This is a transcript, for the video found here:

Bullets:

Forever wars in the Middle East, and now in Ukraine, have drained NATO arsenals.

But while the US and NATO countries have made giant pledges to boost defense spending, China's export bans on critical materials are blowing up supply chains for Pentagon weapons makers.

Report:

Good morning.

Pentagon contractors are running out of the critical materials they need to replenish weapons that are being blown up in Ukraine and the Middle East, and China’s export bans for these materials mean that there aren’t any more coming.

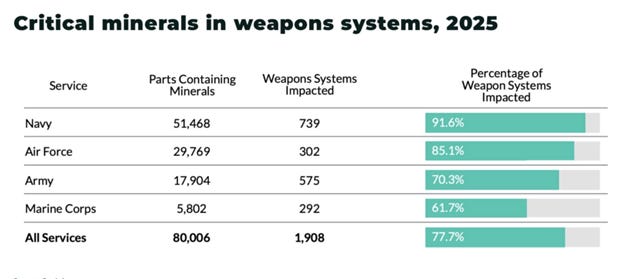

Our military industrial complex is heavily dependent on Chinese suppliers, and the supply chain for everything is “brittle”—"not resilient.” Govini is a think tank that performs analysis on defense industry supply chains. One out of ten Tier-1 subcontractors to the Pentagon are Chinese companies. And 78% of the US weapons systems need critical minerals from China in order to work. For the Navy, over 91% of their weapons systems are dependent on China, that is across 730 weapons systems, and 51,000 parts. For all US armed services, then, over 80,000 parts need materials from China, over 1,900 systems, totaling over three fourths.

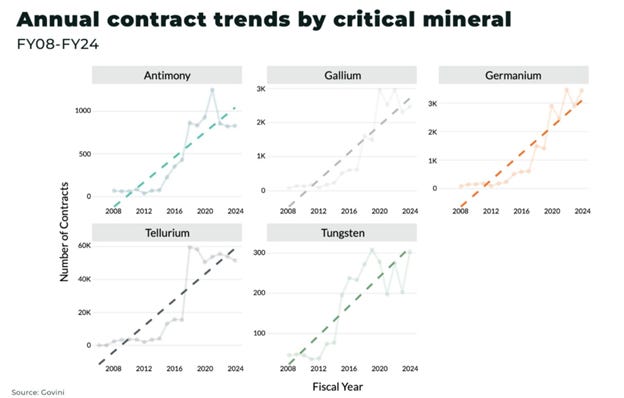

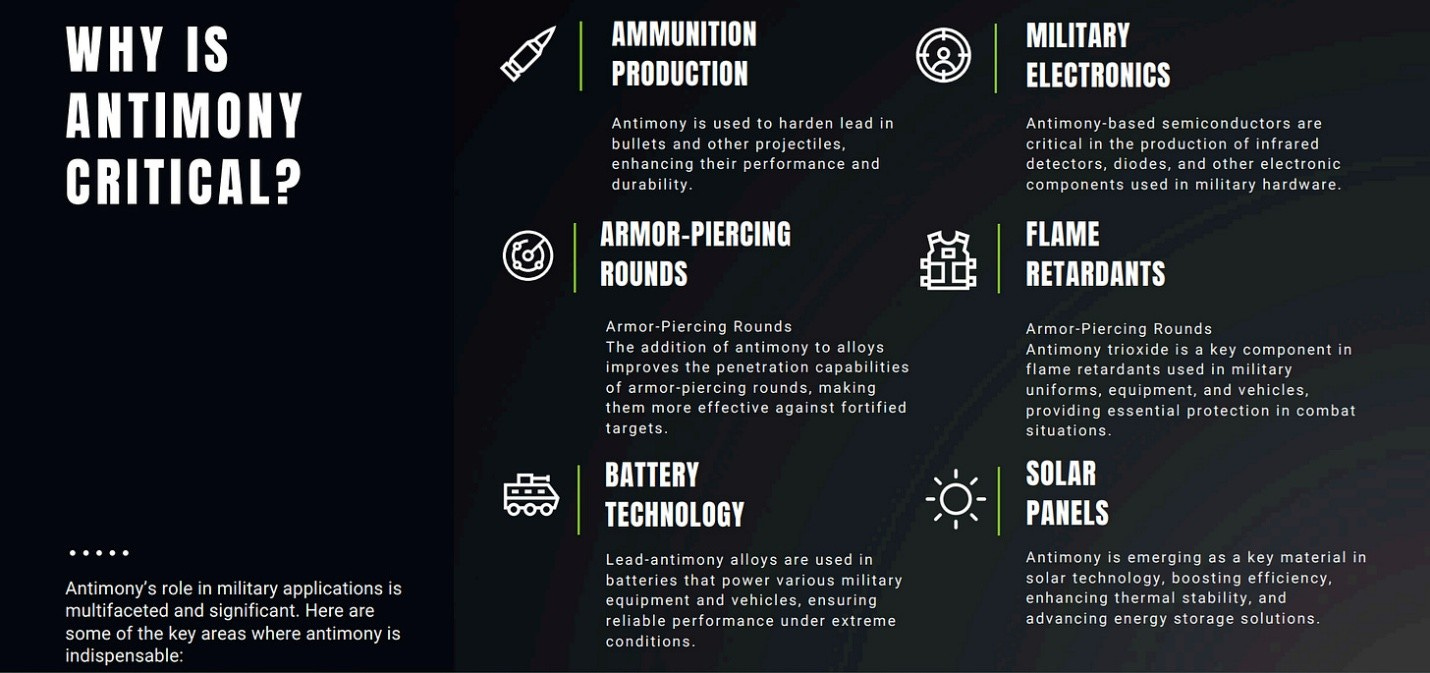

Over recent years, that dependency has been growing. These are the annual contract awards trends for Antimony, Gallium, Germanium, and Tungsten. China has banned the exports of these materials to global weapons manufacturers. Over 43,000 different chains, going down six tiers of suppliers, are dependent on China, somewhere. And even if the mining of these materials come from friendly countries, the refining and processing is done here in China.

So there is no getting around the problem. The United States and NATO countries have pledged to dramatically increase spending on weapons systems, but none of them work without critical materials from China, and China has closed their export markets to them.

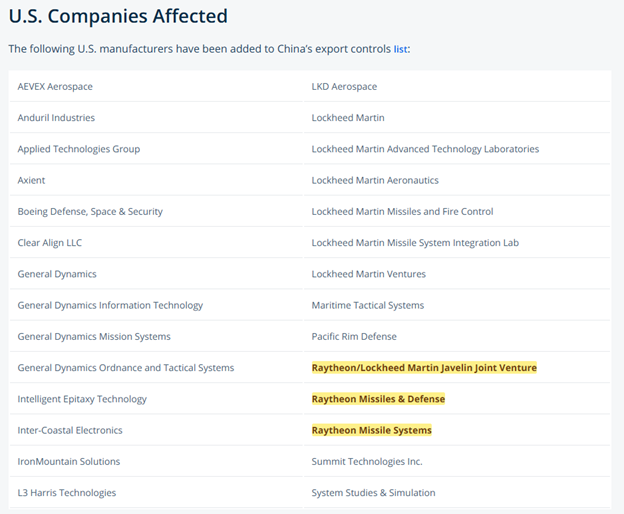

Raytheon is a military contractor, and is a major supplier of missile systems. Raytheon is one of the firms that is specifically targeted by China’s export controls on raw materials. Two years ago Raytheon’s CEO warned that China controlled the supply chain for everything Raytheon and their friends need. The Pentagon directed their suppliers to cut Chinese magnets out of their chains by 2027, and Raytheon said that was impossible. Decoupling is impossible. Arms manufacturers can de-risk but not decouple, and he says that applies to all the other companies on this list. Most companies keep only months of supply on hand, and newer and smaller companies are particularly vulnerable to anything disruptive from China.

That was two years ago, when Raytheon warned that Pentagon cannot decouple from China. But we’re seeing now that China is decoupling from the Pentagon, and blowing up supply chains for everything the Defense Department needs to maintain systems, replace the munitions that are getting blown up by the forever wars, and build new ones.

Prices are skyrocketing; for example a buyer of samarium for fighter jet engines was offered it at 60 times the previous price. Makers of electronics, drones, NVG’s, anything in aerospace—all of them are reliant on minerals produced in China. Nearly all of the supply chains have at least one Chinese company in there.

Production cuts are coming unless China relaxes the rules, or weapons makers find refined rare earths and magnets somewhere else. Leonardo builds sensors for missiles, and they are running out of germanium. Unless they can get a lot more, soon, they will delay production and deliveries.

Drone companies are in a very tight spot, uniquely so. These companies never had the resources to build stockpiles, and it’s a relatively new industry anyway so their executives do not have the deep experience in materials sourcing that the major contractors do. The rare earth magnets problem is the most important concern for them. They talk about it daily, and some of the materials they need have such a tiny market that nobody in the West can make money making them.

The export rules and restrictions out of China are very strict, and they are explicitly designed to prevent their being used for military purposes. Chinese regulators insist that prospective buyers provide documentation, much of which is highly sensitive. Photos of production lines, and detailed lists of intended uses, and previous manufacturing histories. Chinese authorities are approving some for civilian applications, but for anything military it’s a hard no.

A drone company in New Hampshire, ePropelled, makes propulsion systems, and applied to import Chinese rare earth magnets. The company needed to provide technical drawings, a list of customers, and guarantee that none of it will go to build weapons.

But ePropelled does build weapons, for large Pentagon contractors and drone operators in Ukraine. Executives at the company refused to supply the information, so China cut them off. Their drone shipments were delayed by a couple of months, while the company went looking around for other suppliers. But ePropelled learned the same thing that the guys at Govini and Raytheon figured out ages ago—once they go down the supply chains, they can’t get away from China. It’s impossible. ePropelled located other suppliers of magnets, but those companies in turn depend on China for the materials to build those.

Antimony is another critical element on Beijing’s ban list, and antimony is very widely used in defense. The United States Antimony Corporation bought 55 tons from Australia, and tried to ship it to Mexico for refining. Along the way, the ship made a port stop in Ningbo, and the shipment was detained by Chinese customs for three months. Officials released the shipment last month, but required that the antimony be returned to Australia.

There is no way out, in the short term. It doesn’t matter how much money they have, or how much money governments are promising to spend. They’re not getting magnets, they cannot get them, and now they’re more and more panicked as their stocks drop below safety levels, then tick down to zero. And the noose tightens every time something goes boom in Ukraine or Gaza.

Be Good.

Resources and links:

Wall Street Journal, China Is Still Choking Exports of Rare Earths Despite Pact With U.S.

https://www.wsj.com/world/china/china-rare-earths-exports-2fd0dab4

Wall Street Journal, China Is Choking Supply of Critical Minerals to Western Defense Companies

https://www.wsj.com/world/asia/china-western-defense-industry-critical-minerals-3971ec51

China's Grip On Critical Minerals Disrupts U.S. Defense Supply Chain

https://www.zerohedge.com/military/chinas-grip-critical-minerals-disrupts-us-defense-supply-chain

78% of US military weapon systems vulnerable to China’s critical mineral dominance

Nearly one in 10 ‘Tier 1’ subcontractors to defense primes are Chinese firms: Report

China Adds 28 U.S. Defense Companies to Export Controls List

https://www.thomasnet.com/insights/china-us-defense-companies-export-controls/

Defence expenditures and NATO’s 5% commitment

https://www.nato.int/cps/en/natohq/topics_49198.htm

Antimony Is A Strategic Metal That Is Critical For The Defense Industry & The West Doesn't Have Much

https://robertsinn.substack.com/p/antimony-is-a-strategic-met

Following the statement, “The Pentagon directed their suppliers to cut Chinese magnets out of their chains by 2027…”, it is kind of comical to see China stepping in to assist the USA with that prescribed decoupling… free of charge… voluntary action... no thanks needed (from the USA leadership). In effect, it is akin to China saying to the USA Pentagon “How can we help you decouple from us?”, and then do it.

How much of this is due to Trump's constant bellicose bloviating I wonder? I mean it's not like REs haven't been used by the military for many years now, decades in some cases. Hilarious if true, since he seems to think the US military is invincible.