India and China make most of the drugs for the US market. That should be a good thing.

This report serves as a transcript, for the YouTube video found here:

Bullets:

President Trump has promised high tariffs on the imports of pharmaceuticals into the United States, to compel drugmakers to reshore the manufacturing of drugs to the US.

Drug companies in Europe, Japan, and Singapore are particularly vulnerable. They earn their biggest profits in the American market, and charge far higher prices to US patients.

Investors are selling shares of the European drug companies, who face a tough choice between falling US sales because of even higher prices, or investing huge capital to set up new manufacturing lines in the United States.

But another approach is apparent by looking closely at the supply chains for the pharmaceutical industry. Most of the key components for the drugs themselves come from India and China, who already produce at low cost. For many drugs, Western pharma companies simply package and brand the medicines produced by Indian and Chinese firms.

Instead of prioritizing the development of a yet another high-cost industry in the United States, policymakers should instead seek to slash the drug prices paid by patients and hospitals. Buying directly from drugmakers in India and China would do the same for branded drugs as in off-label and generics.

Report:

Good morning. The pharmaceutical industry in Europe is deeply concerned about the trade war, and the high tariffs that are coming on their drug exports to the United States. The US is by far the biggest market for drugs, and it’s in the United States that drug companies make most of their profits.

We’ll look at Switzerland to start, because it’s the best example of how weird this industry is. The Trump Administration recently put a 39% tariff on Swiss products going to the United States. But the pharmaceutical manufacturers in Switzerland were exempt from that tariff. Right away, other Swiss companies were complaining about the unfairness of it. Breitling makes watches, and their CEO points out that the big trade surplus Switzerland has with the United States doesn’t come from his company’s watches, or from chocolate—it’s drugs. It’s the Swiss drugmakers who are responsible for the big trade imbalance, yet ironically, they are exempt from the tariffs.

Pharmaceuticals make up over half of the exports from Switzerland to the United States, and are the biggest driver of the $40 billion trade surplus that Trump was complaining about when the US put on the 39% tariffs. Fifty thousand people work for drugmakers in Switzerland, and generate 7% of Swiss GDP. But their biggest profits are made in the US, where drug prices are a lot higher, compared to Europe. Roche and Novartis sell the same drug to Americans and get two and a half times what they get by selling the drug in Europe.

So this is what the top guy at Breitling is complaining about: If he moves his watch production out of Switzerland, he can’t call it a Swiss watch anymore, and his price premium goes away. But it’s not companies like his that are Trump’s problem anyway-it’s the drug companies. And when the Swiss president asked for lower tariff rates, for the entire Swiss economy, President Trump answered that Switzerland is “making a fortune from their drug sales” to the US. Everyone knows that that it’s the drugmakers who are making most of the rent-seeking profits in the US market, so it doesn’t make sense to anyone that this industry is exempt from the high tariffs, supposedly put on because of the high trade imbalance.

That is only temporary, however—far higher tariffs are coming, and probably very soon. The administration has threatened 200% tariffs on pharmaceuticals. The stock prices for European drugmakers are getting hit across the board, hitting 4-month lows. Bayer is a German company, off 10% in one day. The Trump Administration wants “sky-high levies” to push companies to move production to the United States. The first round of tariffs will be 150%, then 250%. So investors are dumping shares.

But investors and policymakers are looking the wrong way. There are two fundamental problems facing Western drugmakers. The first is right there—a massive chunk of their profits are made in the United States, because the prices are so high.

But moving production to the United States will also push their production costs a lot higher. That’s all on the sales side, and a lot of decisions need to be made, quickly, about whether to move tens of thousands of jobs to the US.

But there is another problem on the supply chain side, which is that for many of these products, these companies aren’t really making the drugs at all. They just package them. API’s are Active Pharmaceutical Ingredients. API’s are basically what makes the drug do what it’s supposed to do. The API for a cough suppressant, for example, is what makes your cough go away. There are other things in the medicine that help with digestion, for example; or aid in absorption into your blood stream; then the branding, with the color, shape, and packaging. But API’s are most important part of all, and India and China make most of those.

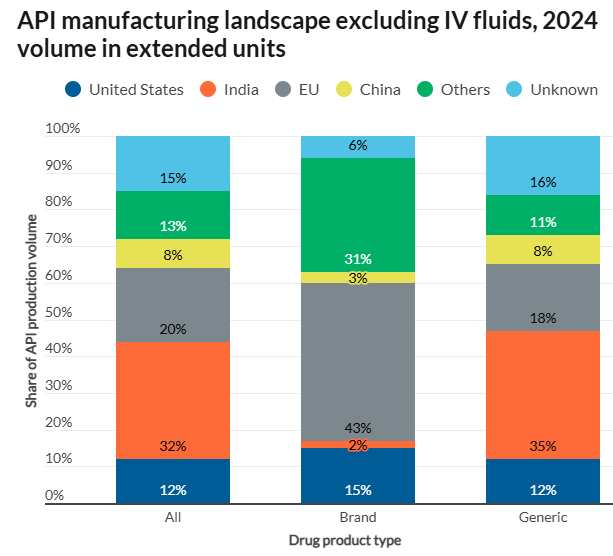

That is especially true for the lowest-cost drugs. This is a comprehensive supply chain analysis of the drug industry in the United States. Generic drugs are the low-cost drugs, which are 90% of the drugs sold in the US. Those mostly come from India. China also chips in a sizable percentage of the API market—8%--but supply chain managers know that number is understated. China builds API’s that are transshipped through other countries that are counted as sourced outside China, for example. And China is also the source for most of the ingredients for the API’s themselves, no matter where those come from.

On this chart, India is in orange. China is yellow. Again, that column is 90% of the drugs consumed in the United States, and India plus China is over 40%. Branded drugs are what the Swiss and the other Europeans are making big profits on—that’s where the money is, but the first column, overall, shows the heavy weighting the off-label drugs are in the market.

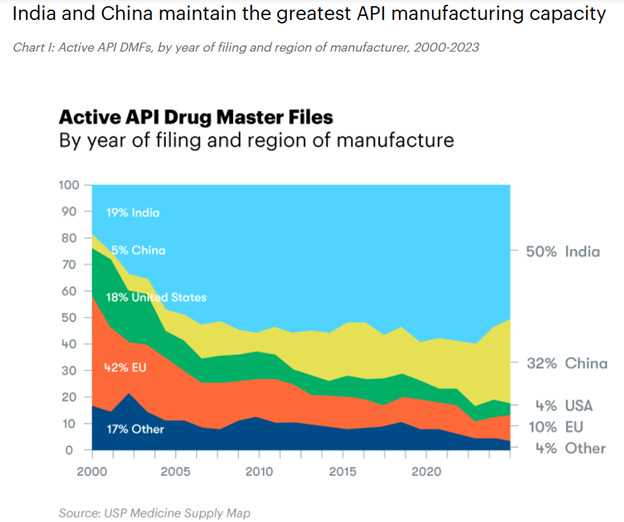

Breaking down the market further, we can see the big part India plays. Again—the branded drugs come from Europe, Singapore, and Japan. But most of the drugs prescribed for American patients are dependent on India and China to make them. These are data from the FDA. The active API master files shown here are the origin of the API’s, across all drugs.

India is at 50%, China at 32%--so India plus China is 82% of all the API manufacturers for US drugs. In 2000, India was just 19%. China has grown even faster, increasing by 63% in just two years. Europe, on the other hand, dropped from 42% in 2000 to just 10% today.

What happened, then, is that Europe simply outsourced the production of their API’s to India and China. And that’s the real high-cost dimension to the tariff problem for European drugmakers. Trump wants all that production moved to the United States. But European companies aren’t wrestling with the issue of moving a job from high-wage, high-cost Switzerland to high-wage, high-cost United States. They would need to move jobs out of India or China and move them to the United States, which is a completely different calculus.

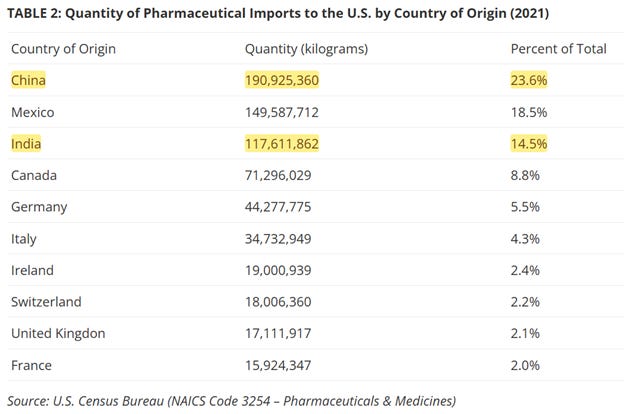

That, ironically, represents a huge opportunity for India and China. They already enjoy huge market share for the API’s, and the generics—which are the highest by volume. Over 40% of all drugs coming into the United States are inbound either China or India.

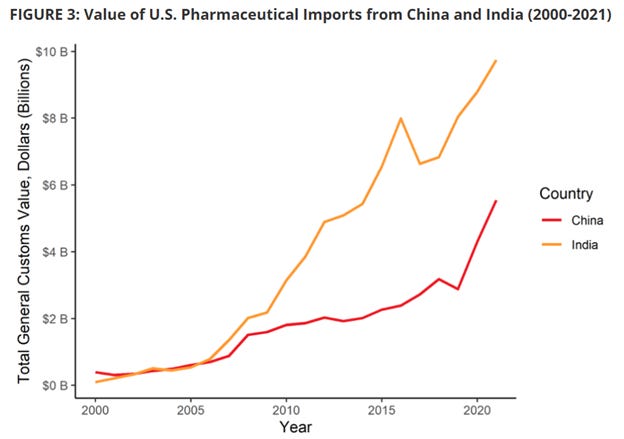

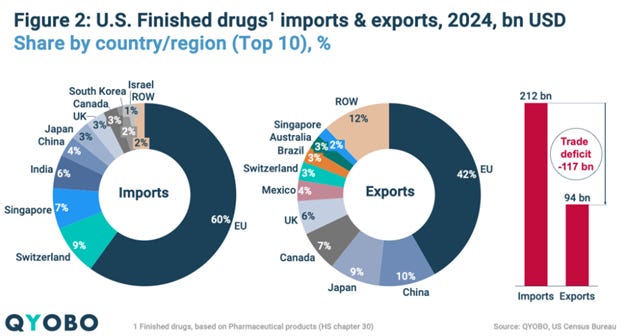

And the value is growing—these lines are going vertical since 2020. It’s just that these drugs don’t cost very much. Consider these two data sets—China and India bring in over 40% of the drugs, but it’s the EU plus Switzerland that makes most of the money, because the big profits are in the branded drugs. Imports are the chart on the left. 60% of the imports to the United States, by dollar value, is from the EU. Switzerland is another 9%. India at 6 and China at 4, means that India plus China is only 10% by dollar value.

But India and China is where the generics come from, and where the API’s come from for so many other drugs. And drilling down further, Key Starting Materials are the building blocks of API’s, and this is a song we know by heart—China has a monopoly on them. Even India relies on China to provide them raw materials to make their drugs. China has done the same in the drug industry that they did everywhere else. First take over the raw materials supply chain, then move down. Now Chinese companies are 95% of ibuprofen, over 40% of the penicillin—overall, 80% of the antibiotics in the United States come from China.

It doesn’t matter which company’s name is on the side of the box. The drugs don’t get made without API’s from India or China, and the API’s don’t get made without Key Starting Materials that come from China. The opportunity here is for Indian and Chinese companies, and American regulators, to finally ask just what, exactly, companies in Europe actually do, in exchange for billions of dollars a year to put pills in bottles? This is a question that Indian economists are asking too, ironically. They admit they need China to help them make the drugs—for the drugs India makes, over 80% of the API’s for those come from China, and for the handful of drugs where the Indians make their own API’s, those need Chinese KSM’s.

This results in low margins for Indian drugmakers. This analyst on Substack points out that Singapore is a tiny country, and Singapore doesn’t show up on this chart, at all, for drug exports to the US by weight, but Singaporean companies earn more money in the United States than India does. The obvious solution for India is to move down the value chain, in the same way Chinese companies did for antibiotics.

The whole situation then is very weird, and just got weirder still. Trump just announced huge new tariffs on India, because India is a major buyer of Russian oil. Consider, though, that these low-cost Active Pharmaceutical Ingredients from India are what make the high-cost branded drugs from Europe and everywhere else work, in the first place. It’s like with our Chinese rare earth magnets problem—without them, the Pentagon’s multibillion dollar ships and multimillion dollar missiles don’t know where they are, or where to go.

Indian and Chinese drugmakers now find themselves in the same position. They own the supply chains for the most important parts of building a drug, and Indian policymakers now have all the reason they could ever want for using that as leverage, just as regulators in China are already doing for their rare earth metals and minerals.

President Trump’s stated primary objective may be to reshore the production of pharmaceuticals to the United States, so those high profits are captured by American companies and workers. But the real objective should simply be lower prices for drugs, and make those obscene profit margins go away for everybody in the middle. We should be pushing for a lower cost structure, across the entire healthcare delivery system. Patients and hospitals in the United States could buy directly from India and China, pay far less than half what they do now, and that’s even after paying the 200% tariff to bring the medicines over.

Be Good.

Resources and links:

API manufacturing landscape excluding IV fluids, 2024 volume in extended units

India and the EU dominate API manufacturing for the most-used ATC-3 therapeutic classes in the U.S. market

Geographic concentration of pharmaceutical manufacturing: USP Medicine Supply Map analysis

https://qualitymatters.usp.org/geographic-concentration-pharmaceutical-manufacturing

U.S. Pharmaceutical Trade Balance and Key Suppliers

https://qyobo.com/us-tariffs-plans/

REALITY CHECK: Indian Pharma is a MADE IN CHINA story

Study Finds Over 90% of all Generic Drugs Dependent on Imports

https://prosperousamerica.org/study-finds-over-90-of-all-generic-drugs-dependent-on-imports/

Skyrocketing Pharmaceutical Imports to the U.S. Endanger National Security

How pharma became Switzerland’s Achilles heel in US trade talks

Shares in European drug companies hit four-month low as Trump tariffs loom

How Big Pharma Profits Off U.S. Healthcare

https://www.statista.com/chart/25920/sales-revenue-of-best-selling-prescription-drugs-by-illness/

AP, Trump to put additional 25% import taxes on India, bringing combined tariffs to 50%

https://apnews.com/article/trump-india-russia-oil-tariffs-2db9dc22d7b56624bdceb2e15c134d60

New York Times, India Will Buy Russian Oil Despite Trump’s Threats, Officials Say

https://www.nytimes.com/2025/08/02/world/asia/india-russia-oil-trump-threats.html

A couple of thoughts:

Many smaller US pharma companies use Swiss "contract mamufacturers". Building a drug manufacturing plant is expensive and takes years. That's a huge risk for a company that makes one or two drugs. Keep in mind that it takes years to run trials and get a drug approved by the FDA.

The FDA sends out warning "letters" to drug manufacturers that are not following "good manufacturing processes". Guess which country is over-represented in the list of these warned drug manufacturers? Think twice before taking drugs that were manufactured in India. Country of manufacture is printed on the big bottles of pills that your pharmacy buys.

Also, when starting a new medication, you might double-check that the pills in your amber plastic bottle are actually what the label says. A quick web search of the pills description (e.g. small pink pill with number 297 stamped on one side) will clear that up. Pharmacy staff are very busy and can make mistakes. You might want to also read up on the side effects and drug interactions. You pharmacist is supposed to know that stuff, but it is unlikely that your doctor will give you the full run down since they only have 13 minutes to spend with you.

Pharmaceutical drugs are generic chemicals--basic manufactured commodities like polyethylene nurdles or copper ingots, not multifaceted consumer goods with competitive features like clothing designs, automobiles, computers, or TV sets. The formula is the formula. Everything else is just packaging- features like enteric coating, time-release formulation, those are just minor modifications to the delivery system in the pill or capsule. The key is the active ingredient. Acetaminophen is acetaminophen, etc.

Synthetic drugs are also absurdly cheap to manufacture, in quantities easily scalable to demand.

As a rule, the vast bulk of the profits of their invention presently go to the investor class, not the inventor class.

Consider the implications.