Bullets:

Large subsidies and tax credits are available to develop a copper supply chain that would reduce dependence on China, who is the world's leader in copper refining.

But China's copper supply chains are highly efficient, clean, and low cost.

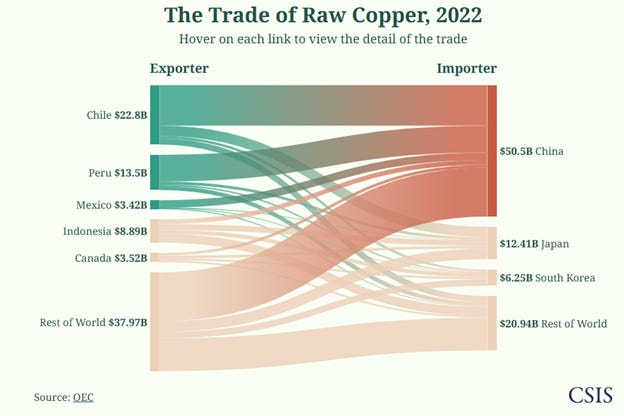

Chinese companies have strong supplier contracts with resource-rich copper areas in Africa, Mexico, Peru, and Chile.

China's deep investments in copper supply chains were necessitated by its rapid industrialization, and then by its enormous factory sector for appliances and electronics.

Now, the world's copper mines feed China's production of electric vehicles and green energy equipment.

Industry experts forecast a parabolic boom in demand for copper, along with plunging demand for oil, and the world's transportation networks electrify.

But insiders are also deeply pessimistic about our own companies' ability to compete against China's smelting and refining industries for copper, and investors have thus far shunned any new mines or smelting operations in North America or Europe.

Report:

Good morning.

A key feature of China’s strategy across supply chains, is to lower the cost of the entire system, at every point of the chain. They make trade-offs at the each stage, so that China’s factory sector is the lowest-cost and most efficient, as a whole. This is a challenge our own companies face, whether they be for raw materials, or for refining, or for manufacturing, or assembly. The very first hurdle to overcome, is how to compete against Chinese companies—on a peer-to-peer level, and also against the entire Chinese industrial system.

That’s the theme that is playing out across all our economies, and we’ll look today at what’s happening in copper markets. Copper is a vital component in electronics, in new energy, in computing, construction, and in infrastructure. And China has taken over the world’s copper chains. Their motivation for doing so, was to feed its own factories with the raw materials necessary to make anything powered by electricity.: appliances, electronics, and now electric cars and solar panels.

Our policymakers at home hope to de-risk from China by cutting Chinese suppliers of copper out of our supply chains. We need our own sources of copper to power the newest technologies in transportation, electronics, and energy. But that’s a lot easier said than done, because Chinese copper just costs a lot less, and Chinese companies control the global market price of it. Woods Mackenzie says declaratively, that without Chinese copper, we won’t have an energy transition at all.

The demand for copper will grow 75% in the next 25 years, to 56 million tons a year. In order to meet our demand with domestically sourced copper, we need to build the mines, the smelters, and the refineries. We have legislation and financial incentives to do that—the Inflation Reduction Act includes incentives for copper mining. But the problem is the entire supply chain of copper, not just mining. Hundreds of billions of dollars in new copper processing and fabrication needs to be built as well. The finished goods would be less efficient and cost significantly more. China’s dominance in copper has a scale that cannot be replaced.

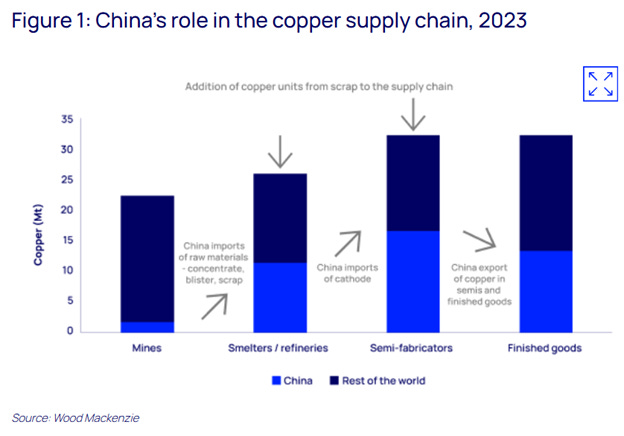

There are four key stages, and mining is just the first. Then comes smelter-refining, semi-fabrication, and end-use manufacturing. That’s the supply chain for copper. We have so far just been focused on trying to get mines started, but for China the mining and smelting and fabricating were necessary to feed their manufacturing, and they started working on that a long time ago. So we’re back to the question, of why investors would put up tens of billions of dollars to build our domestic copper mining industry, when it’s still China who buys the copper to build manufactured product?

This chart from last year shows the supply chain of copper. Most of the mines for copper are outside China, but half of the world’s ores are brought to China for smelting and refining. That turns into more than half again of the world’s semi-fabrication, and just under half of the world’s finished goods that contain copper.

2017 was 8 years ago, when the US strategy to build a critical mineral supply chain was first announced. Since then, the needles haven’t moved in any of the chains, and instead our dependency on China has worsened.

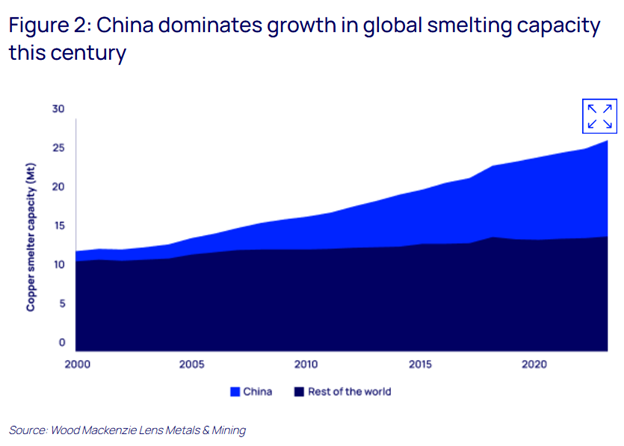

In copper smelting, 97% of new global capacity since 2000 was in China, while the rest of the world has basically stood still. And the reason is that China is where the demand for copper is. In the past 25 years, China’s share of copper demand has gone from under 20% to over 50%, so they had to build up the entire supply chain of copper just to keep their own factories and economy supplied.

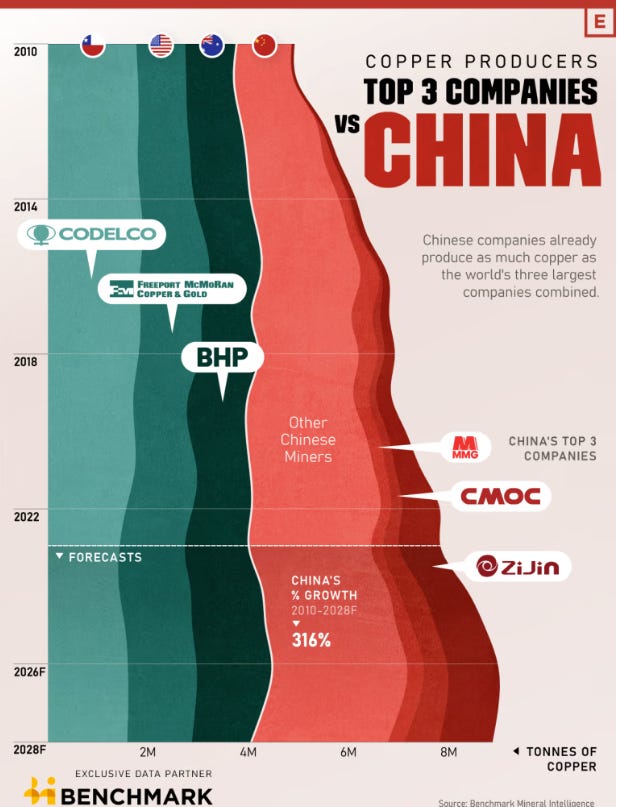

Just looking at the top 3 companies in China, and the top 3 companies outside China, Codelco, Freeport McMoran and BHP are holding steady at 4 million tons a year, while the top 3 in China will grow by over 4 times, producing over 6 million tons a year.

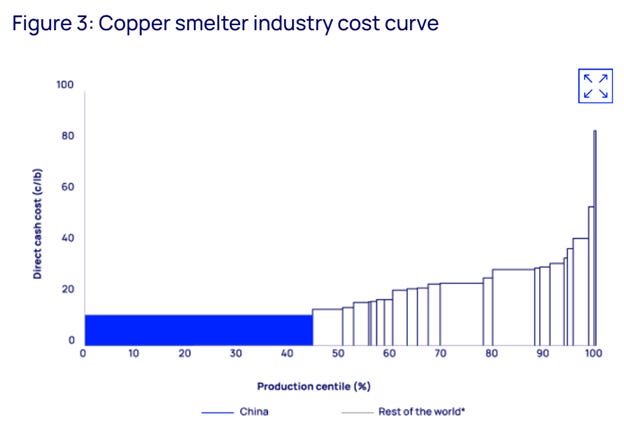

Even more important, China’s driven the cost of copper down, at least for their own. In the past, China’s copper industry was more about economic growth than environmental concerns. That’s changed. Outdated furnaces were replaced by new ones, and now China’s copper supply chain is low cost and meets high standards for environmental protection. Chinese firms are now at the bottom of all the cost curves for copper production, meaning that any new production outside China will automatically carry a far higher cost:

There are a handful of smelters coming online, one in India and two in Indonesia, and next year one in the DCR that’s actually a Chinese company. Combined, these will add another 1.6 million tons of supply, which is the biggest increase outside China for decades And there is no new primary capacity planned for North America or Europe.

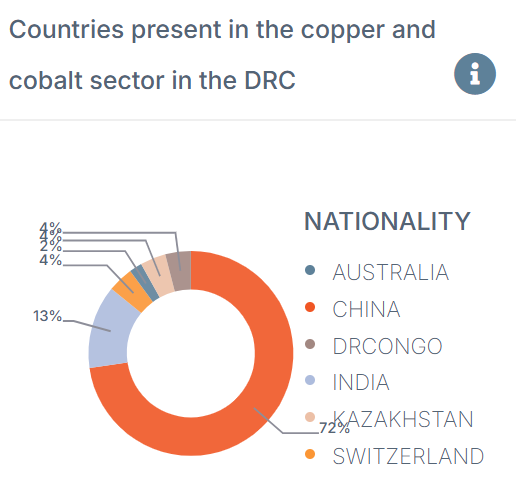

China builds products that are specifically designed to displace oil. China is NOT an oil-rich country, and that’s a vulnerability they can’t easily get away from. And if they want to move everything around using electricity, they need a lot of copper. If China wants to move away from burning coal to get that electricity, they need copper for all that too—renewable power needs a lot of copper. It also China needs a lot of copper to get the electricity from the source to the factories and cities. In order to get the copper, China got busy in copper-rich countries around the world. In the Democratic Republic of the Congo, for example, where some of the highest-quality copper ores are, Chinese companies have 72% of the copper mining projects:

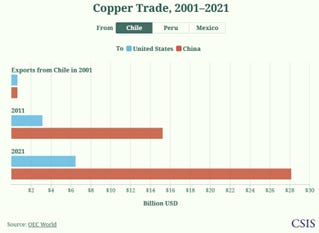

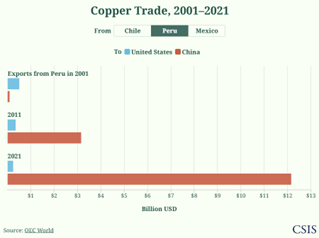

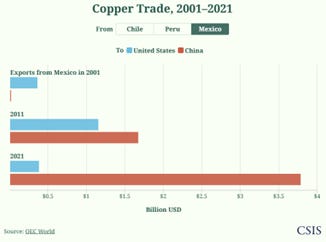

China also takes most of the copper from South America. They have very strong trade relationships in Chile, Peru, and Mexico.

These are copper exports from key copper markets at 10-year intervals, to buyers in the United States, in blue, and China in red. We can see for ourselves, who South American mining companies are doing business with. In 2001, China wasn’t in Mexico or South America at all. Chinese investment went in, production went up, and copper went to China, and the costs went down.

Investors everywhere know how important copper is. Every time China builds an electric car or an electric scooter, it’s a hit to future oil demand. Oil demand has already peaked and is now in decline, because the transportation grids are being electrified across most of the world.

But even with the soaring demand for copper, China’s driving down its cost even faster, along with profit margins for everyone outside China. Chinese smelters are hitting production records. The raw materials are scarce outside China, because Chinese production in Africa and South America and Mexico is already under delivery contract to smelters in China. So operating margins are getting crushed for everybody else. Bloomberg’s chief research analyst says that operations in Chile and Europe and India are at risk of insolvency, which will result in even more production going to China. He forecasts that refining fees earned by smelters will drop by more than half next year, from $80 a ton to $40 or less, and those price points will lead to big losses for smelters outside China.

And that’s what potential investors in Europe and North America realize. They see the subsidies offered by Washington to open new production, to build copper supply in our own chains to reduce the dependency on China, but the math doesn’t work.

China has already done the hard part, on the mining side. They went to Africa, and South America, and Mexico, made the investments, built out the logistics, and now most of that copper ore flows this way. China built the smelters for those ores, and now those are the most efficient, and the cleanest, in the world. Most of all, China built the industrial sector which needs most of the world’s copper. And those factories would, as a first resort, prefer to buy the lowest cost copper, and that’s Chinese copper. As a second, Chinese factories would prefer to source in-country. Our factories would probably prefer that, too, if we had any factories.

Be good.

Resources and links:

How China is reshaping the global copper market

https://source.benchmarkminerals.com/article/how-china-is-reshaping-the-global-copper-market

Addressing China’s Monopoly over Africa’s Renewable Energy Minerals

2022 production data

https://chinaglobalsouth.com/cobaltmap/en/production.html

ZeroHedge, Is Copper Still The 'New Oil'?

https://www.zerohedge.com/commodities/copper-still-new-oil

De-risking from Chinese copper would cost world US$85 billion, ‘mess up’ supply chains

China’s copper production boom threatens to crowd out the rest of the world

Securing copper supply: No China, no energy transition

https://www.woodmac.com/horizons/securing-copper-supply-china-energy-transition/

Copper Trade, 2001–2021

https://features.csis.org/copper-in-latin-america

A New Report Highlights the Need for “All-of-the-Above” Strategy to Meet US Copper Demand

Inflation Reduction Act Guidebook: Clean Energy

https://www.whitehouse.gov/cleanenergy/inflation-reduction-act-guidebook

Thank you!

The Chinese were doing the hard productive yard whilst Western CEOs were working out how to increase their own remuneration