The Shipping Mess, Part 1: Global fleets shift routes, raise costs, slow deliveries to US markets

Bullets:

Global shipping companies are shifting shipping routes to avoid $30 billion in new costs and fees, to hit their Chinese-built or -operated vessels making US port visits.

While the vast majority of these new fees will be passed on to American importers and consumers, shippers are rejigging their logistics systems to avoid even higher fees coming in future years.

Experts warn that these new schedules are already disruptive, and will result in slower delivery times for shipments going to US markets.

This is a transcript, for the YouTube video found here:

Report:

Good morning.

Companies are becoming ever more cunning at getting around whatever high tariffs or fees get thrown in their way. This report is more complicated than usual and is longer than usual, so we’re breaking it up into two reports. It involves global shipping, with a lot of moving parts as higher costs are shifting around, and the only thing we can say for sure is that US consumers are going to pay more for products, and will wait longer to get them.

Starting this month, there are new fees for Chinese-owned ships making port calls in the United States. The objective is to rein in China’s dominance in shipbuilding.

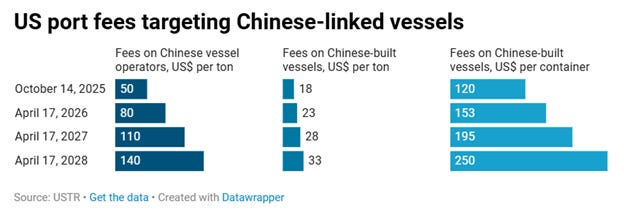

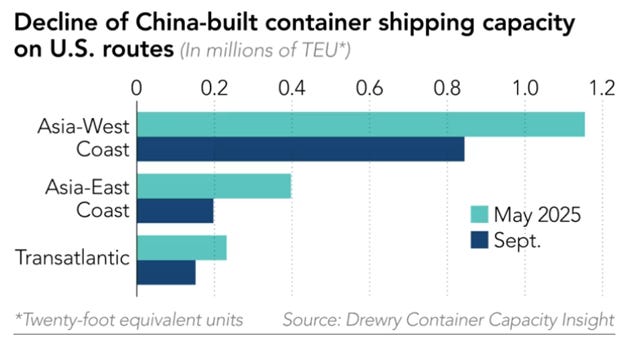

$50 per ton for Chinese ship operators, $18 per ton for ships that are built in China, and $120 per shipping container brought in on those Chinese-built ships.

Two points of view, here. That adds up to a lot of money, given how big these ships are, and how many containers are on them. But on the other hand, it is NOT a lot of money for importers on a per-shipment basis—there is a LOT of product that can be stuffed into a shipping container, so those fees will be passed along to all the importers by the shipping companies.

But to the shipping company itself, it’s over a million dollars for each port visit, and of course they’re trying to get around those fees the best they can. That’s to say that as an importer, I don’t mind paying an extra couple of hundred dollars to get my container over. But for the shipping company that is doing tens of thousands of containers, per ship, it’s a different calculus.

Here then is how the major shipping companies are handling that problem, so far. Shipping company partners are working together, jerking around established freight routes. That creates opportunities for shippers calling on non-US ports. COSCO is a giant company out of Mainland China and Hong Kong. COSCO was already heavily active in developing markets outside the US anyway, before these new fees were announced. In the first 6 months shipments were up over 9% here in China, up over 5 in Asia, up 11.9 percent to Africa and South America and elsewhere. COSCO is also a huge manager of 39 ports across the world, and their revenues and profits are booming, up 7.8% and 4%.

COSCO’s port operations are a crucial component of this issue, and we’ll come back to it in Part II.

COSCO itself is looking at a $2 billion hit to their bottom line next year, after these tariffs go on. And the fees are scheduled to move higher in future years. So they and other ship operators are making big changes to their business operations. Orient Overseas is a COSCO subsidiary, and admits that the new port fees will have a large impact on them and their partners.

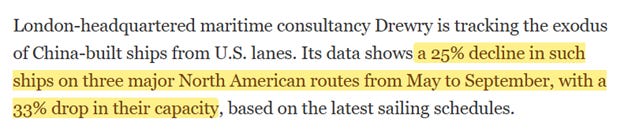

As they and other companies shift global trade patterns to get away from those high fees, shipments to the US will be slowed down, and supply chains restructured. Changes are already well underway, as companies from countries elsewhere are coordinating shipments closely, and we see a sizable reduction in US-built ships making US port visits:

Here’s the strategy, then: the Chinese build more than half of all the ships in the world, but that’s today. There are lots of ships on the ocean that were not built by Chinese companies, and a lot of other ships that aren’t owned by Chinese vessel operators. So companies are getting savvy at breaking up their fleets, to serve only the US market.

Premier Alliance is comprised of three companies from South Korea, Japan, and Taiwan, and so the problem for them, obviously, is that they’ve got a bunch of ships – ten -- built in Mainland China that are subject to the high port fees. So those particular ships will move, to serve other markets. We should assume that Premier Alliance was using those Chinese ships for US ports on the West Coast because it was most efficient to do it that way. More economical, and faster. We should also assume that their new supply chain will be less economical and less fast, less stable, for buyers of imported goods heading to the United States. Capacity shortages are likely, especially during the busiest times. There’s no getting around the higher cost problem, for American consumers, which will be $30 billion a year.

Again, that is hundreds of millions of dollars for each of these shipping companies, but it works out to only $120 a year per American. So if this all seems like a lot of trouble, given that they can just pass along these costs to importers and keep almost everything the same, there are two problems. In six months, April 2026, fees are going a lot higher, across the board. Then again the following April, and then again in 2028:

So this is just the beginning, and shippers need to lock down different berthing and docking schedules at some point, and it’s a race to get that done before everyone else already has. The second problem is here: it is over a million dollars for each port visit, because ships make visits at several ports and will be hit with these fees every time.

So the major shipping companies are already moving to reduce their own costs, best they can. And it’s naturally very complex, across the entire global industry. Shipping companies will demand higher rates from partner shipping lines, and every shipment itself is further complicated by the cargo configurations on each ship. Sharing vessels and port visits and splitting the costs is just very complicated, but it’s a multi-billion dollar cost problem, a math problem that these companies are trying to solve for themselves, first, and then for their partners.

But there is no way out for US importers, who will pay the “vast majority” of all these new costs. They will pass many of those costs on to their customers, via higher retail pricing, or try to push their own vendors harder, or adjusting their supply chains. That means higher prices, and longer wait times.

Be Good.

Resources and links:

South China Morning Post, US plan to tax Chinese ships hits choppy waters as backlash intensifies

SCMP, China’s shipping firms lean on alliances to ride out US port fee storm

Nikkei, US port fees challenge China and its shipping giant in battle for the seas

Kevin, good article as always. You write:

"The second problem is here: it is over a million dollars for each port visit, because ships make visits at several ports and will be hit with these fees every time."

Text in the graphic you included states:

"Fees to be charged when vessel arrives at first of string of US ports, [...]"

It's hard to imagine that this is all just Trump's incompetence, nor that the London/NY based international bankers would let him get away with it. This seems more like plan-B being executed, following the failure of plan-A.

Plan-A was complete domination of global trade and finance, starting with the takeover of Russia in the 90's, which almost succeeded, the ultimate aim being to put the squeeze on China, with the end goal of taking them over as well. In short, a New World Order, based on complete financial control of all major economies.

The first cracks in the dam appeared with Putin's recovery of Russian sovereignty, followed by cooperation between Russia and China to resist plan-A. Then followed an attempt to disrupt Russia through military means, which underestimated Russian resolve and capacity to resist and is failing as we speak.

It seems to me that at this point plan-A has been abandoned, which could explain the appearance of Trump and his insane policies. The basic idea here is to run the western economies into the ground and pick up the assets at fire sale prices, thus retaining partial control of global finance as a tacit admission that total control is no longer possible. In short, recognition that the world is now dividing into separate blocks as envisioned by Orwell, although possibly only two vs Orwell's three.

Domination of world energy markets was central to plan-A, but this too has failed. Russia emerges as the global swing producer, while Saudi Arabia, which has likely hit peak production, is now casting about for alternatives to being a US ally. The last shoe to drop will be an attack on Iran, which will be a disaster for the US and Israel putting the final nail in what remains of plan-A.

This does not bode well for anyone living in the West, the best response to which is to pull up stakes and move to Russia while that's still possible. Recent changes to Russia's immigration rules suggest that they understand this, and thus the ground is being laid for an exodus of westerners, similar to what happened following the collapse of the USSR.