Why isn't China exporting robots?

China's robots aren't intended to replace their workers. They will replace ours.

Bullets:

China's robotics industry is the fastest-growing in the world, closing the gap fast with Germany and Japan, the global leaders.

China already enjoys dominant supply chain advantages in the hardware supply chain, and are catching up quickly in software.

Robotics companies in China offer robots at far lower prices than rivals in Europe or Japan. Chinese models typically cost less than a fourth of what comparable units do.

Yet far fewer than 5% of Chinese robots are exported. China's world-leading adoption rates for robot installations, along with massive official support to the industry, point to the reason: China's strategy is to lead the world in robotics manufacturing and deployment to improve efficiency and productivity exclusively in China's factories.

Report:

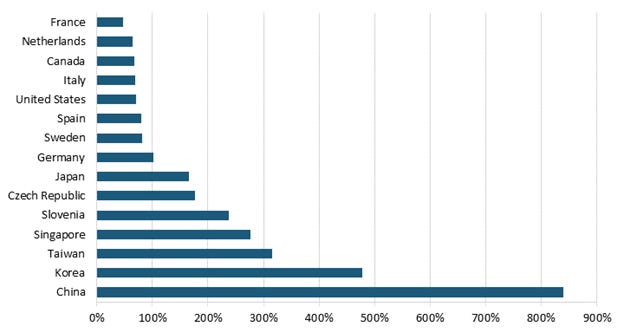

China is aggressively building its robotics and automation industries, while in North America and Europe, orders for automated manufacturing and robotics are falling. This is counterintuitive on its face. The United States and Europe have the highest manufacturing costs in the world, particularly for factory labor. China has far lower labor costs. But our factories have hit a pause on automation and adding robots, while China is going the other way. When we account for wages and production costs, Europe and the United States are installing far fewer robots than expected—that what a number under 100% means in this graph. But China is installing over 12 times more robots than you would expect, given China’s manufacturing and labor costs:

The Wall Street Journal shows us why. Business is slowing down, so factory managers are buying fewer robots. Orders for robots dropped a third in 2023, and in the first half of 2024 they continue to fall. Industrial production isn’t growing—it’s flat—and in appliances and in the heavy duty segments factory activity is falling. The Journal profiled a few companies; Athena Manufacturing added 7 robots a few years ago, but then their order book fell and they’ve only added one since. A Cleveland manufacturing company saw a 75% drop in sales, and so they don’t see a point in investing in robots.

In China it’s a different story though. China is the factory of the world, and it’s understood that robotics and automation is a significant threat to that going forward. If robots are affordable and pervasive internationally, managers would prefer to manufacture in local economies instead of ordering from China. So it’s an urgent imperative for China to develop robotics themselves, and thereby learn how to build them, how to maintain them, and to capture the supply chains for the raw materials, components, and technologies to build them. In other words, China’s plans for their robotics industry aren’t designed to replace Chinese workers now, but rather to replace our workers in the future. And by doing the same in the supply chains for robotics that they’ve done for everything else, it will be impossible for anyone else to catch up.

Germany and Japan thus far lead the market, but China is catching up fast. China is the world’s largest buyer of robots, with more than half of all the robots in the world working here. Recently China became the global leader in new patents for robots, but China is for now still dependent on foreign firms, especially in software. And because this is the biggest market for robots—the rest of the world combined adds up to less than China, most of the Western companies do business here. This is another industry paper, IOT is the internet of things, and they report that 70% of robot installations in Asia, China’s 51%, and China has the largest robot stock in the world. Double digit industry growth is expected for next several years as well.

The central government issued specific guidance and goals for the Chinese robotics industry, and provided tax incentives and financing to make it go. It’s called the “Robotics+ Action Plan”, and will accelerate application of these technologies across industries.

This is a Supply Chain story again—Chinese planners want to control the global supply of components by next year, and have global dominance of humanoid robots by 2027.

The advantage to Chinese systems for now is on cost. We might call this “don’t let the perfect be the enemy of the good”, and this drives the price down for factory managers, and it also allows for robots to be developed across wider ranges of applications.

This Canadian industry paper is wondering how the US and Canada can survive in the space. The US still leads in software design, but 73% of the robots are in operation right here. It’s in Asia where the robots are actually used, and where software engineers can see in real time what improvements are necessary and make them. Chinese innovation moves faster because of how their industrial policies work, co-locating research and industry, and deploying capital accordingly.

The Diplomat looked into the supply chain issues for robotics, and found that the chains for intelligent electric vehicles are very similar to those in robotics. Many of the components and technologies are the same: artificial intelligence software, high-quality and long-lasting batteries, sensors—think here of the LIDAR systems in a car, but applied instead in robotics to make the machines aware of things around them, then computer chips, and finally the different motors throughout the system.

The Diplomat report is from two years ago, 2022 December, and it’s a clever formulation that explains how China’s supply chain dominance in electric vehicle production translates right away into similar advantages in robotics. Blue bars are China, gold is US. China has huge advantages in batteries, sensors, and servo motors. That’s the hardware, then. The nuts and bolts of what we need to build a robot. AI and computer chips are where China needs to make up some ground, but the point here is to show that China is almost there if they want to dominate the manufacturing chain for robots. The good-enough strategy on the features ensures low pricing and high sales, which means that Chinese companies will be profitable at lower price points than industry competitors from Europe or Japan. China’s heavy investment in electric has generated competition in all these technical areas.

When this report was written this was a prediction, and today a reality: China now has lots of production capacity for electric cars, and the rapid declines in pricing is what we’re seeing now for EV’s. And this is likely what’s coming for robots, too, but with one critical difference: the robots China builds are not going to be exported. Chinese robots cost just 20%, compared to robots build by European or Japanese brands, and that’s right now.

They already have those cost advantages, but China’s not exporting them. Xiaogang Song is head of the China Robot Industry Alliance, Chinese robot exports are very limited. Fewer than 5% of China’s robots are exported:

That is a strong indication about what China’s policymakers want for their robotics industry. Think again about those factory managers in the US who say that robots aren’t a good investment now that their orders are down. What if they could buy robots at just a fourth the cost though? That math would be very different, if they could buy 3 or 4 robots from China for the price of one from Japan or Germany. Chinese robots would be a great investment then, and Chinese robots in US factories would dramatically improve US factory efficiency.

Chinese robot manufacturers know that too. So there is another objective here. Chinese policymakers and industry leaders want Chinese robots at work in Chinese factories, instead of in ours.

Resources and links:

Global robot population grows by 10% to exceed 4 million https://drivesncontrols.com/global-robot-population-grows-by-10-to-exceed-4-million/

China bets on robots for rapid growth, says IFR https://www.therobotreport.com/china-bets-on-robots-for-rapid-growth-says-ifr/

Wall Street Journal, In America’s Factories, Even the Robots Are Getting Less Work https://www.wsj.com/business/manufacturers-automation-equipment-robot-slow-down-2b850741

China’s Robots Are Coming of Age https://www.cigionline.org/articles/chinas-robots-are-coming-of-age/

The Diplomat, China’s Trickle-Down Supply Chain: From Intelligent Electric Vehicles to Robots

https://thediplomat.com/2022/12/chinas-trickle-down-supply-chain-from-intelligent-electric-vehicles-to-robots/

Chinese Manufacturers Use 12 Times More Robots Than U.S. Manufacturers When Controlling for Wages

https://itif.org/publications/2023/09/05/chinese-manufacturers-use-12-times-more-robots-than-us-manufacturers-when-controlling-for-wages/

IOT, Robot Installations Top 500,000 a Year; China Dominates https://www.iotworldtoday.com/robotics/robot-installations-top-500-000-a-year-china-dominates

Robots as a new engine for growth

https://ifr.org/news/chinas-new-growth-strategy-backed-by-robots

Great article. “don’t let the perfect be the enemy of the good” 6 years ago a Chinese robot supplier stated, 'if you want fast then buy a European robot. However, we will give you a (much) lower entry cost for automation'.

Now the performance gap is much smaller. Biggest barrier is the difficulty in programming in English. Clearly not a focus for China.