Bullets:

China has strict export controls on seven rare earth metals, which are critical for manufacturing in defense, energy, transportation, medicine, and aviation.

Foreign buyers must guarantee that their shipments will not go instead to a third party in the United States, and further provide assurances that the metals will be used solely in non-military applications.

Chinese-based suppliers who hope to export these materials or magnets must first get permission from national-level authorities, who have announced harsh penalties for any parties in violation.

Firms across the world are increasingly desperate. German manufacturing experts warn that their industries face ruin if Chinese exports do not resume soon. Automakers in India and the US are considering production increases in China.

The companies in defense and munitions manufacturing are in the worst position, as their rare earth reserves decline even as Europe and the US are ramping up defense spending.

Report:

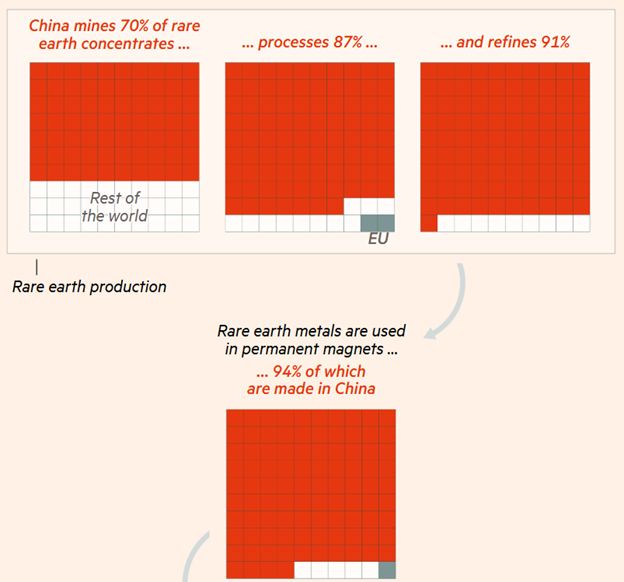

Good morning. These are the two most important charts in the supply chains for advanced applications and manufacturing for the defense industry, energy, robotics, aviation, medical equipment, and transportation. All the expensive stuff, in other words. Because all those industries are heavily dependent on magnets, and rare earth metals are needed to build magnets.

First up is the supply chain for the magnets—70% of the rare earth mining is China, 87% of the separating and processing is China, 91% of the refining is China, and the 94% of the magnet production is China.

The next one shows the problem of doing that ourselves. This is the production of these rare earth minerals, by country. That big blue thing on all of those is China. China is over 80%, for all of them. Green is the United States, and it only shows up one time, for neodymium. We are years, decades, away from building a domestic industry for rare earth mining and processing and refining, then the manufacturing of the magnets. So it all needs to run through China, and China’s government has made the export of these minerals, and the magnets, much more difficult.

China has tight export restrictions on seven of these rare earths and magnets, which are crucial for energy, robotics, and defense. China has approved some exports for Europe, but at a very slow pace. Unless there are big changes, and fast, there will be significant damage to European manufacturing, according to experts there.

Some producers in China are taking orders from customers, but that doesn’t mean the orders are being filled and shipped out, and the orders are piling up fast, now. China’s new export restrictions are not easy to meet: first, companies need to prove that the shipments will not later be sent on to the United States, which would violate the licensing agreement. It’s hard to prove that. And the other restriction is that companies need to guarantee that the imports will never find their way into military applications. Elon Musk and Tesla are trying to figure out how to do that. And this car manufacturer in India doesn’t know how to do that either. Chengdu Galaxy Magnets is a major producer and exporter of magnets until recently, and exports for non-military applications MIGHT still be allowed.

So if Elon Musk and the Indians are having trouble getting their hands on Chinese magnets to build electric cars, we can imagine how bad things look for defense contractors who want Chinese magnets to build weapons systems. Lockheed builds the F35 Lightning, and each one of those needs 920 pounds, over 400 kilograms, of rare earths. The company says they have enough rare earth materials for the rest of the year—which is about half over—and Lockheed believes that US authorities will give priority to Lockheed to source these metals and magnets, given how important they are to Lockheed, and how important Lockheed is to the Pentagon. And it’s good to have friends in Washington, who might give Lockheed first dibs on neodymium, but for everything else you need to have friends in China. But if you’re building stealth bombers and hypersonic missiles, you don’t have any friends in China.

So alarm bells are going off, across the world, and magnets buyers have tough decisions to make. Indian automakers, for example, are considering a move down the supply chain, simply buying the whole electric motor from Chinese suppliers. Any other option will cost a lot of money and time.

There are big hurdles now, on the demand side, and on supply. Every buyer of these materials needs to guarantee that they will be used for civilian purposes, only. That’s demand. And any Chinese company that exports these materials needs permission, first, from regulators at China’s Commerce Ministry, and all the parties to the sale are guided by these new policies here.

It’s a special campaign to combat smuggling and exports of strategic minerals. It applies to companies anywhere in the supply chain for these metals and materials. And severe penalties apply to anyone in that chain who allows any of these exports to eventually end up in an F-35, for example. There is no practical way to do that, and if you’re a salesman at Chengdu Magnets, or one of the regulators in Sichuan that oversees the activities at Chengdu Magnets, that is something that will hang over your head, for the rest of time, if a shipment is redirected instead to Lockheed, who just told us that they have friends in Washington who will get them the magnets they need.

So under these new rules, the Chinese exporters need to document all the information about their buyers, and explain to regulators here exactly how they will be used. Pentagon suppliers may be unable or unwilling to answer those questions, so the implication here is that this business won’t be done, at all. The deadlines can be pushed back indefinitely, without explicitly rejecting importers’ applications to buy. China is in a win-win position—the licensing rules allows China to see who is buying and why—just from the application—and the Chinese can just reject the application anyway.

Some companies are getting desperate, and are trying to get them any way they can. Hong Kong officials found 25 tons of antimony in an outbound shipping container. Antimony is used to make munitions and explosives. And customs agents in Guangxi province found a shipment of bismuth that was declared to be soldering paste. Another company, anonymous, obviously, had a supplier that got some rare earth out on an air shipment, but later attempts by sea were intercepted by customs officers, and we should assume that this supplier isn’t going to be in the supply business for anything from now on.

The trade war is being fought differently, by both sides. The US and Europe are using tariffs, closing off markets by raising prices. China is closing off markets by shutting down exports of the materials our manufacturers need to build anything in these industries. Chinese exports of tellurium, down 44%. Tungsten rods, down 84%. For these other mineral imports, they’ve collapsed completely since last September. This is for the US, and Chinese regulators are closing off all the work-arounds. Companies who need the minerals and magnets from China are boxed in, and many will simply decide to do what the Indians will do—just let Chinese plants build the whole thing, and put their own company’s name on it. That’s an option for Elon Musk and Tesla, too--just increase production at his Tesla plant in Shanghai, and export their cars. And that’s a win-win for China too. This is the Nalati Grassland, in Xinjiang. BG.

Resources and links:

China’s critical metal exports plummet as trade war curbs take effect

https://www.scmp.com/economy/china-economy/article/3307410/chinas-critical-metal-exports-plummet-trade-war-curbs-take-effect

China isn’t getting rid of its controls over rare earths, despite trade truce with US

https://edition.cnn.com/2025/05/20/business/china-rare-earth-export-controls-analysis-intl-hnk

商务部新闻发言人就开展加强战略矿产出口全链条管控工作应询答记者问

https://www.mofcom.gov.cn/syxwfb/art/2025/art_cb45af5894ba458fad7b06d5a0b8d7a5.html

https://weibo.com/7040797671/PruP65rqu?pagetype=profilefeed

Rare Earth Truce or Trap? China’s Grip Still Chokes Global Supply

https://agmetalminer.com/2025/05/22/rare-earths-china-global-supply/

China curbs on rare earth magnets: Electric Vehicle makers face shortage, approach govt

https://indianexpress.com/article/business/china-curbs-on-rare-earth-magnets-electric-vehicle-makers-face-shortage-approach-govt-10013100/

Global supply chains threatened by lack of Chinese rare earths

https://www.ft.com/content/81ba803e-9cce-4752-8432-4dde4e77c691

How critical minerals became Beijing’s ultimate trump card in US-China trade war

https://www.scmp.com/economy/china-economy/article/3310921/how-critical-minerals-became-chinas-ultimate-trump-card-trade-war

China targets smugglers to strengthen export controls on critical minerals

Wall Street Journal, China to Crack Down on Rare-Earth Materials Ahead of U.S. Trade Talks

How critical minerals became Beijing’s ultimate trump card in US-China trade war

South China Morning Post Exclusive | US-China deal no relief for firms as rare earth curbs keep supply chain severed

China targets rare earth export curbs to hobble US defence industry

https://www.ft.com/content/d3ed83f4-19bc-4d16-b510-415749c032c1

About Lockheed Martin

https://www.lockheedmartin.com/en-us/who-we-are/business-areas/missiles-and-fire-control.html

US Critical Mineral Exports from China

https://x.com/nathaniel_sher/status/1922474003328868450/photo/1

Tesla to Expand Production at Shanghai Plant

https://www.caixinglobal.com/2021-11-29/tesla-to-expand-production-at-shanghai-plant-101811399.html

😀 Excellent, Pertinent Information 😃

Trump and his acolytes have already, in essence, declared war on (i.e., to do physical harm to the citizens of) China sometime in the near future (ref.: recent Trump's and JD Vance's speech at Westpoint). So, if military industrial complex have first dibs on rare metals imported from 'whereever', then it wouldn't benefit China to be shipping any such metals to the USA or their allies.