Trump's tariffs, Wegovy, and why one fat American is worth more than 7 fat Chinese

Summary:

American officials are passing new regulations intended to drive Chinese companies out of our pharmaceutical supply chains. And drug companies seem to concur, as they say publicly that they, too, need to diversify away from China.

The reality is the opposite. US and European drugmakers make giant profits from the drugs that are manufactured in China, then licensed for sale in the American market.

Their motivation is the enormous price difference, between what patients pay in the United States, compared to the rest of the world.

Report:

Wegovy is a diabetes and weight loss drug, and it was recently approved by Chinese regulators for sale here. Torpalimab is a cancer drug, made here in China, and it was recently approved by regulators in the United States.

Here are the links to the announcement for Wegovy, in Western press. What was most newsworthy to these news outlets, was the price. Wegovy that will be sold in China is priced far below what is charged in the United States. Fortune, Bloomberg, Biospace—all of them lead with the fact that the price is so different. Wegovy is marketed by Novo Nordisk, and they will sell the drug in China, after getting approval five months ago. Wegovy in China will be priced at 1400 renminbi, which is about 190 dollars. In the US, the patient price is over $1,300.

This is the announcement for a drug that is going the other way, from China to the United States. Torpalimab was approved by the Food and Drug Administration last year. It’s an immunotherapy drug to treat head and neck cancer, and the drug is made by Shanghai Junshi Biosciences, a Chinese company. We see again, the huge difference in price. In China, Toripalimab costs $280 per dose, and in the United States the wholesale price will be $8,892, more than 30 times as much. To this Shanghai company, an American patient is worth 30 patents, here in China. To Novo Nordisk, the maker of Wegovy, one American patient is worth about 7 Chinese patients. That’s the math.

In the United States our lawmakers are passing laws and regulations that are intended to get China out of our supply chains for pharmaceuticals. These efforts will have zero chance of working. The semiconductor sanctions on Chinese companies have failed. The sanctions on Russian oil companies also failed. And if you consider the enormous costs involved in pumping oil and putting it on a ship and sailing it across oceans—those sanctions failed at profit margins of just a few dollars a barrel. The profit margins on drugs coming from outside the United States to the US market is thousands of dollars, per patient, per year.

China has built out its supply chains of some of the most expensive drugs already.:

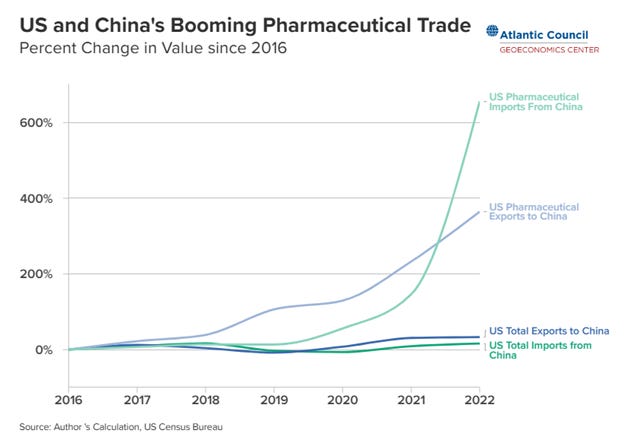

That green line that does from flat to vertical, is US pharmaceutical imports from China. It’s especially notable in the most expensive medicines—Chinese shipments of heart medicine are up 1147 percent since 2017, and for cancer is up over 5 times, 401 percent.

Pharmaceutical executives know where the money is, and they know what to say publicly to make sure they keep getting it. Here’s the Wall Street Journal from two weeks ago: US Drugmakers are breaking up with Chinese companies in their supply chain. Big drug companies like Astra Zeneca, which is a UK company, and smaller ones, are saying it’s time to reduce China risk. That’s what they’re saying.

Here's the reality, though. US and European companies rely on China for lab services, testing, and the most important ingredients, most of the active pharmaceutical ingredients come from China. The cost for top-level work in China is lower than in Western countries, and faster too. 80% of US biotech companies have contracts with at least one Chinese company.

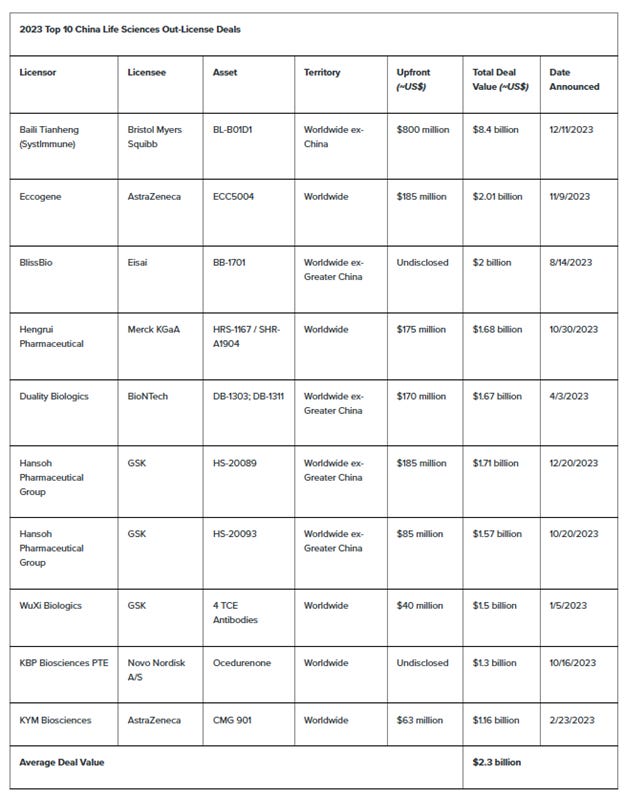

So our lawmakers are saying they want to get Chinese companies out of our supply chains, and our drug companies are telling the Wall Street Journal that they want to get Chinese companies out of our supply chains. But here’s what they’re actually doing. These are the TOP 10 life science out-license deals from China, outbound the rest of the world:

These are Chinese drugs, made here, but they’re just being marketed under a different label. In the territory column, 4th one over, that describes the marketing scope of the licensee, in the second column. “Worldwide ex-China” is the most common for the major drugs, five out of the top seven deals. AstraZeneca may be telling reporters at the Wall Street Journal they want to get Chinese companies out of their supply chains, but in 2023 they signed 2 of the 10 biggest licensing deals here—they paid over 2 billion dollars to Eccogene, and over a billion to KYM Bio. The other companies in the Top 10: Bristol Myers, Merck, GSK, Novo Nordisk. Average deal size is 2.3 billion.

Over a quarter of all the clinical trials take place in China, 50% higher than the recent average. The clinical work is being done here, the labs are here, and the patient populations are here. But the profits are almost all in the United States. Remember that for Wegovy, a fat American pays more than 7 fat Chinese, to Novo Nordisk. Each American taking Torpalimab is worth valuable than 30 Chinese, while the cost to manufacture is the same.

Since the election, we are hearing lots of news about what the new tariffs are going to be. For most products, the tariffs are irrelevant. It’s just a high tax with another name. We can make the tariff 80% and there is still no manufacturer in the US that can beat the price. And for stuff like Torpalimab, or heart medication—where there is literally no other manufacturer anyway, and the price is already 30x the import cost, it’s just another tax that the company is happy to pass along, and the companies will take these giant profits and buy up Chinese companies and licensure rights to make sure they can put their own label on the box.

Be good.

Resources and links:

Novo’s Wegovy Launched in China at a Fraction of US Price https://www.biospace.com/drug-delivery/novos-wegovy-launched-in-china-at-a-fraction-of-us-price

Bloomberg, Novo Nordisk Launches Wegovy in China With Prices Below US https://www.bloomberg.com/news/articles/2024-11-18/novo-nordisk-launches-wegovy-in-china-with-prices-well-below-us

Fortune, Novo Nordisk launches Wegovy in China with prices well below U.S. https://fortune.com/2024/11/18/novo-nordisk-launches-wegovy-china-prices-well-below-us/

China's Rising Role On The Global Stage In The Oncology Market https://www.outsourcedpharma.com/doc/china-s-rising-role-on-the-global-stage-in-the-oncology-market-0001

Toripalimab Becomes First Immunotherapy Drug Approved for Nasopharyngeal Cancer

https://www.cancer.gov/news-events/cancer-currents-blog/2024/fda-toripalimab-nasopharyngeal-cancer

The US is relying more on China for pharmaceuticals — and vice versa https://www.atlanticcouncil.org/blogs/econographics/the-us-is-relying-more-on-china-for-pharmaceuticals-and-vice-versa/

Major Life Sciences Licensing Deal Trends in China in 2023 https://www.goodwinlaw.com/en/insights/publications/2024/03/insights-lifesciences-major-life-sciences-licensing-deal-trends

Wall Street Journal, U.S. Drugmakers Are Breaking Up With Their Chinese Supply-Chain Partners https://www.wsj.com/health/pharma/china-manufacturing-astrazeneca-supply-chain-2ddecb11

Reuters, Merck signs up to $3.3 billion cancer drug deal with China-based LaNova https://www.reuters.com/business/healthcare-pharmaceuticals/merck-signs-33-bln-deal-experimental-cancer-drug-2024-11-14/

Merck licenses Chinese cancer drug, searching for next Keytruda blockbuster https://www.statnews.com/2024/11/14/merck-keytruda-lanova-medicines-pd1-vegf/

PBS, How Russian oil is reaching the U.S. market through a loophole in the embargo https://www.pbs.org/newshour/show/how-russian-oil-is-reaching-the-u-s-market-through-a-loophole-in-the-embargo

CBS News/60 Minutes, Russia works around international sanctions designed to cripple the economy amid war with Ukraine https://www.cbsnews.com/news/russia-works-around-international-sanctions-amid-war-with-ukraine-60-minutes-transcript/

Politico, Grappling with supply chain crunch https://www.politico.com/newsletters/politico-pulse/2024/10/31/grappling-with-supply-chain-crunch-00186356

A Bilateral Approach to Address Vulnerability in the Pharmaceutical Supply Chain https://www.csis.org/analysis/bilateral-approach-address-vulnerability-pharmaceutical-supply-chain