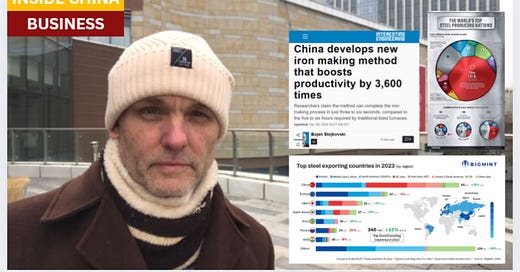

Investor Alert: Revolutionary ironmaking method will nullify tariffs and scramble iron ore markets

China's iron engineers report a 3,600-fold increase in productivity, huge energy savings

Bullets:

"Flash Ironmaking" is a new technique, involving spraying iron ore powders into hot smelters.

Chinese researchers report a 3,600-fold boom in productivity and time savings.

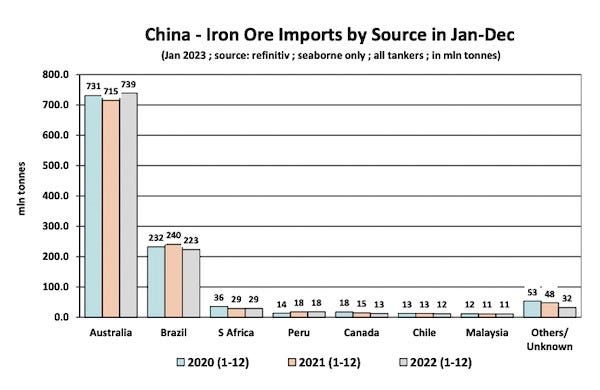

China is heavily dependent on imports of higher-grade iron ores from Australia, Brazil, and Chile, with imports totaling over a billion tons per year. But this new method can successfully employ lower-yield ores, which China has in abundance.

As this process is rolled out across China's iron smelters and they are fueled increasingly by domestically sourced ore, we should expect global prices to fall across the higher grades.

US tariffs on Chinese steel is currently at 25%. In the EU, strong import curbs are in place to ringfence European steelmaking companies. But China should realize production cost savings much higher than 25%, and take even more market share from global competitors.

Report:

Good morning.

This is an important story from China’s steel industry. And hopefully it can serve as an example of how a lot of our understanding of China is just wrong. It’s commonly believed that China is incapable of serious innovation—that Chinese engineers simply copy whatever Western or Japanese companies are doing, then they just throw low-cost labor at the production and over time take market share. Therefore, we can simply apply high tariffs against Chinese products, and those tariffs will protect our domestic manufacturers in North America and in Europe.

All of those beliefs are false. Even in the industries where China already dominates in supply chain, in manufacturing, and in market share, they are still relentlessly innovative. China may be the most ruthlessly competitive industrial market in the world, in the fact. And for many products, the tariff rates levied against Chinese firms simply don’t matter at all. We have no choice but to buy from them, and the alternative is to just go without. So our companies just pass along the tariffs as a cost of doing business to buyers further down the chain.

China is already the biggest producer of steel in the world, and the biggest importer of iron ore to make the steel. That aspect is very important. And Chinese scientists just developed a revolutionary ironmaking technique that results in a massive boost in productivity, and cost savings. It’s called Flash Ironmaking, and it means that the process of making iron takes just a few seconds, compared to several hours. The new method takes fine iron ore powder and injects it directly into hot furnaces, causing an explosion of sorts, and liquid iron forms at the bottom the furnace. Then they just pour it out, and it’s ready for use.

This new process works very well for the low- and medium-yield ore that China has in great supply. China is the biggest importer of iron ore in the world, and buys three fourths of globally shipped ore.

In October, China imported over 120 million tons of iron ore, which was the highest ever.

Most of China’s imports for iron ore are sourced from Australia, and in 2022 China took 739 million tons of iron ore from Australia, and another 223 million tons from Brazil. In total, in 2022 over a billion tons of iron ore were shipped to China, to be made into steel.

Now China has developed this new process whereby they can substitute many of its domestic iron ores instead of importing it. What’s more, it represents an enormous improvement in energy efficiency—it’s over a third more efficient, and completely eliminates the use of coal in the ironmaking process.

This feature in Interesting Engineering gets deeper into the science and engineering of the new method. The idea for it came from the United States, but it wasn’t turned into practical application there. These Chinese researchers began work on the flash smelting technology here in 2013, spent the next 10 years getting right, and now they’re ready for commercial rollouts. This is a crucial aspect here, as well, that China’s manufacturing and industrial hubs invest a lot of resources and time into getting projects off the ground. When they believe that a new technology will be revolutionary, or in this case could dramatically reduce China’s dependency on foreign suppliers or on the energy grids, they’ll go all-in. Chinese industry has a very high success rate for these technologies, over 80%.

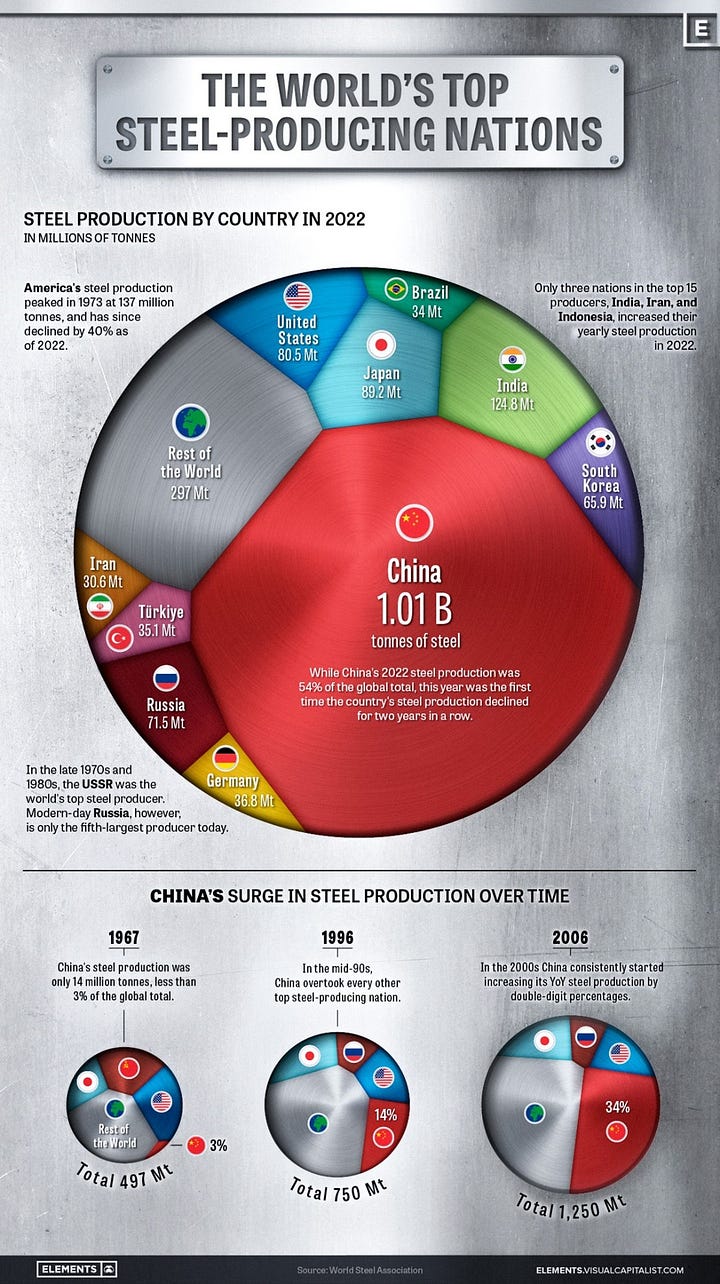

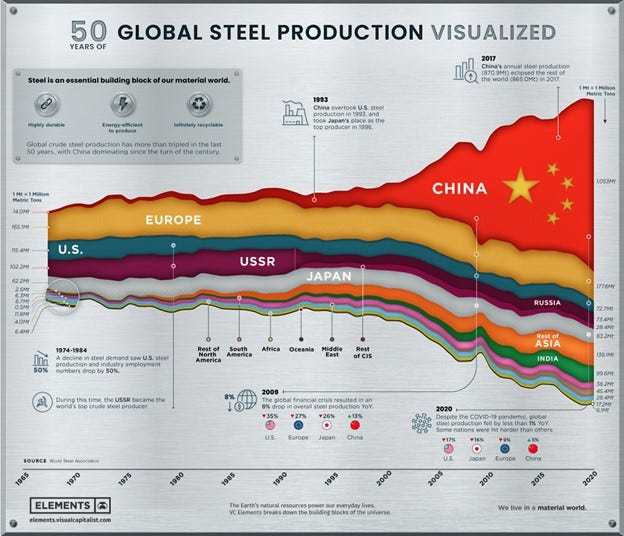

China is the biggest producer of steel in the world, at over 1 billion tons per year (chart left) and (chart right) shows the growth of China’s steel industry over time.

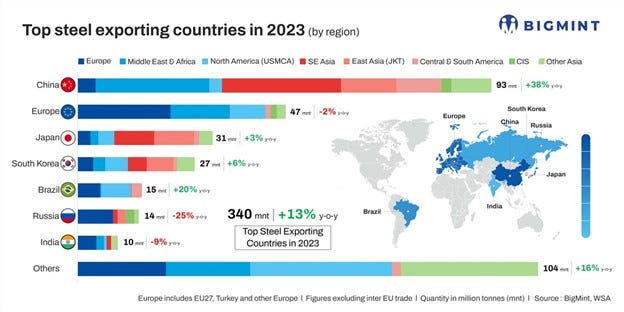

And China is also the biggest steel exporter in the world, exporting over 90 million tons of steel. In the first half of 2023, China exported 43 million tons of steel, and finished the year at 93 million tons.

Let’s look at these. China’s steel production is over 1 billion tons per year, but its exports are less than that 10% of that. China is exporting lots of steel for factories around the world, who then turn Chinese steel into products sold elsewhere. But most of China’s steel production is consumed, here, in Chinese construction and infrastructure. But a lot also goes to Chinese manufactured products that are then sold abroad.

Our governments are trying to raise tariffs to protect domestic industries from both Chinese steel, and from Chinese products that include Chinese steel. In June the European Union extended steel import curbs against China. These safeguards were necessary “to prevent or remedy the injury to Europe’s steel industry”. And there is also a significant reduction of demand for steel across the European Union, because of collapsing factory activity there.

The White House increased tariffs on Chinese steel products to 25%, effective immediately, earlier this year. They also set aside $6 billion for 33 clean manufacturing projects, including for steel, and the combination of these subsidies and tariffs “will bolster the US steel industry” and make it more competitive, they hope. The objective was to make American steel the world’s cleanest steel producer.

When we consider all that, in light of this new Chinese method for making iron, we can see the problems. This new process is now the cleanest way to make iron. It’s much more energy-efficient. And when China rolls out this process across their entire steel-making sector, it is going to make Chinese steel much less expensive than steel sourced from anywhere else. Make the tariff 25%, and it won’t matter. Make it a hundred percent. If you’re a manufacturer of heavy tractors, for example, and you’re buying a lot of iron for your factories, and your assembly line workers already command the highest wages in the world, how can you possibly be competitive against Chinese factories that are building using low-cost steel, sourced from domestic markets now? We can try to seal off the American and European markets from everything coming out of China with any iron in it, but that just means that China will have the entire rest of world to sell to, because we’ll be locked out there because of the price difference.

With this new method, analyses like this fall apart, as well. These are highly respected industry analysts for industrial metals. They conclude here that China’s imports of iron ore will still be elevated five years from now. This is one of their main reasons: China needs lots of high-yield ores for their steel industry, and they don’t have much of that. So Australia and Brazil will continue to enjoy high export volumes to China, because of the stress on high grade ore. But this new flash ironmaking process means that, now, even lower-yield ores can be used in their steel. With this discovery, these iron ore markets in Australia and South America are going to be scrambled, and prices should fall, all else being equal. So investors need to watch that part carefully.

We need to throw out many of the biases and prejudices we have against Chinese industry. China already has big cost advantages in iron and steel production. Labor costs are lower here than in Japan, or in Europe or Australia. China already has far lower energy costs than steel-making countries anywhere else. China already has the supply chains established to get all the iron ore they need. China already leads the world in the production of steel, and China is already the number one exporter of steel.

But despite all of that, behind the scenes, they were innovating anyway, to do it even faster, and even cheaper. A one-third increase in energy efficiency, a huge drop in man-hours required to produce iron—there goes that 25% tariff that the White House just put on Chinese steel. This new process just cut China’s costs by much more than that.

The idea for this story came from a Substack subscriber in Germany, Mr. Brandt in Lower Saxony. Thank you.

Be good.

Resources and links:

Chem Analyst, China Unveils New Iron-Making Technology: A 3,600-fold Speed Boost

Reuters, China iron ore imports head for record even as steel output slips

South China Morning Post, China’s ‘explosive’ ironmaking breakthrough achieves 3,600-fold productivity boost

China develops new iron making method that boosts productivity by 3,600 times

China’s Iron Ore Imports Market Share Reached 71.3% in 2022

https://www.hellenicshippingnews.com/chinas-iron-ore-imports-market-share-reached-71-3-in-2022/

Visual Capitalist, Visualizing the World’s Largest Steel-Producing Countries

https://elements.visualcapitalist.com/visualizing-the-worlds-largest-steel-producing-countries/

Visual Capitalist, Visualizing 50 Years of Global Steel Production

https://elements.visualcapitalist.com/50-years-of-global-steel-production/

Why will China's iron ore imports remain 'high' in 2030 despite production cuts?

https://www.linkedin.com/pulse/why-chinas-iron-ore-imports-remain-high-2030-despite-production/

China exported 90.3 million tons of steel products in 2023

https://gmk.center/en/news/china-exported-90-3-million-tons-of-steel-products-in-2023/

5 among top 10 steel exporting countries register drop in H1 volumes

https://www.linkedin.com/pulse/5-among-top-10-steel-exporting-countries-register-drop-h1-volumes

Global steel exports rise over 10% in CY'23. What lies ahead?

https://www.seaisi.org/details/25375?type=news-rooms

FACT SHEET: President Biden Takes Action to Protect American Workers and Businesses from China’s Unfair Trade Practices

EU prolongs steel safeguard measure until June 2026

Cost of Electricity by Country 2024

https://worldpopulationreview.com/country-rankings/cost-of-electricity-by-country

Thankyou Kevin for your good work. As you note, major impacts for my country- Australia. Suggestion for a future piece, the news that Zhenjiang Shipyard has just built the worlds largest propellor - 13 metres diameter, 480 tons, twice as large as those on a US aircraft carrier.

Kevin, my impression of the west is that they are putting too many eggs in the basket of human enhancement - transhumanism via digital incorporation into the human. As if doing that will enable those in the hegemony to surpass the Chinese. Give up our humanity to become the next step in evolution. Do the Chinese think this way too? Are they also pursuing this insanity? Seems like they just know how to use what's already here.