, which might --- might --- put the first chart into better perspective. If gold is being used as the collateral, Mainland China buyers and sellers need to convert back and forth to renminbi, and maybe they’re using short-term gold futures on the Shanghai exchange to make that part of the trading work.

The implications are obvious to everyone, and these bullet points here include Russia, and they also apply to every single other country that might be worried about running afoul of Western governments. This whole system is sanction-proof. Countries will do all the trade they want, and American and Europeans regulators can’t see any of it.

Resources and links:

Shanghai Gold Exchange launches first offshore vault in Hong Kong

The BRICS 2025 Dedollarization Endgame

China Produced the Most Gold in 2023

https://www.voronoiapp.com/natural%20resources/China-Produced-the-Most-Gold-in-2023--1085

Central Bankers Are Still Buying Gold After Record Bull Run

The New Gold Hub? Here’s Why Singapore Storage Is Rising

Gold Keeps Setting New Record Prices. So Where Are the Investors?

https://www.usfunds.com/resource/gold-keeps-setting-new-record-prices-so-where-are-the-investors/

It behooves China to not back their currency with gold for the simple reason that their currency, and by extension their entire economy, will get manipulated like a yoyo by Jewry with the most gold holdings. We're talking about 125k+ tons of gold looted from China in the 1930s alone, not to mention all the booty plundered from many nations during their remote-control conquests such as of India, Russia, SE asia, middle east, etc. that by some conservative estimates amount to over 300k+ tons of gold that has been melted down and remolded to illuminate traceability.

The conspiracy theory that there is not as much gold in Fort Knox as there is supposed to be has been around for quite a few years. Futures trade below the implied price of physical delivery for this reason. With increased geo-political tension and threats of a complete trade block between US and its small part of the world and the rest of world, this all seems perfectly natural.

Equally if I were an asian gold trader or investor, I would want to trade Shanghai delivery gold.

The problem for the RMB becoming the dominant reserve currency is the lack of assets - loans to high quality credits - China just doesn't need to borrow.

But for Gold trading, there is plenty of underlying asset.

So Gold trading naturally flows to where the money is, while reserve asset trading stays where teh borrowers are (for now)