Why China is winning the chips race: materials, markets, money, and Moore's Law

New advances in semiconductors take much longer, and cost much more

Bullets:

Huawei and SMIC are quickly catching up to global rivals in advanced semiconductor manufacturing, which is surprising to many industry analysts.

Chinese tech firms enjoy access to China's enormous supply chain advantages, such as in refined silicon, and in wafer manufacturing.

Chinese companies are also the biggest buyers of semiconductor chips. China is simply too big a market for Western companies to lose, and so they are strongly motivated to go around the export bans, or even set up manufacturing and distribution plants in-country and be outside of US and European oversight.

The Chinese central government, a host of local governments, and Chinese companies themselves have invested far over $100 billion in their semiconductor industry in recent years, which is much more than investments made by other countries.

But another feature of today's chip industry is that Moore's Law is reaching the limits of what semiconductor companies can do. Massive investments in capital and time are required to build the next generation of ever-smaller chips.

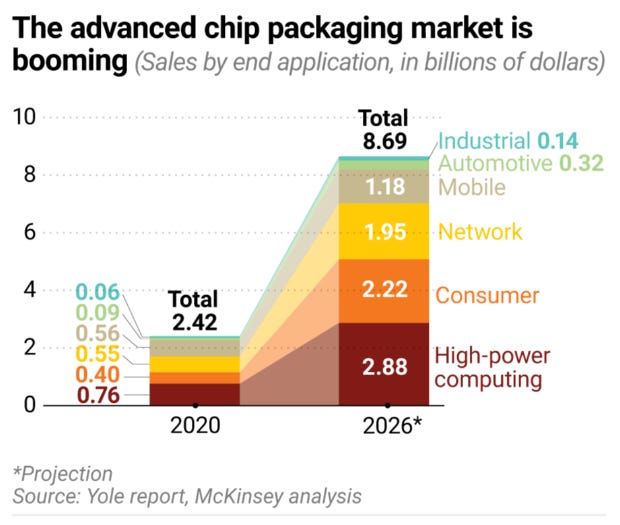

So companies have turned to "chip packaging" to achieve high productivity gains, using existing chips. Chip Packaging is an area where Chinese companies are already strong, and allows them to employ economies of scale. This plays directly into their industrial strengths.

The timing of the semiconductor chips war, therefore, has been beneficial to China. It has allowed Chinese firms to catch up, and fast.

Report:

Good morning.

The semiconductor sanctions and export bans that were intended to prevent China’s development of their own advanced semiconductors have mostly failed. China’s chip industry is stronger than ever, and its leading tech companies are thriving not only despite being on blacklists, but probably because of it. The chip bans compelled Chinese industry to figure it out on their own, and our own experts are constantly being surprised at the progress Chinese semiconductor companies are making, and at how quickly they’re catching up to our own top companies.

Huawei and SMIC are the most famous and talked-about companies, here and in our own media, who have thousands of top engineers who are keeping their companies competitive. There are two, perhaps three dozen others, companies that are also making big advances in other industries that support semiconductor manufacturing. And in a lot of ways their success in semiconductors is similar to how China has succeeded in practically all the other ones.

China has monopolies on the key raw materials for semiconductor chip manufacturing. In silicon, Chinese companies have monopolistic positions, and set supply volumes and pricing for electronics. “No other country comes close to China’s scale” in silicon.

In 2019, China’s global share of electronics-grade polysilicon was 67%, and there are individual companies in China, such as Tongwei and GCL Poly, who refine more silicon than entire countries.

China also dominates in the manufacturing of silicon wafers, with over 50% of the global market, and the world’s top 5 wafering firms are Chinese companies.

So China has the supply chains for the raw materials and for the refined products that go into making semiconductors.

And China is also the biggest end user of semiconductors. China and Hong Kong combined is more than 4 times bigger than the US market. Greater China is six times Germany. China is where semiconductors are built, and China is where semiconductors are sold. And that’s another important reason the Chip War is lost—for our own companies, the rest of the world isn’t big enough to replace China, either as a supplier or a customer. Chinese companies are going around our export bans, because our own companies are going around them. China’s just too important a market.

But there is another aspect to the chip wars story, which has also been a boon to Chinese efforts to stay competitive. We are at the stage of semiconductor manufacturing where each new advance is much more difficult, takes much more time, and is much more expensive than the last. Some of the information here is dated, it’s a year old, but it’s a strong argument that the chip wars are taking place at a time that is strongly advantageous to China. Many of the gains that come in semiconductors come not from building smaller and faster chips, but by packaging the chips differently. And new breakthroughs in semiconductor performance, from building smaller chips, can only be achieved by huge investments—and China is making those investments, putting in hundreds of billions of dollars.

In 2009, one of the top guys at TSMC was wrestling with a problem that the industry had been putting off. Chip companies make semiconductors more powerful by putting more transistors onto chips. Transistors control the flow of electricity through the chip. TSMC’s idea was to focus more on the chip packaging, and at that time it was a new direction for the company, and for the industry.

Moore’s Law in semiconductors says that the number of transistors on a chip will double every year, and that makes chips and processors much more powerful every year. By 1975, Moore’s Law was already slowing down, and the number of transistors on a chip doubled every two years, instead of every year.

It’s almost unimaginable how small today’s transistors are. In the early days the transistors were a centimeter in length, and today they’re measured in nanometers. A nanometer is a billionth of a meter. A drop of rain is 2.5 million nanometers. A bacteria is 2,500 nanometers long. Today’s semiconductor chips contain billions of transistors, of only a few nanometers in length.

Small improvements in efficiency—multiplied by the billions of transistors on a chip, multiplied again by how many chips, and how well those chips work together, those result in massive increases in computer power. And the most advanced tasks require the greatest concentration of computing power possible, which means very tiny transistors. For generative AI, experts think that the chips need to be 4 nanometers or smaller.

It costs a lot of money to do all that, many billions of dollars, and the top companies were far ahead of Chinese companies, who have struggled to keep up. But if Moore’s Law is slowing down, it changes everything. The fear is that computer chips will become just like any other commoditized industry. And in commoditized industries, it’s economies of scale that matter the most, and China is very good at economies of scale.

And there is lots of evidence that it is slowing, and this is allowing China to catch up, fast. The gap between Intel and SMIC is narrower than ever before. Intel previously was at least four to five years ahead, which in the chip industry is two generations—Moore’s Law, remember, doubling every two years. But now the lead is much smaller, at 3 years. And this article is a year old, and the gains in 2024 have been surprising too.

The gains are much harder to come by, they are taking longer, and they’re much more expensive. TSMC, Intel and Samsung spent nearly 100 billion dollars in R&D in 2022—a single year, and that is more than two times as much as the entire EU will spend in the next 10 years to build out their industry. This soaring cost is itself a reason why the industry is slowing down. And that is helping China.

Nobody can agree on how fast Moore’s Law is slowing, but it’s clear how expensive each new gain is. Going to 2 nanometer chips will cost $30 billion dollars, just for the initial investment, for a single plant. That’s 10 times more than a chip plant for consumer electronics, and even those are pushing the limits of what the market can bear. The processors for iPhones cost ten times as much today than a decade ago, so the question becomes, how much is the customer willing to pay for the newest and fastest tech? These are industry insiders here, who are asking, what is the purpose of doing it? We need to think about what justifies all these investments. The performance of the processors is improving, but it may be the law of diminishing returns, now, given how much it costs to get them.

Going back to TSMC, who looked at ways forward that did not involve making things ever-smaller. Chip packaging is just how you put chips together with others and get them to work together. It’s less demanding and less expensive, because the researchers are working with existing chips and technologies instead of inventing new ones. In the beginning, nobody took it seriously. Now, everyone is, and chip packaging is one of the most important fields. For advanced chip packaging, industry sales will almost quadruple in six years. Advanced chip packaging is taking chips and stacking them on wafers.

The chip packaging segment of the industry was 43 billion dollars last year, and will be 74 billion in 2028. And let’s remember, that China owns over half of the world’s wafer production.

So, here again, these industry trends play into China’s hands. They have access to all but the very latest generations of chips, and are doing a good job of making many of those themselves, but chip packaging just means China can get people busy playing with different combinations of memory and processors. The barriers to entry are much lower in chip packaging, compared to fabrication. Advanced packaging can get China to 3 nanometer performance, even using chips that are less advanced than 3. The “slowdown of Moore’s law is good timing for Chinese chipmakers”. They quickly narrowed the gap with the industry leaders. And if advanced packaging becomes a primary driver, that’s another shortcut that China could take.

SMIC is a Chinese company, one of Huawei’s most important suppliers. SMIC is also investing billions of dollars to keep pace, $24 billion over four years. And this is a point we’ve made many times, that CAPEX in China should be measured differently, because everything just costs less here. SMIC is at $24 billion, and Huawei’s R&D spending is 81 billion dollars from 2019 through 2022. That’s over a hundred billion dollars, total, just those two companies. And there’s reason to believe they’re going to succeed in their goal to catch up with 3-nanometer chip fabrication. Huawei is already an advanced chip designer, as good as those used by Apple and Nvidia.

The chip packaging industry in China has a lot of government help, as well. Beginning in 2016, the government put heavy emphasis on China’s integrated circuit packaging.

China is very aggressive in packaging. This is an area with no restrictions. So on the packaging side, Chinese firms have invested a lot of capital and time in getting existing chips to run faster and more efficiently.

On the capital investment side, China’s government is able to make large investments, which at least match what our top companies do. Earlier this year their national semiconductor fund put together $47.5 billion dollars to put into research and development, and this was the third phase of what China calls the Big Fund. Compare that 47.5 billion to what the Biden Administration promised with the CHIPS Act, which is 39 billion, plus another 75 billion in loans and guarantees, and for companies to get that money they need to hit certain performance and production benchmarks. And Huawei is the center of the circle, so to speak.

Local governments are setting up their own funds. Beijing set up a $1.2 billion dollar investment pool to support tech companies in Beijing. And the Shanghai Semiconductor Investment Fund put together 2 billion—on top of the 1 billion they invested in Shanghai companies previously. The local government funds are not part of the BIG FUND money, so there’s no double-counting involved in that funding.

So in total, China’s central government invested this year’s $47.5 billion. In 2014, the initial phase, was 139 billion yuan, or about $22 billion at the time. Then a second phase in 2019, which was another 31 billion or so. All together, over a hundred billion dollars, plus smaller investments that provincial and local governments are making into their tech companies. That’s the government side, plus SMIC at $24 billion, and Huawei at 81 billion, and that adds up to a capital pool that dwarfs anything our governments and companies are doing.

And it all makes sense when we consider why companies do R&D in the first place. It’s obviously, they believe they have a market for the products they are developing. They need to get their investments back, later, after the chips are designed and built. The chips need to be sold, to consumers who demand the highest-performing chips. But China is the biggest buyer of chips. When the chip export bans were put on Western companies, shutting off the Chinese market for their most advanced chips, huge profit drivers were taken away. For many of our own companies, China is more than half of their gross sales.

So that begs the question, what is the incentive for US and European and Japanese chip companies to invest in the newest and fastest chips, if they cannot sell them to China? It’s clear who Chinese chip companies hope to sell to—they can sell to other Chinese companies. And for the legacy chips that Chinese firms are making faster and better with new packaging technology—they have China’s domestic market, plus export markets. But for American or European or Japanese investors who are asked to invest $30 billion in a new plant that will make the smallest chips—who are the customers? How will they get their money back, if they’re not allowed to sell to China? Or shouldn’t they do what Intel, and Samsung, and TSMC and Nvidia are already doing—which is just to open that plant in China? They’re all doing that. They need China’s supply chains to make the chips, and they need China’s market to sell the chips. As Moore’s Law slows down and the costs shoot up, the only companies that will survive are the ones who are here.

Be good.

Resources and links:

The great nanometer chip race

https://asia.nikkei.com/Spotlight/The-Big-Story/The-great-nanometer-chip-race

Exclusive: Inside Huawei's mission to boost China's tech prowess

Bloomberg, China Creates $47.5 Billion Chip Fund to Back Nation’s Firms

South China Morning Post, Tech war: Beijing sets up US$1.2 billion semiconductor fund as China splurges on chips

https://www.scmp.com/tech/tech-war/article/3276614/tech-war-beijing-sets-us12-billion-semiconductor-fund-china-splurges-chips

SCMP, Tech war: Shanghai injects US$1 billion into chip fund as China strives for self-reliance

The Diplomat, China’s Big Fund 3.0: Xi’s Boldest Gamble Yet for Chip Supremacy

https://thediplomat.com/2024/06/chinas-big-fund-3-0-xis-boldest-gamble-yet-for-chip-supremacy/

Substack, The Semiconductor Trade War

China remains crucial for U.S. chipmakers amid rising tensions between the world’s top two economies

Semiconductor supply chain: Political and physical challenges in 2024 and beyond

US Asks South Korea to Toughen Export Curbs on China Chips

China’s Dominance in the Global Silicon Supply

https://waferpro.com/chinas-dominance-in-the-global-silicon-supply/

Chinese companies are going around US semiconductor export bans. So are American companies.

Appreciated & Shared!

This text is very good, explain everything about the chip's war between China and EUA.