The US Dollar will keep falling. World's top banks recommend more gold buying, more hedging

This is a transcript, for the YouTube video found here:

Bullets:

The US Dollar is seeing its steepest decline in fifty years, and investment banks forecast continued weakness.

The fiscal position in the United States is deteriorating, with record deficits. Trade policies have also eroded global confidence.

Most foreign holdings of US Treasuries are unhedged against further rises in interest rates, and investors are being repaid in cheaper dollars.

Hedging activity will likely surge to protect against further losses to bondholders.

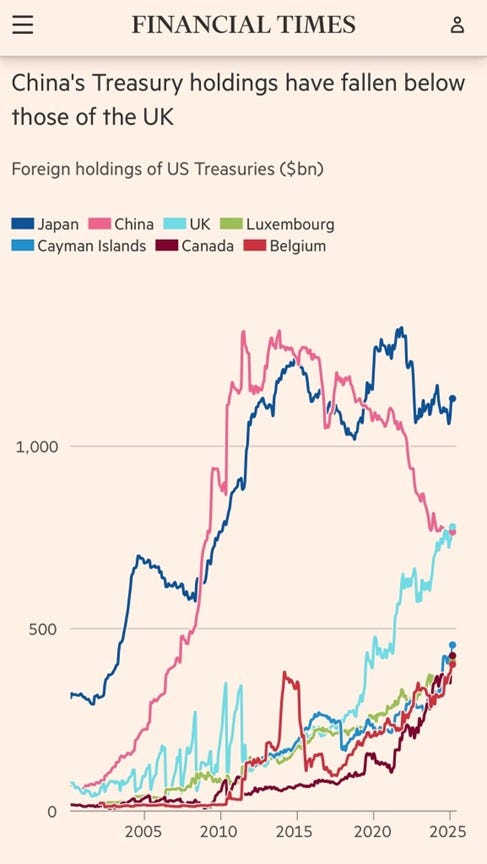

China's central bank is being urged to further reduce its Treasury holdings, already at their lowest level in fifteen years. Increased gold buys and BRI investments to lock down key supply chains are also recommended.

Report:

Good morning.

The Bank of China is the one of the largest banks in the world, the fourth largest. BOC is different from the PBOC, the People’s Bank of China, which is their Central Bank.

Bank of China has operations in over 60 countries, and BOC’s bank in New York is one of their primary clearing banks for renminbi. This bank in New York is a key part of China’s offshore RMB market, and manages the conversion of currencies back and forth between US dollars, mainly, and the Chinese currency. So as China’s exports boom to the rest of the world, this is one of the main banks charged with taking this trillion dollars’ equivalent from countries across the world, and converting them into renminbi.

Researchers from this bank, the Bank of China, published a report of their recommendations, to the People’s Bank of China and to other regulators here. They want to reduce even further their exposure to US dollars. The national debt in the United States keeps going higher, setting records. US Treasury bonds aren’t in default, technically, yet, but things cannot keep going the way they are without something breaking. The American economy cannot outgrow the problem—debt is rising far faster than any growth anyone thinks we’ll see. The certainty of rising US debt and trade deficits, and the uncertainty of tariff rules have resulted in a crisis of credibility. So these executives at the Bank of China are calling for more selling of US Treasuries, and for more buying of gold and other commodities.

China is all that already. But Bank of China is recommending they go faster. US Treasury holdings are at their lowest level in sixteen years, going back to 2009. For gold, China is already the world’s top miner of gold, and they are also buying record volumes of gold on foreign exchanges, and hauling it back to vaults here in Asia and in the countries of their biggest trading partners.

Those were the recommendations from Bank of China. Morgan Stanley is a US investment bank, and they came to the same conclusion with the respect to the direction of the US dollar. The USD just saw its biggest drop in over 50 years, and MS says that will continue--dropping another 10% by the end of next year.

Foreign investors will have little choice, but to hedge their exposure to US assets, which will drive further dollar declines.

Looking at the bond holdings chart again, the only down arrow—the light purple, is China. All those other arrows are up. Japan’s is off its high and they may be outright sellers going forward, but the UK, Canada, and the money center banks are buying more. Morgan Stanley says here that over half of these bond holders from Europe are not protected against a decline in the value of the USD, or in the bond holdings themselves.

When yields go up--and they are--the market value of their bonds goes down. What’s more, the US dollar is also falling in value, so the interest payments these investors receive are worth less today than when they loaned the money. If the USD strengthens--goes back up--it’s not a problem. But if it does go down another 10% by next December, these lenders need a new strategy, and that means buying options before the others do.

The end result is even further declines, this time from hedging activities. China has already gotten mostly out of the way, and the falling dollar isn’t nearly the problem for them that the others have, especially in proportion to their trade surpluses.

Goldman Sachs is another US investment bank, and they point out that China’s economy is growing much faster than they thought it would be, and that is yet another macro factor driving US dollar selling. The People’s Bank of China carefully manages the exchange rate, which is currently the highest since last November.

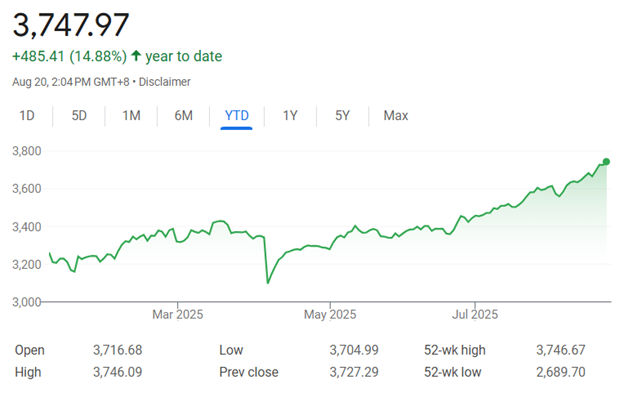

The Shanghai stock index is today at its highest level in over 10 years, since August 2015. This is the year-to-date chart, yet another chart where it’s hard to see, just where exactly, our trade war is hurting the Chinese economy. Bloomberg points out that China’s stock market rally this time is different from the previous bull markets, in 2008 and 2015: Interest rates in China are much lower today, compared to then, so a lot of this money going into the stock market now is long-term money, and not from short-term speculators. So if China’s stock markets keep driving higher, that will be another factor that will push the conversion of foreign currencies back into renminbi, to fuel domestic investment here.

The research report from Bank of China also called for increased purchases of key resources and strategic materials. The secret is out, now. China’s has monopolies on rare earth metals, and particularly the refining of those. China also enjoys massive supply chain advantages over lots of other raw materials inputs crucial for manufacturing.

Those have resulted in real-world impacts that very few people foresaw a year ago. Now, NATO defense contractors can’t build weapons, and factories in the G7 can’t get raw materials they need to make products that compete against factories here. The Bank of China is saying to regulators in Beijing that they should keep doing exactly what they have been, but faster: continue selling Treasuries, continue buying gold, and continue Belt and Road Initiative investments to lock down supply chains for everything their customers in the industrial sector need. If they do that, these giant trade surpluses and exports will also continue.

Resources and links:

Top Gold Producing Countries (2024)

https://www.voronoiapp.com/wealth/-Top-Gold-Producing-Countries-2024-4501

China vs the world: Goods exported in 2023

Visualizing All of China’s Trade Partners

https://www.visualcapitalist.com/cp/china-trade-partners/

Morgan Stanley, The Depreciation of the Dollar

https://www.morganstanley.com/insights/articles/us-dollar-declines

China’s trade surplus just keeps growing, as the world prepares for Trump 2.0

https://www.voronoiapp.com/trade/Chinas-trade-surplus-just-keeps-growing-as-the-world-prepares-for-Trump-20-3041

About Bank of China

https://www.bocusa.com/about-us

South China Morning Post, Why China’s yuan is forecast to extend gains against the US dollar through 2025

https://www.scmp.com/economy/china-economy/article/3316463/why-chinas-yuan-forecast-extend-gains-against-us-dollar-through-2025

South China Morning Post, Chinese researchers lodge concerns over US debt as Beijing limits exposure

Bloomberg, China’s Stock Rally Has the Makings of a Durable Bull Run

https://www.bloomberg.com/news/articles/2025-08-18/china-s-stock-rally-has-the-makings-of-a-durable-bull-run

Thanks Mr. Walmsley... I understand more each posting. Still, how gold will be more secure for a mid-west farmer, I don't know.

If the USA is doing less trade with China (and vice versa), then China may be thinking: Why should it hold all those US treasuries/bonds? In the past, when China did a lot of trade with the USA, it made sense to have a lot of US treasuries/bonds. Now, it may not be. So, if it isn't, then China has to acquire something else (e.g., gold, capital assets, etc).