The Shipping Mess, Part 2: New Chinese regulations may be targeting Wall Street, US investors

Bullets:

High fees and tariffs on Chinese-built or -operated commercial ships calling on US ports go into effect this week.

In response, Chinese officials issued new regulations governing foreign-flagged ships making China port visits.

The United States has a very small domestic shipping industry, so most analysts concluded that the new rules are not likely to deeply impact American companies.

But the new regulations are written very broadly, and could be directed at ships and companies that are flagged offshore, but are nevertheless mostly owned by Wall Street funds and US institutional investors.

These new rules, then, do allow for China to respond commensurately: over $30 billion in US port fees will be levied against global shippers in 2026 because of the Chinese-built vessels in their fleets. China may do the same, based on foreign ships’ proportional US ownership.

This is a transcript, for the YouTube video here:

Report:

Good morning.

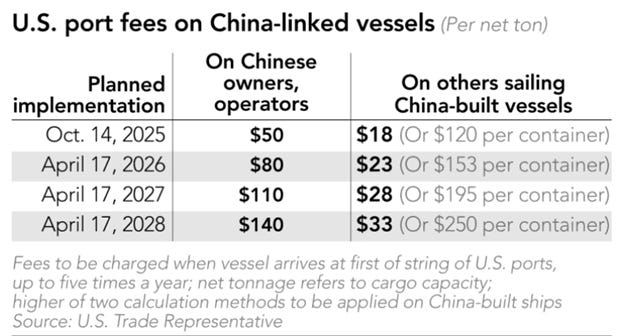

The United States has announced high port fees, on Chinese-owned or Chinese-built ships, that will go into effect shortly. Here they are again:

The objective of these new fees is to reshore the American shipbuilding industry. That’s going to take a long time, if it happens at all, and global shipping companies are already responding by shifting supply routes and, wherever possible, using ships built and operated by other countries to get around some of those fees. This report is part two of this one, which we uploaded earlier.

There are two serious problems for everyone in the shipping business, with these new fees. First, they’re scheduled to go even higher over coming years. The costs just for one Chinese company, COSCO and its subsidiaries, will be over $2 billion next year, and higher still in future years.

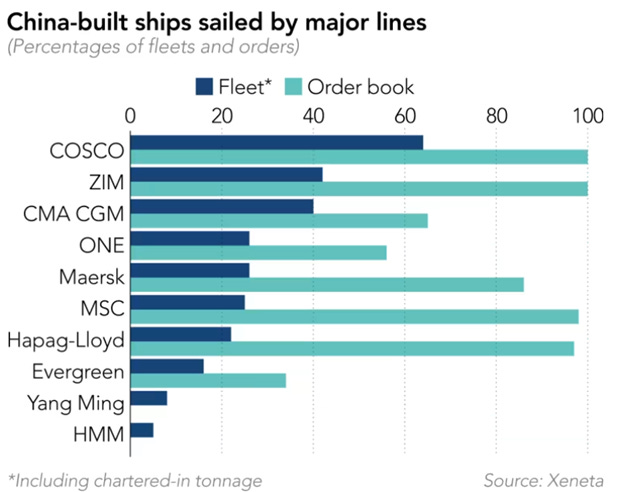

But it’s a hit to all the other global shippers too, because of how many Chinese-built ships are in their fleets now, and how many more are on the way.

The dark blue lines are the percentages of existing fleets which are Chinese-built. COSCO is over 60%, most of the others are over 20%. But the light blue lines show the new ships that will be added to the fleets. These are ships under contract and construction now, and for almost all of these companies, over half the new ships coming will be built in China. The headlines are about how COSCO and other Chinese shippers are being targeted by the new fees from US ports, but they’re coming for everyone.

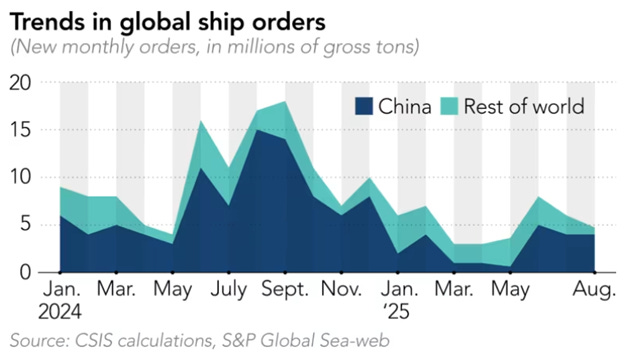

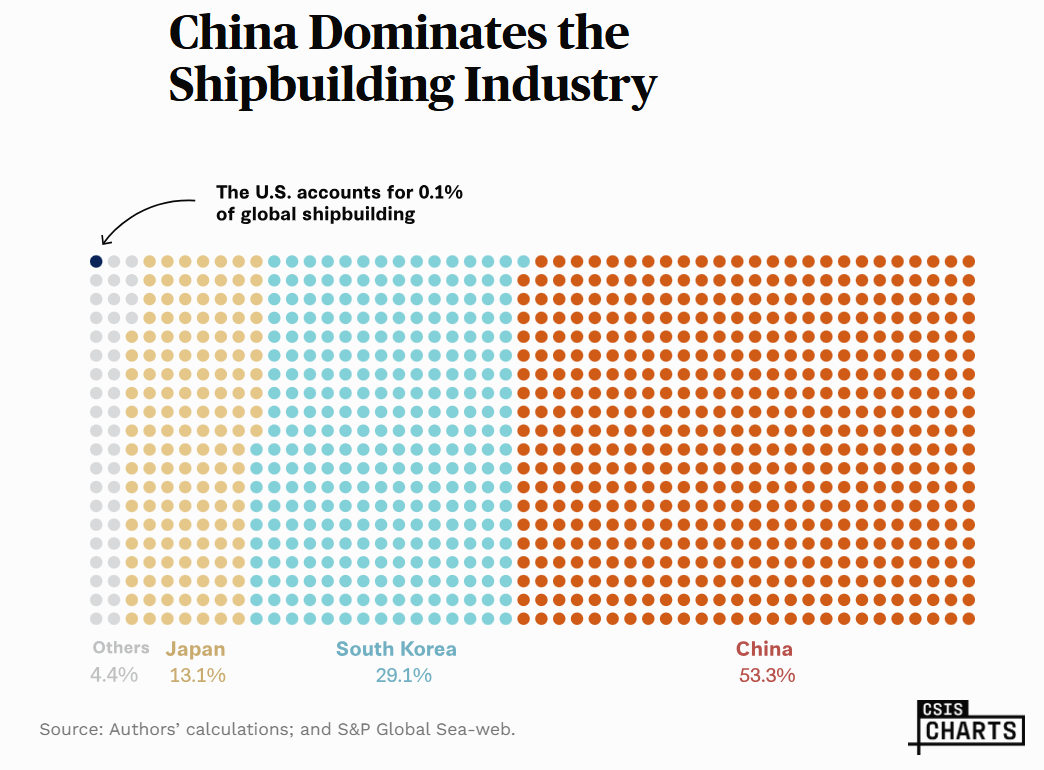

China’s shipbuilding industry builds ships faster, has lots of capacity, builds with high quality, and fairly priced. In August, new orders for Chinese ships were 84% of the world’s total. In June, it was 65%.

The takeaway there is that China is gaining new ship orders, even after the new high port fees on Chinese-made vessels were announced:

To Chinese officials, this does represent a new salvo in the trade war, that is directed at their industries specifically. But in this case, Chinese regulators are in an unusual position. The trade war is being fought by Western governments with tariffs and import restrictions. China is using its dominance in supply chains, and its ability to source easily from friendly countries. Retaliatory tariffs from China, when they do go on, do enormous damage—to American farmers and Canadian lobstermen, for example.

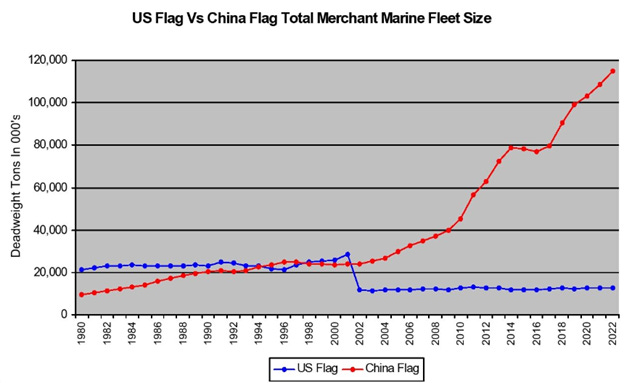

But that is only true because China does have other sources of supply. High tariffs go on US and Canadian crops and seafood, and Chinese firms shift their buys from South America or Vietnam, for example. But this situation is trickier, from a trade war perspective, because the American merchant marine fleet doesn’t really exist at all.

The US merchant fleet was crashing to zero a long time before China was getting serious about building ships. In 1950, the United States had over 3,000 flagged vessels which made up half of the world’s tonnage. Now those numbers respectively are 178 and a half of one percent.

Chinese-operated ships passed those of the United States in 2002, but at that time China was just standing still, while American ships just sailed off to be run by companies in other countries. Chinese production went parabolic starting in 2010 or so, while the US merchant fleet flatlined.

So the problem is that there is no US shipping industry to retaliate against. But under new policies announced by China last week, they may be, MAY BE, targeting the US shipping industry much more broadly. Matson is the biggest US shipping company, but it ranks just 29th largest worldwide. These new rules from China could raise the cost for any Matson ship unloading cargo in China.

But what has shipping analysts more concerned is the language of the new Chinese regulations, which do not even mention the United States at all. The way these new rules are written, Chinese officials have wide discretion to raise fees for ships coming to Chinese ports, based on ownership: Big money is made by Wall Street investors and institutions who own and operate ships in low-cost countries, and China could simply retaliate with high fees on any of those ships heading this way.

We’ll go through two as examples, of what the Chinese could—COULD—have in mind with these new rules. Star Bulk Carriers is based in Greece, and does a lot of shipping business in and out of China. Star Bulk also has a lot of ships on order from Chinese shipyards. But the company itself is traded on the NASDAQ, in the United States, and almost all its major institutional stockholders are American investment companies. Alliance Bernstein, for example, owns over 3 million shares worth about $70 million.

Global Ship Leasing is another one. It’s an American company with container vessels, but it’s headquartered in London. Ticker for them is GSL, and over half the company’s shares are owned again by major US institutions. These shipping companies are also attractive to investors, especially US pension funds, for examples, because they tend to pay high dividends.

These are American companies, traded on American exchanges, owned by American investment firms. A long time ago Wall Street investors realized they could make more money by owning ships, but operating them from elsewhere. China understands that too, and with these new regulations officials here could simply do what’s we’ve done, and assessed port fees based on that proportion of ownership whenever those ships dock at Chinese ports.

And it will also be interesting to watch what will happen in Chinese-owned and -operated ports across the world. Remember that COSCO is not just a giant shipping company; they also are a giant port operator, with 39 ports and 379 berths across the world, and it in negotiations to scoop up a lot more from CK Hutchinson. Hutchinson has two ports, one at each side of the Panama Canal. Lloyd’s List says that’s very important, both as a way to reduce the impact of the high tariffs directed at them, but also for leverage in everything else all these other shippers hope to do.

We don’t want to chase our tail with all the what-if’s, but let’s just remember the dominant position China is in on the shipbuilding, and in the logistics, and the reason all these ships are going back and forth from China in the first place: it’s China that buys so many of the raw materials coming out of the ground across the world, and it’s China that exports so many of the manufactured products across the world. And it’s just hard to see how these new US port fees will move the needle on any of that, but it’s clear that American consumers and importers will be paying a lot more. And now, probably our investors will too.

Be Good.

Resources and links:

South China Morning Post, US plan to tax Chinese ships hits choppy waters as backlash intensifies

SCMP, China’s shipping firms lean on alliances to ride out US port fee storm

Nikkei, US port fees challenge China and its shipping giant in battle for the seas

Global Ship Lease (GSL): One of the Most Underrated Shipping Stocks With High Yield

The Shipping Mess, Part 1: Global fleets shift routes, raise costs, slow deliveries to US markets

Canadian lobster now cheaper than steak, after China shifts supply chains to Vietnam

US farmers beg Trump to stop the trade war and save American farming. But it’s already too late.

China Dominates the Shipbuilding Industry

https://www.csis.org/analysis/china-dominates-shipbuilding-industry

Tariffs wiping out American farmers on all sides, and farm equipment manufacturers are laying off

What to Watch 2023: America Must Begin Growing Its Merchant Marine

https://centerformaritimestrategy.org/publications/what-to-watch-2023-america-must-begin-growing-its-merchant-marine/

China issues retaliatory rules ahead of US port fee targeting Chinese vessels

Institutional ownership of GSL and SBLK, from Nasdaq.com

China developing alternative energy while reducing fossil fuels. This makes their products even less expensive to make while we cancel wind and solar and strong arm nations to buy our oil. Great strategy.

Let’s just say what everyone is thinking about the USA’s (or Trump’s, or future Democratic POTUS) imposition of China owned or made cargo ship docking fees: It fits with Trump’s art of the grift in a grand boisterous way - demand that the other pay and pay and pay more at the dinner table.