Trump Administration's bold plan to revive US shipbuilding will kill American exporters instead

Bullets:

The new US administration is floating a strategy which is hoped to rehabilitate the American shipbuilding industry.

The proposal targets Chinese-built ships and ship operators, and involves a levy of $1,000,000 per US port visit with the expectation that the higher cost will encourage construction of ships in the United States.

But the sheer massive cargo volumes of today's ships means that on a per-product basis, a surcharge of that size wouldn't make a difference.

It is the other parts of the plan, however, that lead maritime supply chain experts to conclude that it would be a disaster for US exporters. US products on outbound ships would be required to sail on US-operated and -owned vessels, with the eventual requirement that the ships themselves be US-built.

Immediately upon these rules being enacted, shipping insiders will create "parallel fleets" to paper over the new restrictions on import trade flows. But for US exports, the soaring costs and delivery times will make American exporters uncompetitive in global markets.

Report:

Good morning.

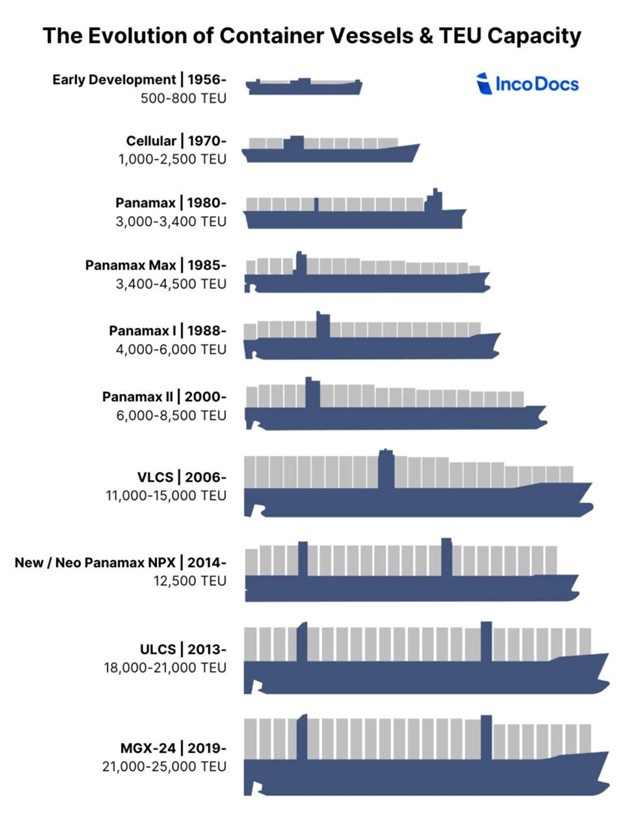

This is a photo of a Chinese container ship at the Port of Long Beach, California. All those shipping containers at the top are called TEU’s, or twenty-foot equivalent units. Container ships are getting ever-bigger, and able to transport almost unimaginable volumes of these TEU shipping containers.

Halfway down this graphic we see VLC’s, or Very Large Cargo Ships, that could carry up to 15,000 of them. We’re now at the Ultra Large Carriers, with a capacity of over 20,000 shipping containers.

And shippers and freight forwarders are very clever how to pack these things, so there’s not much wasted space. Here’s a peak inside, palletized shipments from floor to ceiling.

With all this in mind, let’s consider a new proposal that would charge high port fees for non-US built ships to use American ports. It’s specifically targeting China, and the hope is that these measures would rebuild the United States production of civilian ships, which basically is nonexistent anymore.

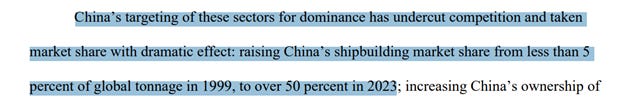

Today, the global fleets of merchant shipping comes from three countries here in Asia, China, South Korea, and Japan are 90% of the market. And China is the biggest builder of all. Twenty five years ago China was less than 5% of all the shipbuilding, and now they’re over half. Chinese companies also own 19% of the world’s fleet of commercial ships, and 95% of all the shipping containers in the world. By comparison, the United States ranks 19th, building fewer than five ships a year while China builds over 1700.

The first idea is to charge a $1 million fee when a Chinese-built or Chinese-owned ship enters a US port. That sounds like a lot of money, and the announcement got some people in the shipping industry nervous. But let’s look at these photos again: If one of those ships is hauling 20,000 TEU containers, 1 million divided by 20,000 is $50. $50 per container, then. And that fifty dollars would be spread out among all the buyers of everything in that container. Maybe just a few pennies for each bag or item in the shipping container, in other words. Or if it’s a heavy tractor or something else that takes up the whole container, it’s an extra $50.

It’s nothing, and nobody believes that is going to move the needle at all. It’s a math problem. There’s not enough money there to compel new shipyard construction and the hiring of tens of thousands of people.

There is more to the proposals than just the port entry fees, though. At least 1% of American products exported by sea would need to be on US flagged and operated carriers, climbing to 15% after 7 years, with the eventual requirement that the ships be US built. Now this would be a huge problem, but not for importers. The problem would be for US companies doing export business.

And it’s this part that has shipping experts and supply chain guys perplexed. It would make US exports uncompetitive, starting the first day, because there simply aren’t enough US ships and crews in the whole world to handle American exports. Immediately upon enactment, ship operators would build what are called “parallel fleets”, and set up distribution hubs offshore the US to handle the volume. Unlike imports coming in, all of this would be very expensive on a per-piece basis.

For example, they might have ships that just zip back and forth between Bermuda and the US East Coast for the US-crewed and US-built ships, then offloaded there and sent on their own international charters from Bermuda outbound. Pacific—hard to know how things would go there—use a Mexican port maybe. Ensenada is going to be like Rotterdam. Or Vancouver, Canada, could be. But those shadow fleets and new port facilities in foreign countries would spring up right away, and make the international seaports closest to Long Beach/LA and New York and Savannah suddenly some of the busiest in the world. Obviously the plan would dramatically drive up the cost of US exports, and delivery times.

It's worth a look to see how we got here, and some other facts on the ground. China now builds more commercial shipping than the rest of the world, combined. And American companies aren’t buying ships from China—in the past 8 years China sold only a handful directly to the United States. US companies don’t own and operate fleets of commercial ships—we outsourced that work a long time ago too. And it’s certainly not the United States that builds them.

Here’s an ugly chart, shipbuilding by tonnage. The US barely shows up at all, and Japan and South Korea combined are less than China.

The few American shipyards that we still have are doing contract work for the US Navy. The Pentagon is a money-no-object buyer, and the Defense Department seems to accept cost overruns and production delays as a matter of course, in a way that private buyers of commercial ships would find completely unacceptable. Question I’m asking here is whether American shipyards could be competitive with shipbuilders elsewhere when they’ve grown fat and lazy off defense contracts.

Since 2010, shipbuilding workers in the US has grown by another 25,000 or so, but all of that is due to military shipbuilding and repairs.

Some analysts believe that these proposals are going to really benefit, instead, Japanese and South Korean yards. But we’ve got problems there too. Simply put, there simply aren’t enough people. China has surplus, for now, and that’s why China has been able to grow its capacity to build everything. The United States can’t put another million people to work building ships even if we wanted to, let alone 5 million. And that’s what is needed, to take business away from China.

And the Japanese and Koreans can’t do it either. In the beginning, again, these proposals seem like they would help US shipbuilders—who don’t exist—and then the benefits would accrue to Japanese and Korean shipbuilding companies, because it’s much more sensible to outsource ship construction there. A joint venture between a Korean yard and a US-one could paper over the ownership problem, for example.

But that is already being tried, and the Koreans are already facing big problems, because South Korea doesn’t have enough skilled workers either. Hanwha and Hyundai—Korean companies—have US Navy contracts for repair and maintenance. But they are already facing labor shortages in servicing those contracts. South Korea brings in workers from other countries to do the contract work, and local unions in Korea are objecting to that.

That’s Korea. Here’s Japan’s problem, from the US perspective—Japanese shipbuilders have joint ventures with Chinese shipyards.

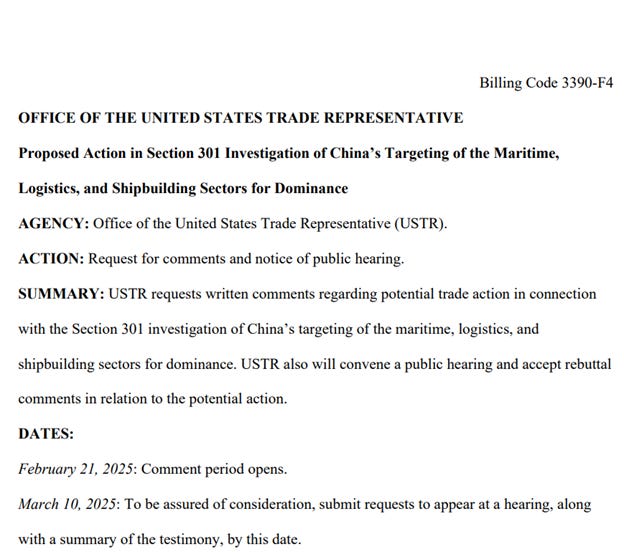

This is the actual proposal from the administration, the US Trade Representative. It begins with China’s dominance in shipbuilding, then the proposal to charge up to a million dollars for any Chinese vessel operator. Or, up to 1,000 per ton of capacity—now that would make it very expensive—suddenly now the entrance fee is $1000 per ton times 280,000 tons is $280 million dollars, which means those ships won’t go to the US at all until the ship operator sets up a shell company outside China, problem solved. It’ll take some time to get the paperwork sorted, but that’s what’s would happen on the import side.

But it’s the rest of the proposal that is going to be such a serious problem, not to China or to US consumers or retailers, but to American exporters. US labor unions and politicians who want their votes are being quoted here, who think it’s great, for them.

But these quotes are from maritime shipping experts. Lars --- If you meet a guy named Lars Jensen, probably should just assume that he knows everything about the ocean, and anything floating on it. Lloyd’s List is one of the oldest newspapers in the world, very deeply respected, and Lloyd’s of London has been in the shipping and cargo insurance business for longer than the United States has been a country. And these are some of the people whose job it will be, on Day 1, to build the shipping and logistics systems to get around these new rules for inbound trade.

But Jensen and Lloyd’s agree, that US exporters likely will not survive the shock of what their new shipping bills are going to be, if their products have to go out on US ships. Because we don’t have any ships.

Resources and links:

Sources new war in shipbuilding, high port fees on non-US ships?

US shot across China’s bow in shipbuilding could backfire as allies fall short

US’ port-fee proposals targeting China make waves in shipping sector

Trump Proposes New Ship Fees to Challenge China’s Maritime Might

Trump Gets New Tool to Fight China With Findings on Shipbuilding

OFFICE OF THE UNITED STATES TRADE REPRESENTATIVE Proposed Action in Section 301 Investigation of China’s Targeting of the Maritime, Logistics, and Shipbuilding Sectors for Dominance

https://ustr.gov/sites/default/files/files/Press/Releases/2025/Ships%20Proposed%20Action%20FRN.pdf

What is TEU in shipping?

https://incodocs.com/blog/teu-twenty-foot-equivalent-unit/

Loss trends - Larger vessels bring bigger losses

Top 20 US container ports

https://cpcs.ca/top-20-us-container-ports/

In Shipbuilding, the U.S. Is Tiny and Rusty

https://www.wsj.com/business/logistics/in-shipbuilding-the-u-s-is-tiny-and-rusty-03fb214e

Photo, COSCO container ship at Port of Long Beach, CA

Bloomberg

Lloyd’s List

https://www.britishnewspaperarchive.co.uk/titles/lloyds-list

There is too much built in expense in the US economy. Government, medical, education at all levels and everything else is over priced in the American economy. No matter how efficient an operation is, that operation is at a disadvantage because of all the built in unseen costs.

The basic problem that America and Europe have is that if you draw a circle on the world map that includes India and China, more than half of the humans in the world live inside that circle. Europe is a peninsula at the very end of humanity’s main landmass. The US isn’t even on humanity’s main landmass, and makes around 4% of the species.

The centre of gravity of the human species is Tibet. Europe and America have currently got the power and money but the centre of gravity is in the east, the only thing that shifted that was the Industrial Revolution, and that head start is pretty much gone now - we frittered it away on tax breaks for billionaires and privatisations.