Investor alert: China is drinking a lot more coffee, and taking coffee supply chains off our exchanges

Bullets:

China is the fastest-growing coffee market in the world. There are now more coffee shops in China than in any other country, by far, up from virtually zero just twenty years ago.

It is instructive to observe how China is meeting this new, booming demand, because it is so similar to China's supply chain strategies across entire industrial and consumer sectors.

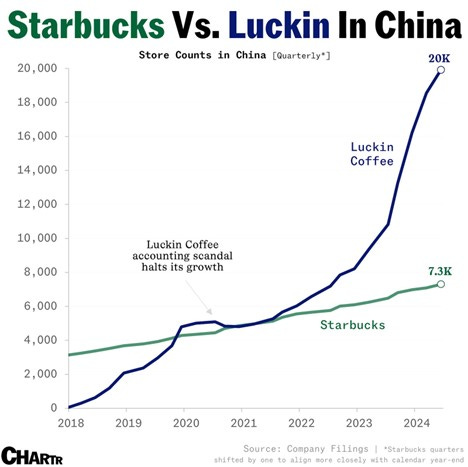

For this presentation, we will follow the recent moves of Luckin Coffee. Luckin is now the biggest chain of coffee shops in Asia, with Cotti close behind, but neither company existed just ten years ago.

First, Chinese domestic companies will rapidly scale up production in-country. At the same time, Chinese companies overseas begin meeting with suppliers to sign medium-term contracts to ensure increased production abroad, with a "right of first refusal" on any excess production by those same suppliers.

Then, as Chinese demand grows further, entire supply chains shift, away from seasonal or short-term production represented by commodities contracts traded on global exchanges, to bilateral trades.

These trading arrangements are mutually beneficial. Sellers to Chinese firms lock in pricing over several years, which makes business operations and cash flow far more certain. And Chinese companies can largely ignore short-term price moves in global markets, and guarantee flow of raw materials to factories and stores.

Report:

Good morning.

This is a large—venti as they call it—Java Chip Frappucino, from Starbucks. I used to drink these all the time. I came to China in 2012, June 1. My flight was outbound Tampa, Florida, connecting flight in New York, then to Shanghai. In the airport in New York, I bought one, and is was over $5. I couldn’t believe the price, but I was in New York, and I was at the airport.

I fly to China, go to my hotel, and there’s a Starbucks right next to my hotel in Shanghai. I went inside, and ordered the exact same thing, and it was 35 quai, 35 renminbi. I asked my friend who was with me, is the exchange rate 6 to one? He says yes, and I said, “This thing is $6? I just paid $5.50 in New York, and I hated myself. It’s more expensive here?” And they told me that Starbucks is considered luxury, kind of, in China. The Starbucks was full. Almost all the Starbucks in China are full. I was so surprised by all this that when I set up a new Twitter account a few months after that and all the good usernames were already taken, and made my handle 35 quai. I didn’t like my username then and I hate it now but I don’t know how to change it.

Anyway, you might imagine that it wasn’t long before Chinese got curious about just how much it costs to brew a cup of coffee, compared to what Starbucks was getting for selling it.

Here we have two charts, which reflect the boom in China’s coffee market, and how that is tipping over into global supply chains. The Chinese still do not drink much coffee, compared to consumers elsewhere. It’s rare to find someone my age who drinks coffee, ever—not even a single time. But the law of large numbers says that in a country of over a billion people, even a slight change in consumer buying habits have big consequences, and those are now being felt in global coffee markets.

The story of Chinese coffee is also fascinating from a supply chain perspective, and illustrates their strategies here, which are so similar to how Chinese firms operate globally to ensure they are well supplied in their factory sectors, and in their consumer markets.

This growth has happened very suddenly, and very recently. Luckin is the biggest coffee chain here, and 2018 was just 6 years ago. And all that coffee needs to come from somewhere. China is a tea-drinking country, so they don’t grow much coffee domestically, yet. So that’s priority one—get some coffee farms going in China. They are still just getting started—in 2023, Chinese coffee production doesn’t really register, at all. 0.06%, 130,000 bags. And almost all that production comes from Yunnan province, which is where the premium teas also tend to be grown, because the climate is ideal. It’s still very low, but rising fast, and that’s a key feature of China’s supply chain strategy, dramatically scale up domestic production.

At the same time, they get busy forming partnerships and sign exclusive supply contracts with producers around the world. Chinese executives headed to Brazil, where previously they were the 20th-ranked buyer of its coffee beans. In just 2 years, China was the 6th biggest buyer. But even that news is old. Luckin Coffee signed contracts with Brazilian suppliers totaling $500 million, for 120,000 tons. Brazil’s Minister of Agriculture is thrilled: 3 years ago Brazil sold $80 worth of coffee to China. Last year it was $280 million. This year, just a single Chinese company took down another $500 million.

That headline was June 2024. This is a new one, from November. Just five months later, and Luckin is back and wants to buy even more. Now they are buying 240,000 tons, for a minimum of $1.38 billion, and may go as high as $2.5 billion. So consider the prices paid, too—In June, Luckin locked in 120,000 tons for 500 million. Now they’re doubling the order, but the price is a lot higher now. C

hina is willing to pay top dollar, in advance, to secure supplies. This is typical—Chinese buyers come in to your company, or your mine, or show up at your farm, and they say, give us a number. Tell us your price, where we – China – has the right of first refusal for everything coming out of the ground, or out of your fields. Chinese executives aren’t buying contracts on commodities exchanges in Chicago or London—they go directly to the people doing the work, shake hands, sign a contract.

Prices are already at all-time highs for coffee on global exchanges. These deals that China has just done, are naturally going to strain our own markets, as well, but yet again this is another example of enormous trade volumes that will not be done through our exchanges or our banks, because it’s bilateral. We will see big price moves in our own markets, though, as the supply chains get shifted, and Brazil producers figure they will make more money working with China.

Consider the question asked here, in the headline. Why are Brazil’s wealthy suddenly seeing coffee plantations as a great investment? Coffee isn’t new. But coffee in China is new. Historically, coffee farms in Brazil are not profitable—most farmers earn less than $1 per pound. But China has scrambled the math. Chinese companies often handle all the logistics, the inspection, the packaging. They also lock in a price, and suppliers know that is the price floor, so they can make long-term production plans, whereas dealing with our commodities exchanges, production plans cannot last much longer than a single harvest. Chinese buyers take that uncertainty away. So Brazilian producers, in this case, of coffee in this case, can make long-term plans for hiring, new production, capital improvements.

In just the 13 years that I’ve been here, I’ve seen this personally in 3 consumer discretionary markets. Milk, beef, and coffee. As Chinese consumers had more money to spend, they wanted more dairy, more beef, and more coffee. And they were starting from a very low point, domestically, to supply the new Chinese demand. On the milk, Chinese overseas companies showed up at dairy farms around the world, and said, give me a price for 5 years. And companies here in China got busy raising more dairy cows. Beef—same thing. Coffee, now, same thing. It’s the same playbook. Global prices may go up, may go down, and China doesn’t care. Their coffee shops, their supermarkets, their factories, are always going to be supplied. This leads to stronger trade relationships, outside China, with their suppliers. That’s the concern expressed here—remember, the United States is a much bigger consumer of coffee than China, and probably will be forever, but that’s not important. China has decided to drink a lot more coffee, and that’s enough to blow up markets for everyone else.

Be good.

Resources and links:

Luckin Coffee blew past Starbucks in China; now it’s coming to the US

https://sherwood.news/business/luckin-coffee-blew-past-starbucks-in-china-now-its-coming-to-the-us/

China’s coffee production: A New Frontier in the Global Market

https://coffeebi.com/2024/08/23/chinas-coffee-production-a-new-frontier-in-the-global-market/

Why would a Brazilian billionaire buy a coffee farm?

https://intelligence.coffee/2024/07/billionaire-buys-brazilian-coffee-farm/

Luckin Coffee agrees $500m Brazilian coffee sourcing deal as Chinese demand soars

Luckin Coffee will buy 240,000 tons of coffee from Brazil

https://www.forumchinaplp.org.mo/en/economic_trade/view/8455

Luckin Coffee strengthens Brazil trade with $1.38bn coffee supply deal

https://finviz.com/futures_charts.ashx?p=d&t=KC

https://finviz.com/futures_charts.ashx?p=m&t=KC

A closer look at Chinese consumers

https://hoards.com/article-34072-a-closer-look-at-chinese-consumers.html

The rise of China as the biggest beef buyer

https://www.cattlebusinessweekly.com/articles/the-rise-of-china-as-the-biggest-beef-buyer/

China is now the world leader in coffee shops

https://www.economist.com/china/2024/08/08/china-is-now-the-world-leader-in-coffee-shops

Coffee price surges to highest on record

https://www.bbc.com/news/articles/c36pgrrjllyo