USDt / Tether is a pillar of the new BRICS financial system Banning it only makes it stronger

Bullets:

Across the new BRICS economic bloc, the Tether stablecoin is a highly preferred medium of conducting trade.

Nearly $200 billion in trade settlements are conducted via Tether daily, making it the most actively used cryptocurrency in the world.

Tether is a digital US dollar, but is completely unregulated and out of reach of banking officials in the United States and the European Union.

Efforts are underway to strictly regulate Tether, by requiring them to deposit their vast Treasury bill portfolio with the US Federal Reserve, and to comply with onerous reporting requirements on user activity.

The European Union has effectively banned Tether from its banking systems, pending Tether's compliance with those deposit and reporting restrictions.

But by simply refusing to do so, Tether positions itself even more firmly across giant markets in Asia, Africa, South America, and the Middle East.

Report:

Good morning. The BRICS countries are building a new global financial system, and they’re using US dollars as the primary currency. They’re using dollars, but they’re using their own banks and doing trade directly, between themselves. US dollars, our debt instruments, are being used, but all the economic activity and growth accrue to their banks, and to their companies.

Tether is a primary channel for all this trade. Tether is a cryptocurrency. But unlike Bitcoin or other cryptocurrencies, Tether is a digital US dollar. One tether is one US dollar, so it’s called a stablecoin. Its price is stable, reflecting the US dollar value. That’s one thing that makes Tether attractive to users. The second attractive feature is that Tether is unregulated. It’s offshore the United States, and its activities are hidden from governments and regulators.

This article is not that old, from just last year. Tether was then almost as big as the Visa network, and was making more money than Blackrock with just a handful of people. Tether was moving $190 billion a day in transactions, on $120 billion in assets. So Tether was turning over its assets every 16 hours, or so. Compare that to a traditional bank, which lends for 5 years on a car, or for a new house over 30 years. Tether is lending out and getting back faster than every day.

And Tether undermines the powers of governments to deploy sanctions to cut off access to the US dollar. Dollar transactions involving US-regulated banks need to comply with the whims our policymakers and banking officials, but Tether is different.

Naturally Washington hopes to crack down on it. Tether and USDt are synonymous—they’re the same thing. Tether is the third-biggest cryptocurrency by value, but it’s the most actively traded. Federal prosecutors in New York are trying to find out if it’s used in the drug trade, terrorism, or money laundering. But their real objective is to stop sanctions evasion.

We’ll link today to good analysis about how the system works and you can read through them yourselves. But their conclusions are off, because they misunderstand that what makes USDt so attractive to so many users is that our own governments can’t do anything about it. Here they quote, “If Treasury adds Tether to the Blocked Persons list, it would be devastating.” No, it’s the opposite. The fact that the American officials and banking regulators don’t trust Tether, and want to sanction it, that only makes Tether stronger in the new trading bloc.

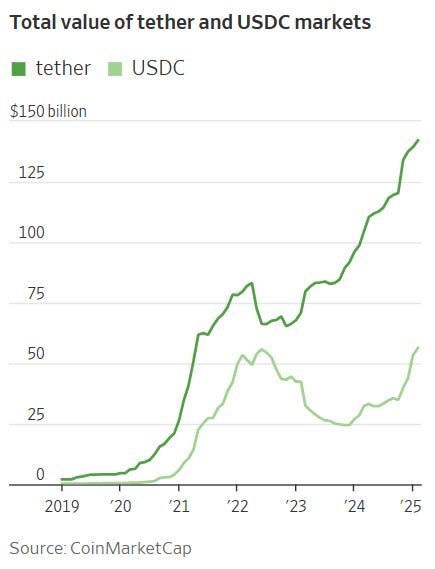

This is a summary from the Covey Network, who compares the two leading US dollar stablecoins, Tether—USDT, and Circle—USDC. Circle and Tether are competing for global dominance, and Tether has a big lead, with almost 70% of stablecoins in circulation. Tether has over 42 million users, almost 3 times as many as Circle. This part is right: “Tether vs Circle is a case study in market positioning, partnerships, trust.” Branding, you could say.

Tether is decentralized. Circle is playing by the US rules, and is growing within the mainstream financial system. Tether is not playing by those rules. These proposed laws are to regulate stablecoins, and impose new reserve and reporting requirements. They will help Circle in mainstream markets. But they will also help Tether in emerging markets, if Tether simply refuses to comply.

The Wall Street Journal analysis here is more current, and since last year Tether has only grown in popularity in emerging markets, outside US jurisdiction. In 2023, remember, Tether was used in 69% of transactions. Now it’s 80%. Its profits are now $13 billion, more than 2 times the $6.2 billion they earned in 2023.

This chart shows the growth of Tether versus Circle: both are growing fast, but Tether is ripping higher much faster than Circle, which has just recently passed where it was back in 2022.

One of those drivers was the change in Federal Reserve policy. When the Fed began raising interest rates, the earnings on Tether’s Treasury bills went up 40 times, to hundreds of millions a quarter.

But here the Wall Street Journal swings and misses the same way Bloomberg did: “Treasury is concerned about the boom in Tether, and could lock Tether out of the US banking system.” That’s easier said than done, actually. Anyone anywhere can buy US treasury debt, and if they want to hold it offshore, they can. It’s a messy problem for Treasury officials, in that the only way to really lock Tether out of the US financial system is to suspend interest and principal payments on Tether Treasury holdings, but that would call into question all the dollar-denominated debt held offshore by everyone, everywhere. Everyone would sell, and Treasury knows it.

These efforts here, then, are ways to go right up to that line, without crossing it. And they will all help Circle, probably. Allaire is the head of Circle, and he is petitioning Congress to overhaul stablecoin regulations by requiring issuers to hold their deposits at the Federal Reserve, and ban digital dollars issued offshore.

Circle is trying to do the same around the world—USDC are pushing Japan, Singapore, Europe, Brazil, and trying to get those governments to impose the same stablecoin laws he wants in the US. The European Union did go along.

But we see here the same problem, because Tether does not hold reserves in US banks, and they are issuing stablecoins offshore. So they’re already on the wrong side of the rules that the European Union just passed. What happens if Tether also ignores what Circle wants US regulators to do in the United States, and just keeps doing what they’re doing now?

Here is a report from three days ago, where Russia is using crypto to get around Western sanctions in its oil trade with China, and India. Russian companies are using Bitcoin, ether, and Tether to convert Chinese renminbi and Indian rupees to Russian rubles. This news follows other reports that Venezuela, Iran are also using crypto and stablecoins to avoid using US dollars directly. All these countries love dealing with dollars, but they need a way to use US dollars without using US banks. Crypto is how, it's convenient and helps run everything much faster.

This is the procedure: a Chinese buyer of Russian energy pays a middleman in yuan, the agent converts that into crypto, transfers to another account, then to a third which converts to rubles. Just for one Russian trader dealing with China, it’s tens of millions of dollars a month.

There are lots of people in lots of places who are strongly motivated to use our dollars, but not our banks. And global central banks know that they need to choose, whether they want the business that this can bring in to their country. Thailand is saying yes to both—Tether and Circle are acceptable.

Hong Kong concludes the same thing. The Hong Kong dollar already has a US dollar peg, which makes it similar to these stablecoins. Hong Kong is also where China has its giant offshore trading hub, with billions of dollars flowing that way from Mainland China to capitalize the new BRICS financial system. And these Hong Kong bankers are looking at Tether in the same way that Mainland Chinese factories are—Tether stablecoins are a way to do US dollar business with the world, but without going through US banks.

“The reality is that everybody, everywhere—including China, loves dollars.” That’s why this huge market cap for Tether exists. It is proven to be highly attractive in emerging markets, where lots of people don’t use banks at all, and “especially appealing in Asia and Africa.”

Stablecoins achieve operational efficiencies over traditional banks as well—reducing friction and costs and time, so they will increasingly be used to settle international payments in real time.

Traditional banking systems, like SWIFT, do overnight settlements, sometimes longer. That drives the costs up, and gives regulators in Western systems time to block a transaction. Again, that is a feature of regulated systems, and by saying no to those restrictions, Tether will take all the business for stablecoins for any party, who does not want their transactions to face the same risks of freezing or seizure that makes him not want to use our banks in the first place.

Resources and links:

Crypto’s ‘too big to fail’ token Tether faces new threat from US

Bloomberg, Crypto’s ‘Too Big to Fail’ Token Tether Faces New Threat From US

https://www.bloomberg.com/news/articles/2024-10-25/crypto-s-too-big-to-fail-token-tether-faces-potential-new-threat-from-us-usdt

Wall Street Journal, The Titans Battling for Control of the Crypto Future

X, Stablecoin Wars: Tether vs. Circle – Who Will Dominate?

https://x.com/CoveyNetwork/status/1867837026453586073

Tether vs Circle: The Battle for Stablecoin Dominance

https://www.tokenpost.com/news/regulation/14294

Wall Street Journal, Cryptocurrency Tether enables a parallel economy that operates beyond the reach of U.S. law enforcement

https://www.wsj.com/finance/currencies/tether-crypto-us-dollar-sanctions-52f85459

Zerohedge, Russia Using Bitcoin, USDT For Oil Trades With China & India; Report

https://www.zerohedge.com/crypto/russia-using-bitcoin-usdt-oil-trades-china-india-report

Reuters, Russia leans on cryptocurrencies for oil trade, sources say

Thailand’s SEC gives Tether and USDC the green light for digital trades

https://cryptoslate.com/thailands-sec-gives-tether-and-usdc-the-green-light-for-digital-trades/

SCMP, As stablecoins grow, Hong Kong’s US dollar peg seen as advantage despite Web3 challenges

https://www.scmp.com/tech/blockchain/article/3301577/stablecoins-grow-hong-kongs-us-dollar-peg-seen-advantage-despite-web3-challenges

Tether does have the ability to freeze any holder of USDT and does work with law enforcement across the world to freeze accounts involved in illegal scams, amounting to 100s of million of dollars of frozen tether a year.

So when using them there is a fine but undefined line that you need to walk when doing questionable transactions. OTOH, Tether gets to decide what is frozen and what is let through, not any government (at least not directly).

Wildcat banking is great until something goes wrong, like maybe those tether coins are NOT backed 100% by US Treasury holdings. Ooops.

SWIFT is slow because it's junk technology. Banks have been capable of instantaneous and near zero overhead transactions since the 1970's, without crypto. SWIFT reminds me of those old dial up 2400bps modems. Fix SWIFT and get rid of US government hegemony obsession and the rationale for tether disappears, especially because real banks are regulated and so can't just issue unlimited coins not provably backed by US treasury assets.

Don't be another technology/finance idiot bamboozled by complicated crypto jargon. Wildcat banking has always existed, and it always ends in tears.