Europe is re-arming to counter Russia. But first they have a China problem.

Bullets:

Stocks of European defense companies are soaring, amid plans to dramatically increase military spending.

Airbus is one of many companies that are vying for new, lucrative weapons contracts in Europe, even while Chinese companies are key suppliers for their commercial jet fleets.

But most of the raw materials and components for advanced weapons come through China, or are sourced in other BRICS countries. And China's export bans on raw materials are already wreaking havoc at the Pentagon.

What's more, new export control lists targeting top US defense firms are likely to restrict many of the semiconductors that are used in the most expensive platforms across naval, air force, and missile systems.

Will China allow the exports of these raw materials and semiconductors to European firms, weeks after banning their sale to US weapons makers?

Report:

Good morning.

Most of the headlines for the trade wars today involve tariffs, and how companies and countries are responding to the new tariffs that are being levied, seemingly now by everybody against everybody.

But more important is what’s happening farther up the chain, in raw materials and components parts. Because it’s at that part of the supply chain where China and the other BRICS countries hold enormous advantages, and the tariffs don’t matter here at all.

A 25% tariff on electric vehicles, for example, just means that consumers in that market will be paying a lot more for EV’s. But an export ban on graphite or refined lithium, on the other hand, means that EV’s don’t get built at all.

And that’s a crucial difference when we look at headlines, like these here. In January, the United States put Tencent and CATL on a list of companies that allegedly aid China’s military. Tencent and CATL were two companies on a list of over 50 big companies here that the Pentagon declared to be military companies.

This was an announcement from China’s Ministry of Commerce, who put 28 American companies on an export control list. Raytheon, Boeing, Lockheed Martin and 25 others are restricted from importing from Chinese suppliers any dual use goods, which are products with both military and civilian applications.

It’s hard to know what to make of the Defense Department’s announcement, or what it means in a nuts and bolts way when a Chinese company is placed on that list. Tencent is a big company here, in social media and gaming and in payment processing. CATL is a giant producer of batteries that go into Chinese EV’s, but Chinese companies cannot export EV’s to the US markets as it is.

But Beijing’s export control list can have very tangible, real-world effects, because of how deeply dependent Western companies are on Chinese suppliers, to build everything. Beginning in 2019, a consulting group began a 5-year analysis on the Pentagon’s supply chain, spending, and weapons acquisitions systems. Their takeaway is 3 bullet points that describe the ‘unsettling dependence’ on Chinese companies for our own defense.: Over 40 percent of the semiconductors in Defense weapons systems and infrastructure come from China. Over a 15-year period, the number of Chinese companies in the Pentagon supply chain has gone up 4 times. And in the eight years through 2022, our military’s dependence on Chinese electronics has gone up 7 times.

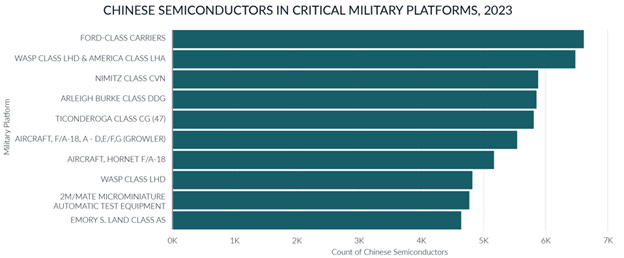

For example, our newest aircraft carriers need over 6,5000 Chinese semiconductors.

Here are some other US Navy assets, and these green bars represent how many Chinese-made semiconductor chips are in each platform. The F-18 is an attack fighter aircraft, and it takes over 5,000 Chinese semiconductors to conduct operations.

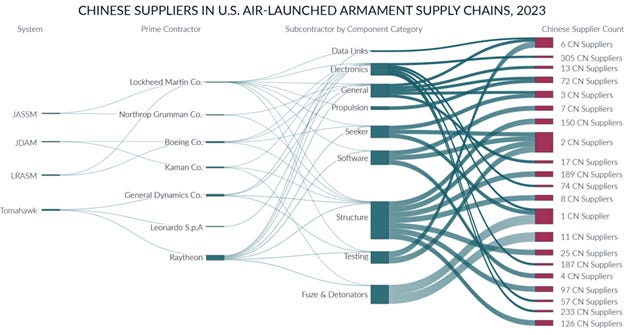

All of our major missile systems have deep dependence on Chinese suppliers. Everything from Data Links, Electronics, Propulsion, airframe—these are our most critical air-launched systems, and dozens of Chinese suppliers are building parts for them.

So going back to this list, we see Raytheon, Boeing, and Lockheed Martin. Those three companies are prime contractors for all of those missile systems. All those lines go to at least one of those companies that are now on China’s export control lists, which restrict dual-use exports.

Back to the original question, what does it all mean? I’m guessing on our side, that if Tencent is on the Pentagon’s list of companies that help China’s military, that Pentagon contractors and military personnel can’t have League of Legends on their government devices. And I’m guessing, on the China side, that if Raytheon is on China’s list of companies restricted from buying dual-use semiconductors, it means we can’t build Tomahawk missiles.

Now, I think that’s what it means, but I don’t know the answer to that question. But it seems that nobody is even asking the questions at all. Here are some headlines from Europe, where they are significantly increasing their defense spending. Airbus is one of the companies that is capitalizing on that trend, and negotiating now for new defense and space orders. Airbus’ order book increased 15% to about $16 billion even before this recent big spike in spending. Airbus, by the way, isn’t keeping up with production for civilian aircraft, and they’re already behind on their military orders too. Their book-to-bill is 1.4.

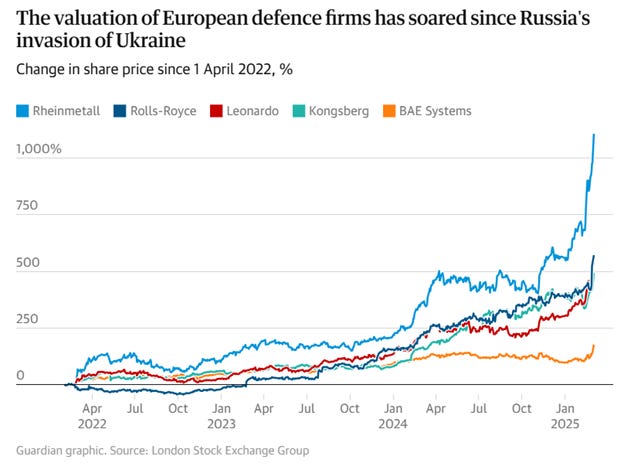

It’s not just Airbus. Stock prices for European weapons makers are all jumping higher. Investors anticipate significantly higher spending on defense. Western governments and investors just assume that our defense companies are going to be able to continue buying critical raw materials and hardware from China. Everyone involved in this story—European governments, defense contractors, investors, and even the journalists, just accept uncritically that just because Europe wants to build weapons, that they can.

All the supply chains run through China. And what has China done, that we do already know? China has an export ban on gallium, used to make weapons-grade semiconductors. China has an export ban on germanium, used in other semiconductors, satellite systems, and night vision equipment. China has an export ban on tungsten, used everywhere in ballistics, along with aircraft engines and missile guidance systems. China has an export ban on antimony, used in explosives.

Airbus is already dependent on China to build planes for the civilian sector. Over 200 suppliers in China build parts for Airbus. So where does this confidence come from, in the boardrooms of Airbus, and for all the investors who are bidding up the prices for these European weapons makers, that these new weapons platforms that Europe wants, will be built?

Without Chinese semiconductors, the US Navy ships don’t know where to go and our missiles don’t fly, and China said they’re not doing that anymore. No more chips, and no more raw materials to make them. So where does Europe think they will get them? And why isn’t anyone else asking that?

Resources and links:

Forbes, America’s Carriers Rely on Chinese Chips, Our Depleted Munitions Too

https://www.forbes.com/sites/erictegler/2024/01/09/americas-carriers-rely-on-chinese-chips-our-depleted-munitions-too/

Reuters, Airbus says it is in defence and space talks amid spending surge

Department of Defense Designates Over 50 Top Chinese Corporations as ‘Military Companies’

https://www.fdd.org/analysis/2025/01/07/department-of-defense-designates-over-50-top-chinese-corporations-as-military-companies/

Reuters, US adds Tencent, CATL to list of Chinese firms allegedly aiding Beijing's military

Airbus builds strong supply chain in China

Reuters, Biden administration finalizes US crackdown on Chinese vehicles

China Imposes Its Most Stringent Critical Minerals Export Restrictions Yet Amidst Escalating U.S.-China Tech War

China chokes tungsten exports to the United States

https://financialpost.com/commodities/mining/china-chokes-tungsten-supply

China’s New Graphite Restrictions

https://www.csis.org/analysis/chinas-new-graphite-restrictions

China proposes export ban on battery cathode and lithium processing technology — here are the specifics

https://www.metal.com/en/newscontent/103121013

China’s First-Ever Use of Export Control List Against U.S. Defense and Tech Companies

European Defense Stocks Go Parabolic as War Spending Surges

https://www.usfunds.com/resource/european-defense-stocks-go-parabolic-as-war-spending-surges/

European defence stocks soar as arms makers expect orders boom https://www.theguardian.com/business/2025/mar/03/european-defence-stocks-surge-as-arms-manufacturers-eye-orders-boom

Nobody is asking because everybody with a lick of sense has seen this coming. And there's no room for sense in a government bursting at the seams with hubris.

I know nothing about anything, especially military & war & sanctions.

But although I know next to nothing, just little bits & scraps picked up here & there, I also predicted by summer 22 that we wouldn't be able to replenish our weapons.

To those that say China won't lift a finger to help Russia or Iran, they were just waiting for the right moment.

Well that moment has come, where on the one hand our stockpiles have run far enough down, & on the other their economic strength grown enough, to flip the switch.

Here's where China takes us down without firing a shot. Like Russia, I'm sure they'll talk & talk & talk & come to agreements .. .with nuances.

Good luck prying apart BRICS now that they are the brink of total victory.

The US MIC has long ago descended into the business of fraud, under the pressure to produce ever growing profits or rates of return.

1. The most profitable military weapon is the one that is never built, as R&D requires the least amount of capital, most of which is spent on generating false reports of performance and bribing the supervising military officials with free golf trips and retirement sinecures .

2. The next most profitable military weapon is the one that does not require extensive tooling or investments in production, and never gets used in real combat so it can be produced in limited quantities at Rolls Royce type mark-ups.

To allow these frauds to continue, the MIC must have the image of a war pending projected into the simple minds of the tax payer base, while at the same time controlling the Pentagon to insure that no full-on war against a real peer (Russia/China) actually takes place as that would expose the weapons as either (1) missing or (2) useless. Exposing this profitable fraud would force them to go into the far less profitable business of huge investments in mass producing weapons that actually work in large quantities at a minimum cost.