Bullets:

President Trump elated US steel producers while enraging trading partners in Europe, Canada, and Mexico by announcing sweeping new tariffs on steel and aluminum.

Companies in the EU, Canada, Mexico, and other countries would exploit a loophole in the original steel tariff announcement, by buying poured steel from China, and turning that into finished product that could be exported to the United States tariff-free.

But by equalizing tariffs on steel, irrespective of source, Chinese steel producers are suddenly at a huge cost advantage. The complex, and costly, re-routing of steel supply chains only made sense when high tariffs applied to Chinese steel, but not to companies in other countries.

Producers now foresee a global price war on steel which will drive down prices, and collapse profit margins for steelmakers across the world, who can no longer compete in North American markets, or in other markets where Chinese steel can be sold.

Report:

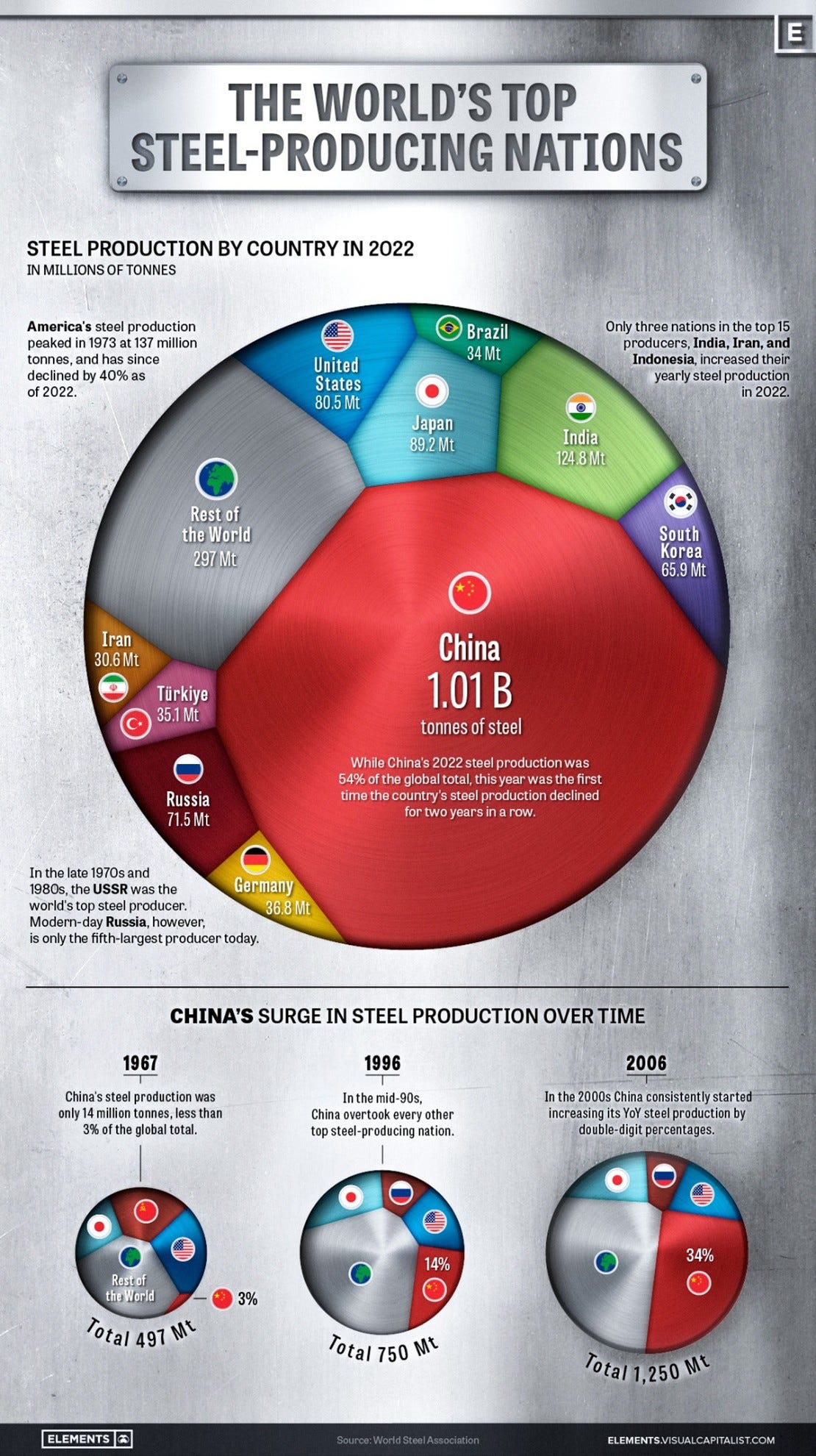

Good morning. China is by far the biggest producer of steel in the world.

There’s some good stuff to take away from this graphic here. At the bottom is the growth of China’s steel industry over time. I was born in 1967, we had a nice-sized American flag on that pie chart, when China was at only 3%. By 1996 China was the biggest steel producing country in the world, and ten years later they were growing at double-digit rates every year, and now makes more than the rest of the world’s combined. American steel production hit its all time high in 1973, and is down 40% since then.

Here are some other data that are surprising. First, even with the sharp declines in US steel production, the United States is not nearly as dependent on imports to meet our demand for it. It’s not like so many of the other metals and minerals, where our production is zero, or statistically so insignificant that we need to supply everything from abroad. For steel and aluminum we’re in a far better position.

These next charts are surprising as well.

This is China’s steel exports. Thirty-eight plus 31 means that 69% of China’s steel exports are headed to markets here in Asia. Just 3% of Chinese steel goes to North America. North America includes Canada and Mexico, which is the problem, as we’ll see later. But North America is the smallest export market for Chinese steel.

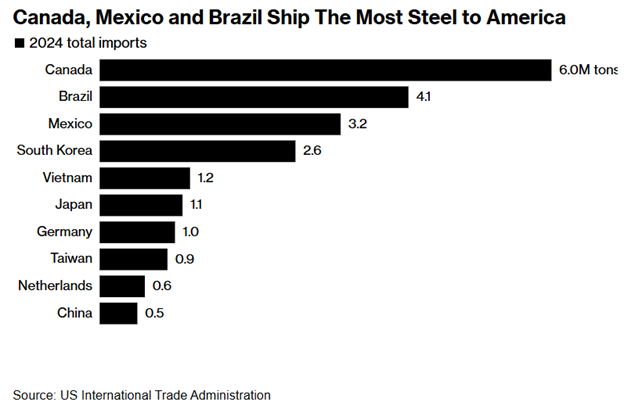

This one shows where US imports of steel are coming from, with China at the bottom. Just 500,000 tons of steel came to the US from China in 2024. Canada was 12 times that. Brazil was 8 times, at 4.1 million tons. Mexico is at 3.2 million tons. Just two EU countries—Germany and the Netherlands, export more than three times more steel to the United States than China does.

Remember again that China is the biggest producer. Going back to this one of the global top 10. Germany barely shows up at all, and the Netherlands doesn’t. Holland is lumped in with “Rest of the World”. Also in “Rest of world” is Canada and Mexico. They’re not in the Top 10.

Now, the new tariffs from the Trump Administration have scrambled up all this math, for everyone. When the first Trump administration put high tariffs on Chinese steel, suppliers simply went around those rules by setting up in Mexico. Last year, July 2024, the Biden Administration shut down that loophole on Chinese steel and aluminum, which were just re-routed through Mexican companies. This was the procedure. Chinese steel companies would pour the metal here in China, then ship to Mexico where they were turned into the final products. At that point, they could cross the American border with no tariffs, under NAFTA rules. Biden officials said the objective is to protect American steelworkers, particularly ones that are being subsidized with government loans.

President Trump goes a step further this time, with the new rounds of tariffs, which are being levied on everybody: 25% tariffs on all steel and aluminum, no matter the source. This was the first instance where the European Union had been hit by tariffs, and they quickly retaliated with countermeasures of their own. Canada did the same, later the same day. The tariffs on steel and aluminum mark the first time in Trump’s second administration that tariffs have been applied to all countries.

The key terms of the Executive Order are here. Trump reinstates the full 25% tariff of steel, and sets aluminum also at 25%. The White House eliminates any side agreements and applies strict standards of “melted and poured”, which was the workaround for Mexican firms who were just re-routing Chinese steel. But not just Mexico. European Union and Canada had exemptions on the “melted and poured” standards that were exploited.

Steel producers in the US are happy about how this is all going so far, and they are reminding Trump not to make the same mistake as before, allowing for tariff exemptions for companies in friendly countries.

Now global steel markets are bracing for a steel war which will drive prices down, not up. South Korea is a major steel producer already, and so are countries in South America. But what they know is that since these high tariffs now apply to everyone, equally, buyers will simply be buying direct from China and paying the tariff.

All the complex calculations involved with buying poured steel from China and turning that into finished products for export to the United States—all those are gone. That math only worked if the tariffs were high enough to justify huge investments in Mexico turning Chinese steel into Mexican steel.

That’s over. So ironically, the United States market will be more open now to Chinese finished steel products, but closed to Mexican and European steel products. Because Mexico and Germany and Netherlands cannot compete against Chinese steel and steel products if all the tariffs are the same.

Resources and links:

Ranked: The World’s Biggest Steel Producers, by Country

https://www.visualcapitalist.com/biggest-steel-producers-country/

A Global Steel War Heats Up With Trump’s Latest Tariff Move

Steel Sits at the Core of Trump’s Tariff Ideology

Too Much Steel in China Means Trouble for the World

Trump tariffs of 25% on steel and aluminum take effect, prompting EU retaliation threat

https://www.cbsnews.com/news/trump-tariffs-25-percent-steel-aluminum-eu-retaliation/

Fact Sheet: President Donald J. Trump Restores Section 232 Tariffs

Trump imposes sweeping 25% steel and aluminum tariffs. Canada and Europe swiftly retaliate

https://www.cnn.com/2025/03/12/economy/trump-steel-aluminum-tariffs-hnk-intl/index.html

Biden administration to tax foreign-made steel and aluminum imports routed through Mexico

Biden Announces Tariffs on Chinese Metals Routed Through Mexico

https://www.nytimes.com/2024/07/10/us/politics/biden-steel-china-mexico.html

😀 😃