How China recycles its huge trade surplus with EU, US into BRICS infrastructure projects, risk-free

Bullets:

Chinese officials have released $250 million in loans to complete a railroad project in Nigeria. This project is one of hundreds across China's Belt-and-Road Initiative, which develops major infrastructure in across the BRICS and Global South countries.

China increasingly uses loans and equity investments denominated in US dollars or Euro. By using its enormous trading surpluses with Europe (over a billion Euro per day) and the United States ($1.4 billion per day), China can afford massive investments, with no risk to their own banks or currency, the renminbi.

Report:

Good morning. The BRICS and Global South countries are developing their own financial and banking system. And they are using our own currencies, dollars and euro, to finance a lot of their trade, and even to fund major infrastructure projects.

This effort is primarily led by China, because China has such enormous foreign exchange reserves, and huge trade surpluses with the United States and Europe. Every day then they have giant new pools of capital that they can invest or lend, or put to use here in Mainland China.

This was a minor news story everywhere except in Nigeria, but it serves as a great example of what is happening now in many places across Africa, Asia, and South America. And this was the headline in most media outlets. Here’s Railway Supply, the Nigerian railway project got a $250 million dollar infusion from the China development bank, and the whole project will run almost a billion dollars—973 million. And this is the one from Reuters.

But the South China Morning Post goes deeper into where the money for the project really came from, and why. The Nigerian railway project was paused in 2020 by Chinese banks, but now there’s new financing and the project is underway again. The Kaduna-Kona railway will be funded 85% by China and the rest by Nigeria, and will stitch together China’s existing rail networks in the country. China’s Eximbank had planned to lend the proceeds for the Kaduna-Kano line, but changed their minds when they had doubts about how they would be repaid.

The solution now is to use a loan from China Development Bank instead, and China now believes that the project will become commercially viable. So right there begs a question, why doesn’t Eximbank do the deal, now that they think the project will be viable? And here’s the answer, kinda: China Development Bank is going to make the loan in Euro, instead of renminbi. That’s because “interest rates denominated in euro carry a lower interest rate than for dollars or renminbi”.

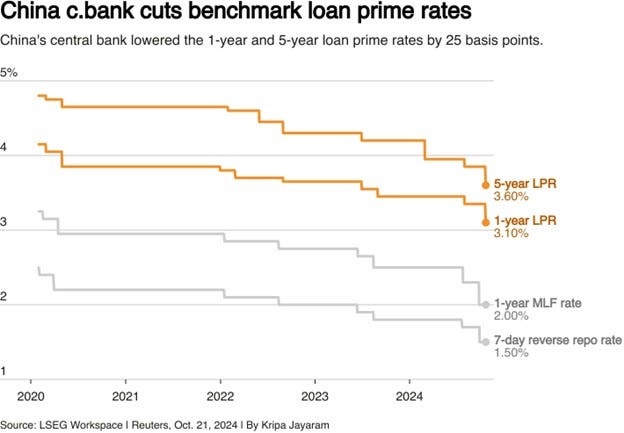

Our problem is that this part isn’t quite true. Euro loans carry higher interest rates than loans in renminbi. The benchmark interest rate in the EU is 3.8%, and is up sharply since 2022. In China it’s around 3.5, and falling since 2022. A Chinese bank has a lower cost of funds for renminbi than a bank’s funding cost for Euro:

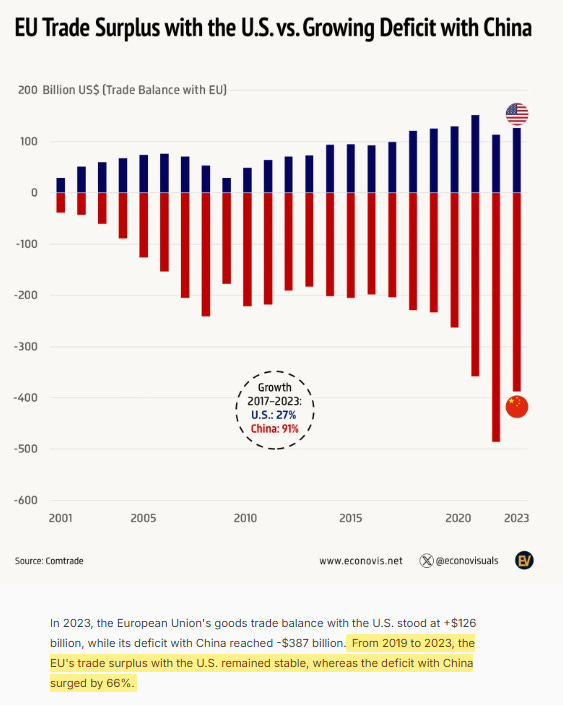

So when we try to figure out why a Chinese bank is lending euro to build railroads in Nigeria, the first step is to understand that every day, over a billion euro every day pour into China because of its trading surpluses with the EU.

In 2023, the EU had a merchandise trade deficit with China of $387 billion, or about $380 billion euro. There are 365 days in a year, so call it a billion euro a day, every day. This $250 million euro that China Development Bank sent to Nigeria aren’t dollars, they’re euro. And 250 million euro is what China earns in trade with the EU every six hours. In other words, China will be able to build that entire Nigerian railroad with just one day of income, with just the EU. Chinese bankers go to bed at night thinking about how to build the Nigerian railroad, and when they wake up the next morning the money for the whole thing just rolled from their trading surplus with the EU. Literally overnight.

A quick summary of what happened here, then. China doesn’t want to lend its own currency, the renminbi, because that is risky money, for a Chinese domestic bank to lend abroad on deposits here in Mainland China. But this is offshore money, until Chinese bankers and regulators bring it here. When the money is in Hong Kong, they can lend these euro and dollars however they choose. And increasingly, China believes that it’s better to invest their trading surpluses into Africa or South America, instead of back into the US or Europe. Instead of buying US Treasury bonds, they’ll lend their USD to BRICS countries to build infrastructure there.

So in this case, this railroad will benefit Chinese supply chains in Africa. Most of work will be done by one of their own engineering companies. Nigeria gets thousands of jobs working to build the railroad, then thereafter in the warehouses and mines and refineries and logistics hubs that China needs to keep their factories going here. And Nigeria also gets a passenger railway, basically for free.

If Nigeria never makes a single principal payment on this loan, China might not even care much—these billion euro is house money, representing just one single day of doing business in Europe, and China can afford to ignore whether enough passengers are buying enough tickets between Kaduna and Kano. The valuable part is the freight railroad, and that’s why Chinese regulators changed their minds about the commercial viability of the project. Said another way, the stability of China’s supply chain is more important than the stability of this particular loan to get the railroad built. Whether or not it’s a performing loan 10 years from now is secondary.

The Belt and Road is a massive diplomatic effort and involves giant investments in developing countries to get infrastructure developed. And for China, it’s also about bullet-proofing their supply chains, tightening relationships with natural resources economies so their factories here can keep exports flowing, and produce more charts like these, above. And the Chinese don’t even have to use their own money.

Resources and links:

Funding Secured for Nigeria’s Kano-Kaduna Railway Project

https://www.railway.supply/en/funding-secured-for-nigerias-kano-kaduna-railway-project/

China Development Bank Approves $255 Mln Funding For Nigeria Rail Project

China Development Bank releases $255 mln for Nigeria rail project

Graph, EU Trade Surplus with US vs Deficit with China

https://www.voronoiapp.com/trade/-EU-Trade-Surplus-with-the-US-vs-Growing-Deficit-with-China-2868

China’s central bank says it will cut banks reserves, rates at proper time

European Central Bank cuts key interest rate to 3.25%

https://www.dw.com/en/european-central-bank-cuts-key-interest-rate-to-325/a-70521077