Bullets:

President Trump's high tariffs, it is hoped, will compel America's trading partners to forge new agreements, and invest in manufacturing plants in the US in exchange for access to American consumers.

But China's strategy is to eliminate global access to the key raw materials required to build high-end products, and especially the technologies that are critical in defense, aerospace, semiconductor manufacturing, telecom, energy, and transportation.

What's more, China enjoys near-monopolies on the capital equipment necessary in mining, separating, refining, and manufacture of the supply chain for the metals and magnets.

China's dominant advantages in supply chains, logistics, and manufacturing proficiencies now position China to decide where, and whether, these technologies are built at all.

Report:

Good morning.

The tit-for-tat on tariff rates in the trade war is what takes most of the headlines, with China, the EU, Canada, Mexico—everywhere, just about, and exporters and importers shutting down trade because nobody has any idea what the tariff schedules are going to be.

So they will wait until they have a lot more clarity before placing orders, and that uncertainty is already leading to a collapse in shipping volumes out of China.

The good news is that, theoretically, the tariff rates can be negotiated, or rolled into comprehensive trade agreements that satisfy policymakers in Washington. That may happen quite quickly. But supply chain managers see much bigger problems coming from policymakers in Beijing. And that’s because the policy changes from China will be long-lasting, and structural.

Most of the headlines involve the United States raising the costs to import products from China, into the US. But the headlines from China involve shutting off exports, to everywhere, of the most important products used in defense applications, robotics, and advanced manufacturing. Think of it this way: China aims to be the factory for the world, for everything, and they own the supply chains and the logistics to do exactly that. By shutting down the materials our factories need to build anything, the tariff rates don’t matter. They can be 20%, or 120%, or a thousand and twenty percent. We can either buy products from their factories and pay their prices, plus whatever tariffs our governments levy on them, or we will go without. It’s a binary choice.

The position that China is in, and that we are in, derives from their total dominance of the supply chain for the mining and refining of rare earth metals. Without those metals, the products don’t get made. This is a press release from a US mining company, “China has launched a precision strike against the Pentagon’s supply chains” for rare earth metals. The critical minerals that are necessary “in all US defense systems, electronics, manufacturing”, high tech, transportation, and energy. China has struck on the supply chains for “our most powerful weapons systems, stealth aircraft, precision-guided bombs and missiles”, satellite systems, hypersonic weapons. Without them, the Pentagon’s most advanced systems go to being obsolete. “It’s a geopolitical earthquake in slow motion. A material cold war fought with export licenses and embargoes.”

This is the most recent announcement, in Chinese, that has Pentagon supply chain managers scrambling, looking for new sources of supply, and here’s the English from Reuters: China’s rare earth magnets are now covered by strict export controls, and this isn’t directly only at the United States, but everywhere, so manufacturers are looking for new sources everywhere.

These minerals are used to make weapons, electronics, and household products, and manufacturers have been buying from China for decades, and these chains are being closed off. It’s not just the raw materials and refined products, but permanent magnets and other finished products, difficult to replace. Procurement and supply chain managers in aerospace have a big problem, because key parts of their avionics systems have only Chinese suppliers—nobody else builds that equipment at all. Raytheon, Honeywell, Boeing, and GE—have big problems, along with Airbus.

Analysts believe that China’s new restrictions may prompt Western countries to develop our own supply chains. Mining, separating, and refining industries for rare earths are separate processes, they’re all expensive, and they’re all dirty, and we have outsourced all that work to China. Now they have it all, and to build our own is going to take a lot of time.

Mark Smith is the same CEO who wrote the “Precision Strike” press release, and his company has a permit to build a mine in Nebraska, but needs more money. His shares were up, along with USA rare earth. But MP Materials dropped over 10%, because their refining is all done in China.

Everyone acknowledges that China has a comprehensive, end-to-end manufacturing supply chain for these magnets, and nobody outside China has even two pieces of that chain, let alone all four. And another problem is here, all the important capital equipment used in the industry is also made in China, so nobody pretends that China will allow them to buy that machinery to build our own mines and refineries and magnets.

And there are lots of other industries that need the materials that China just slapped new export restrictions on. The Pentagon sucks all the air out of the room, because defense is a money-no-object industry. But these are billion-dollar companies here, they’ve got lots of money, but they have the same problem the Pentagon does. Scandium is used in smartphones, wifi systems, and base stations. Dysprosium is in hard drives and electric vehicles. The new rules include raw materials, refined materials, and finished goods. The entire supply chain, in other words

.

This table is helpful. There were three rounds of Chinese export restrictions on these materials, in the far left column. Round 1 was last December, Germanium, gallium, and antimony. Round 2 was in February, when Tungsten, Bismuth, and 3 others were added. Round 3 is now, and includes these six. All the affected applications are in the other columns, and this article goes more deeply into the chemical processes involved in transforming these rare earth metals into the most cutting-edge applications in use today.

For the metals that China has put on that has substitutes, there are substantial tradeoffs in costs and risks. So for round 1, those restrictions hit production of wafers for the fast chips from the top companies, Intel, Taiwan Semiconductor, Samsung. Other big problems in Round 1 for data storage.

Route 2 hit chip fabs more directly. So the initial rounds, restricting these materials strikes at the core of modern semiconductor production.

So here is Round 3, where China is leveraging its dominance in mining, refining ad processing, and materials sciences. The global semiconductor manufacturing industry—smartphones, computers, smart cars, and stealth bombers—nobody knows where their supplies are going to be coming from.

This is a deliberate strategy, executed in phases, targeting the entire vertical stack of production. Over time, the impact may decrease as the industry adapts and finds new sources of supply. But that will take many years. It took decades for China to build it out, and so these restrictions are highly disruptive across all the tech chains. China developed the rare earth mines wherever the rare earths could be found, but they built the refineries here, in China, and now China can decide where – and if – any product that requires rare earths to work, get made.

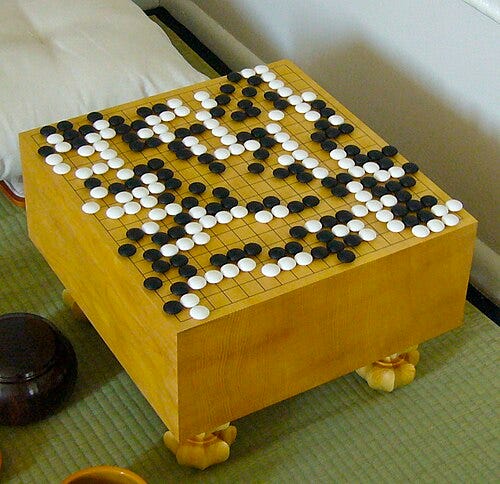

This may be the oldest board game that is still being played today. It’s from ancient China, and it’s called Wei Qi, or Go. It takes a long time to play, and involves building formations on the board with your pieces. It’s not like chess, where you need to strike at the other player’s king, and you can get lucky sometimes even against more experienced players.

And there are no dice, or any other elements of randomness or chance introduced into the game, where you might get lucky there. To win, you need to close off your opponent’s “liberties”, or his freedom to move, and take control of most of the board.

And the Chinese have been playing this game for over three thousand years.

Resources and links:

Tariff Shockwave: US Import Bookings Collapse After Q1 Surge

https://www.vizionapi.com/blog/tariff-shockwave-us-import-bookings-collapse-after-q1-surge

CHINA sets up GO for regular curriculum in elementary schools

https://mysanrensei.wordpress.com/2014/07/14/china-sets-up-go-for-regular-curriculum-in-elementary-schools/

商务部 海关总署公告2025年第18号 公布对部分中重稀土相关物项实施出口管制的决定https://www.mofcom.gov.cn/zwgk/zcfb/art/2025/art_9c2108ccaf754f22a34abab2fedaa944.html

China Launches New Precision Strike Against Pentagon Rare Earth Supply Chains

https://www.niocorp.com/china-launches-new-precision-strike-against-pentagon-rare-earth-supply-chains/

Reuters, China hits back at US tariffs with export controls on key rare earths

https://www.reuters.com/world/china-hits-back-us-tariffs-with-rare-earth-export-controls-2025-04-04/

Reuters, Rattled by China, West scrambles to rejig critical minerals supply chains

https://www.reuters.com/markets/commodities/rattled-by-china-west-scrambles-rejig-critical-minerals-supply-chains-2024-12-06/

Tom’s Hardware, China's rare earth export restrictions threaten global chipmaking supply chains

US Tariffs on the World

https://www.voronoiapp.com/economy/US-Tariffs-on-the-World-4590

BBC Analysis: Why Beijing is not backing down on tariffs

https://www.bbc.com/news/articles/cjew7y4j724o

Where most substacks in geopolitics have unavoidable overlaps with each other, Kevin’s substack, and the related YouTube’s, are unique — and uniquely valuable.

Anyone thinking they can fool the Chinese is living in dreamland. Win-win is a great idea but the USA hates it. Sharing and progressing suit genuine human societies. Notice that most of the uses of the rare materials the USA yearns for are to destroy others. It is called "defense" but that is untrue. Give peace" a chance.