Experts said that high US tariffs were causing China's economy to suffer. They got it backwards.

This is a transcript, for the video found here:

Bullets:

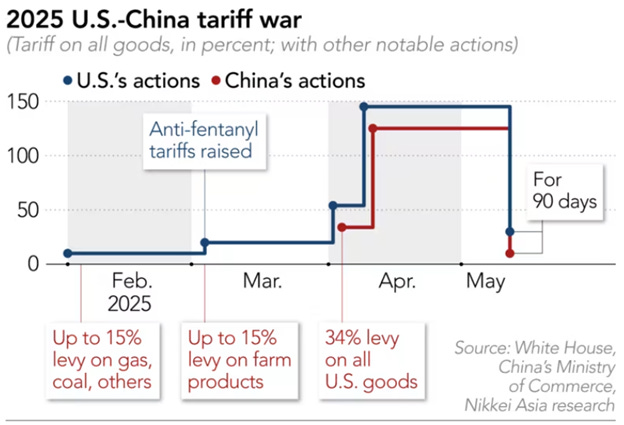

High general tariffs on Chinese goods were the highest of all the US trading partners, and retaliatory tariffs by China mirrored American moves, though at lower rates.

Top officials and economists believed that China's economy was suffering, as trade with the United States collapsed.

But supply chain managers in the US were stocking Chinese goods in anticipation that the tariffs would eventually ease, which reduced somewhat the negative effects on the American side.

However, it was the Chinese tariffs against American energy and farm products that have demolished exports of US commodities.

Over the past decade, China has diversified itself away from the United States, and trade with the ASEAN countries, South America, the EU, and Africa has boomed.

Trade with those blocs are far more important to China's economy than its losses in US export markets.

Report:

Good morning. The new US administration has been raising tariffs on American trading partners, and it was China that got hit with the highest—by far the highest—tariffs.

This is a chart since the beginning of Trade War II, in blue we have US tariffs on China, in red are China’s retaliatory tariffs on the United States. The tariffs reached a high of 145% on imports from China, and exports to China were 125%. They were dropped, and now we are at 51% and about 32%—with the 90 days about to run out.

Back in May the tariffs were at the highest point, at 145% and 125%. Our top officials assumed that a lot of damage was being done to China’s economy. President Trump said that China’s economy is suffering greatly, because they’re not doing trade with the United States, and it’s in the US that China makes most of their money. Scott Bessent is Secretary of the Treasury, and he said that the situation was untenable, “especially on the Chinese side. Those high tariffs (are the same) as a trade embargo.”

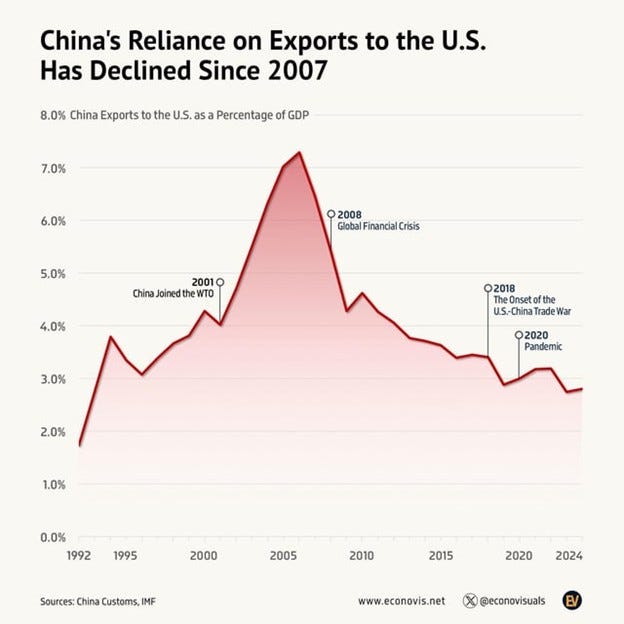

Neither of these statements is well supported by the actual data. It’s true that China exports a lot of goods to the United States, but on a percentage basis, it’s in the low-double digits—just 13% of China’s exports overall. And as a share of China’s total economy, exports to the United States represent only about 2.7%:

And we pointed out in an earlier presentation that supply chain managers have some tools that buy us some time. During the period with the highest tariffs, importers in the United States were stuffing warehouses in Free Trade Zones, full of Chinese products, waiting for tariff rates to come down. Then when they did drop, there was merchandise available for sale, and that blunted some of the impact that many expected.

The issue on the China side, is that the Chinese economy has diversified away from the United States. Forbes pointed out that China is now just the 3rd largest trade partner for the US--a distant third--behind Mexico and Canada. In the month of May, China was less than 6% of US trade, which is the lowest level in over 20 years:

In Trump’s first term, it was over 17%. So China is already less than a third of what it was, compared to just seven years ago. The trade routes shifted away from China, and to other countries. But our trade deficits didn’t go down, those just moved around too. The trade deficit with China dropped about 30%, but rocketed higher against everyone else. With Mexico, our trade deficit more than doubled. Against Canada it’s up nearly three and a half times. So if anyone thought that less trade with China would result in a resurgence of US manufacturing—that didn’t happen. We just started buying more from everyone else, while China started selling more to everyone else

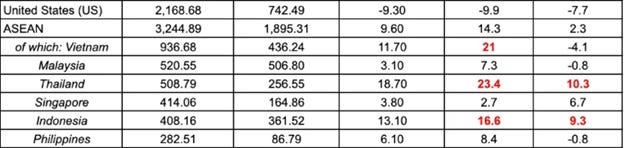

.These are the ASEAN countries, and together they have a population twice as large as the United States, over 700 million people. These are also some of the fastest-growing consumer markets in the world, with a fast-growing middle class. And this group of countries is now China’s largest trading partner, by far, way ahead of the European Union and the US.

Looking at trade data from just the first five months of 2025, the first column is exports from China, next column is imports to China, then the rolling year-over-year percentage difference. Over the past five years, United States overall trade is down 9.3%. Exports are down 9.9%. But here are the biggest trading partners in the ASEAN bloc—Exports to Vietnam up 21%. Thailand up 23%. Indonesia up 16.

Foreign Direct Investment between China and the bloc is also strong, growing over 34% year over year, and now at over $25 billion.

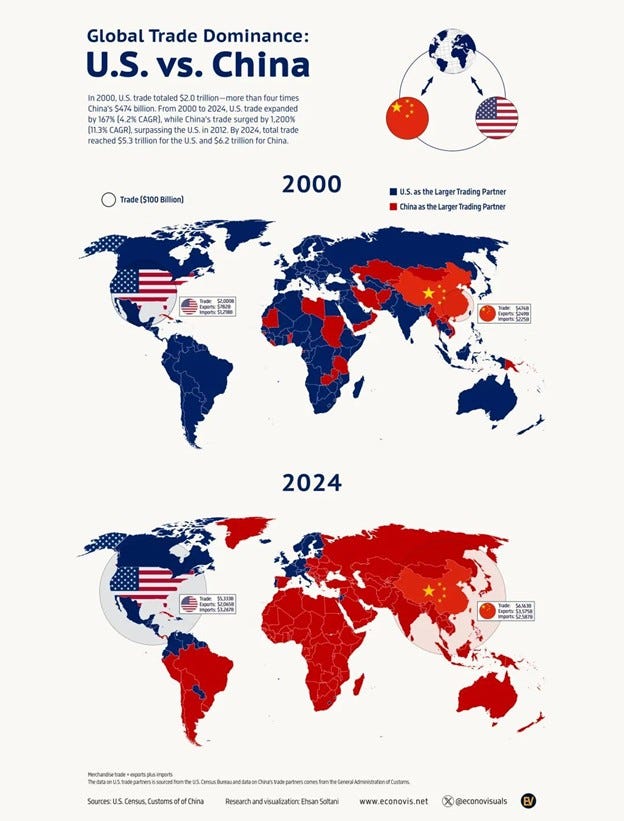

China is also dramatically increasing trade with South America. In 2000, China was less than 2% of Latin American trade—that is South America plus Central America. Since, this trade is growing at 31% per year, and in 2024 came in at $518 billion, and it continue to rise. China is now South America’s top trading partner.

Let’s pull back and see what that leaves everybody. These maps compare China and the US—which of the two is the larger trading partner. In 2000, most of the world was in blue, and trade with the United States was larger than with China’s. 2000 was not that long ago, but it’s a different planet now. Except for Israel, buying bombs and missiles, every single country from Morocco to New Zealand does more trade with China than with the United States.

So this explains why, even with these huge tariffs from the US on Chinese goods to the US, exports out of here just keep rising anyway. January through June, China’s trade surplus hit a new high of $586 billion. That’s over $3 billion per day, every day, in merchandise trade surpluses, rung up by the Chinese manufacturing sectors. What’s more, it is accelerating, up 5.8% per year in June compared to 4.8% in May. China’s exports to the US were minus 16.1% year over year in June, and down 9.7 for the first half. But it’s going up everywhere else.

And here is another myth that needs to be put to bed, that China’s trade is mostly plastic toys and cheap furniture. Exports of semiconductors, ships, cars are growing faster than the overall goods number. Tariffs are hitting clothing, shoes and toys, but these are low-value-added sectors. These data all add up to China’s exports growing faster than expected, and China’s first half GDP comfortably ahead of what everyone expected.

Now that these 90 days are about to run out, markets are looking for direction and clarity over what the next trade deal with China is going to look like. And this is a different world today, than it was just a few months ago. Beijing’s trade delegation is no doubt more confident in late July than they were back in early January, when they had no idea what the first half trade numbers would be.

Now they do know. China has found new suppliers for food and energy. Liquefied Natural Gas imports from the US are down two thirds from last year. Crude oil imports-- also down two thirds. Coking coal down 87%. In ag, US exports to China of corn, down over 90%. Beef -- down over 9%. Soybeans and pork are – China’s imports of American soybeans and pork went to zero. So exports have gone off a cliff. Now that I think about it, those numbers do look like an embargo. They’re a disaster.

But ironically it’s in food and energy that analysts are hopeful. In negotiations going forward, economists expect food and energy to be the focus, because American factory products aren’t competitive here. And it would be theoretically simple for China to switch back to buying from American farms and oil companies, because those commodities are easily substituted. So their thinking, now, is that Chinese buyers are eager to switch back to US suppliers, after setting up strong relationships with Russia and Iran for energy, and Russia, Brazil, and Argentina for food. And that they’re eager to pay higher prices. That’s what they think now.

Resources and links:

r/infographics, China's Reliance on Exports to the U.S. Has Declined Since 2007

https://www.reddit.com/r/Infographics/comments/1k707xx/chinas_reliance_on_exports_to_the_us_has_declined

Nikkei, China tariffs will push up US prices in coming weeks, manufacturers warn

https://asia.nikkei.com/Economy/Trade-war/Trump-tariffs/China-tariffs-will-push-up-US-prices-in-coming-weeks-manufacturers-warn

Newsweek, China Reacts to Trump Claims About 'Suffering' Chinese Economy

https://www.newsweek.com/china-reacts-trump-claims-economy-trade-war-2068990

Forbes, U.S.-China Trade Plummets From 18% To 6%: Trump Tariffs Or Trickery?

https://www.forbes.com/sites/kenroberts/2025/07/15/us-china-trade-plummets-from-18-to-6-trump-tariffs-or-trickery/

China’s trade growth rebounds after tariff de-escalation, offering a boost to first-half growth

https://think.ing.com/snaps/chinas-trade-growth-rebounds-after-tariff-de-escalation-offering-a-boost-to-1h25-growtha/

US farmers feel pain as soybean exports to China flatline despite tariff truce

https://www.scmp.com/economy/china-economy/article/3311560/us-farmers-feel-pain-soybean-exports-china-flatline-despite-tariff-truce

China’s Growing Influence in Latin America

https://www.cfr.org/backgrounder/china-influence-latin-america-argentina-brazil-venezuela-security-energy-bri

China — ASEAN — US Trade 2025: Rebalancing Import, Export and Investment Flows

r/economy, Tell me why are these People think China is hurting?

https://www.reddit.com/r/economy/comments/1m8vu84/tell_me_why_are_these_people_think_china_is/

SCMP, China’s imports of US goods plunge amid trade war, complicating ‘phase 2’ deal

Statista, China Fills U.S. Exports Gap with ASEAN, EU & Africa

https://www.statista.com/chart/34803/chinese-exports-to-selected-countries-groups-of-nations/

Great stuff (data)! Thanks, for getting the numbers and facts together... much appreciated!

Thank you for this information. Since I've shifted portfolios using some of your information, my earnings are outpacing previous years. It looks like the new economic reality will be multipolar with a further decline of the US dollar. Votes and policies matter.