Why Nvidia is desperate to get back to China

This is a transcript, for the video found here:

Bullets:

The Artificial Intelligence industry in the United States faces a perfect storm of bad news.

Companies that have deployed AI in their operations report seeing no return on their investment, and deep resistance from employees and customers.

Nearly half of business users are abandoning their AI projects.

Cash flow at hyperscalers like Facebook and Amazon has turned negative, and most AI users don't pay for using it.

Households are seeing double-digit cost increases in electricity bills to power the AI data centers.

Nvidia has benefited more than any other company, in building the GPU's that power AI.

But while the industry in the US is hitting strong resistance to further growth, it is the opposite story in China.

Application of AI is booming across all industry and service sectors, and the government is urging adoption in all segments of its economy. Low-cost electricity, the world's largest pools of user data, and half the world's top AI scientists and patents are driving the industry forward at over 50% per year.

Report:

Good morning.

Nvidia makes some of the world’s most advanced semiconductor chips, which are used in Artificial Intelligence. Nvidia’s exports of those chips to China were restricted by the Trump Administration, and by the Biden Administration before that.

But Nvidia is desperate to keep their access to the Chinese market, because their survival as a company is now dependent on it. Developments in the AI industry in the United States are all moving the wrong way. It has hit a wall, and so will Nvidia if they’re only allowed to sell its chips in the US market.

So Nvidia needs to get back to China, and that’s a big problem from two directions—American regulators don’t want Nvidia chips sold in China, and the Chinese government itself is pushing suppliers not to use Nvidia chips anyway. But Nvidia’s second problem is moot if they can’t get Trump to give them an export license.

A month ago the Trump Administration said it would allow Nvidia to sell one of their AI chips models, the H20, in China, but didn’t follow through and issue the license. Jensen Huang flew to Washington to meet with President Trump personally, then agreed to give the federal government 15% of Nvidia’s revenues in China. That “essentially made the federal government of the United States a partner in Nvidia’s business in China”—that’s the quote here, and in doing so probably just made the Nvidia’s problem a lot worse with the Chinese government. But two days later the Commerce Department issued the licenses.

Advanced Micro Devices is another company that will probably get the same deal, to sell their chips in China. If Nvidia sells $15 billion of chips here, that would be over $2 billion heading Washington’s way.

This whole arrangement is certainly unconstitutional, and a violation of Article 1, Section 9. It is a tax on exports, which is unconstitutional, and a literal act of Congress is required to raise taxes of any kind. But legal analysts point out that it in order to have it heard in court, it needs to be either Nvidia or AMD to bring a suit to have it overturned, and they’re not going to. In fact, it may have even been Nvidia’s idea, an offer to pay the money in exchange for getting the export license. It “sets a dangerous precedent”, and the imagination runs wild how this can be abused, by governments and by corporations.

But Nvidia is happy at least for now, and has approval by American regulators to sell their chips to China. The Artificial Intelligence industry in the US has big problems. American companies are spending a lot of money on AI, but not getting anything back. A McKinsey report showed that 80% of companies surveyed were implementing generative AI, but it’s not paying for itself.

The expectation was, by now, that AI would have already revolutionized American business. But except for a handful of tech companies that build AI systems and sell them, the payoff isn’t there. Companies have budgeted to almost double spending on AI this year, $62 billion, but it will be years before there is any return on that investment.

Corporate managements generally don’t wait years, so companies are giving up. S&P Global talked to over a thousand managers last year, and 17% of their companies abandoned their AI projects last year. This year, it’s 42%. These executives reported high levels of employee and customer resistance. Managers were hoping to use AI to reduce headcount, and lay off employees. The CEO of Ford Motor said that AI will replace half of all white-collar workers in the United States. That right there explain the “employee resistance” the companies are reporting.

Here is the report from McKinsey with the lede is at the top—80% of companies have deployed AI and 80% of companies say they’re not making money.

Corporations are the only ones paying for AI. The data centers running thousands of Nvidia processors gobble up a lot of electricity, and households are paying for that. In New Jersey, electric bills are going up 20%. Power bills up big also in Ohio, Maine, and Connecticut.

Building AI training centers is like building five nuclear power plants per year, just for AI. We’re not building any nuclear power plants, so electric bills can only go one way, and will more than double the next few years. And this is on top of high inflation in electric bills since 2020—up more than 30% since then.

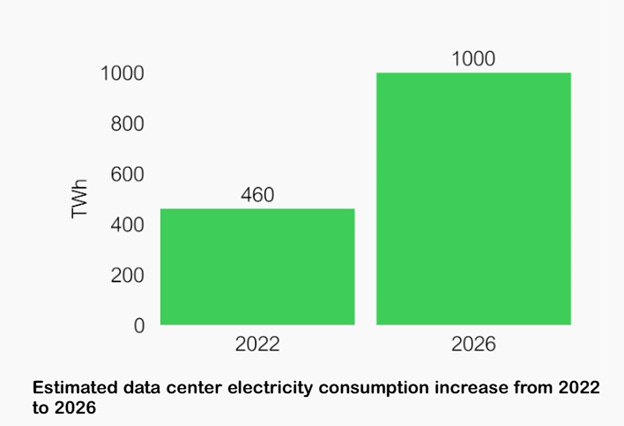

There is a direct correlation between these two charts—retail energy prices and the electricity demand from data centers:

Besides sucking up lots of power, data centers also need lots of water, and the newer ones powered by Nvidia’s newest generation Blackwell chips need more electricity and more water than the previous models, which were already causing lots of problems. And those problems are more acute in the West, especially in the desert Southwest, where there isn’t enough water already.

Finally there’s this, that in business and industry, companies that do pay for AI say they aren’t getting anything for it. But very few people are paying for it anyway. The biggest companies are going to spend almost $400 billion this year on capex for AI, but already they’re hitting a wall because their customers willing to pay to use it. Free cash flow is the life blood of a company, and it’s in decline for these companies, except for Microsoft, who has a rich licensing deal with ChatGPT which might carry them a few more quarters until OpenAI runs out of cash.

Nvidia has been making lots of money, despite all these concerns, because they build the GPU’s that the hyperscalers are investing in. At some point though, cash flow will decide how many Nvidia chips get sold in the US. And there is no cash flow, there won’t be any cash flow for a long time, and American politicians from all 50 states have voters screaming at them about high electricity bills.

The problem for Nvidia is that all these problems are hitting at once, in the US domestic market. But in China, none of this is a thing. Electricity prices are falling for everybody. And the consumers of AI in China industrial and manufacturing. Medicine. Logistics. The real economy. We’ve shared our own experiences in Chinese factories that use AI for everything, and the efficiencies that are hard to believe, even as we’re standing there and seeing it for ourselves.

China is determined to lead the world in AI by 2030, and in stark contrast to the AI industry back home, everyone here is making money, with forecasts of 52% return on capital by 2030. China has access to more user data than any other country, more cheap electricity than any other country, and half of the world’s top AI researchers and patents.

In the US then, companies are abandoning AI projects, but in China it’s the opposite. Industrial enterprises’—factories, logistics, warehousing, engineering—application of AI more than quadrupled in a single year, to 47.5%. Over a third are deploying it across multiple functions.

This researcher at the NDRC basically is telling us here that this is a government initiative. “Manufacturing is the focal point of competition among major powers”. Promoting AI-driven industrial upgrading is paramount for the Chinese economy.

This piece goes on for several pages, with company-specific examples of how they’re creating efficiencies and cutting costs. The “bottleneck is that there are still constraints in computing power.”

Nvidia executives read that part and realize that this is a problem China is aware of, and China is determined to solve, and if they do so without Nvidia chips they’ll never be able to sell them anywhere. So giving up 15% of their revenues for Trump to play with is a small price to pay, just to be part of the conversation here.

Be good.

Resources and links:

AI in China: A Sleeping Giant Awakens

https://www.morganstanley.com/insights/articles/china-ai-becoming-global-leader

Thirsty for power and water, AI-crunching data centers sprout across the West

https://andthewest.stanford.edu/2025/thirsty-for-power-and-water-ai-crunching-data-centers-sprout-across-the-west/

Eye-Popping Electric Bills Come Due as Price of AI Revolution

https://www.newsweek.com/ai-data-centers-why-electric-bill-so-high-2109965

The looming power crunch

https://www.se.com/ww/en/insights/ai-and-technology/artificial-intelligence/looming-power-crunch/

The AI revolution is likely to drive up your electricity bill. Here's why.

https://www.cbsnews.com/news/artificial-intelligene-ai-data-centers-electricity-bill-energy-costs/

McKinseyThe gen AI paradox: Widespread deployment, minimal impact

https://www.mckinsey.com/capabilities/quantumblack/our-insights/seizing-the-agentic-ai-advantage#/

New York Times, Companies Are Pouring Billions Into A.I. It Has Yet to Pay Off.

https://www.nytimes.com/2025/08/13/business/ai-business-payoff-lags.html

Bloomberg, Is the AI Winter Finally Upon Us?

https://www.bloomberg.com/opinion/articles/2025-08-18/is-chatgpt-5-the-start-of-ai-winter

AI powering China's industrial evolution

https://www.chinadaily.com.cn/a/202508/18/WS68a26728a310b236346f2129_2.html

This is the critical detail that could unravel the AI trade: Nobody is paying for it.

New York Times, U.S. Government to Take Cut of Nvidia and AMD A.I. Chip Sales to China

https://www.nytimes.com/2025/08/10/technology/us-government-nvidia-amd-chips-china.html

Trump’s Unconstitutional Export Tax Is Probably Here to Stay

https://www.cato.org/commentary/trumps-unconstitutional-export-tax-probably-here-stay

EIA: Electricity prices to rise faster than inflation through 2026

Nvidia, caught in the US-China trade war, takes a $5.5 billion hit

https://www.cnn.com/2025/04/16/tech/nvidia-plunge-h20-chip-china-export-intl-hnk

Nvidia reportedly orders suppliers to stop work on China AI chip but says new chip in the works

https://www.euronews.com/next/2025/08/22/nvidia-reportedly-orders-suppliers-to-stop-work-on-china-ai-chip-but-says-new-chip-in-the-

I thought I read somewhere that Howard Lutnik let the cat out of the bag bragging that the H20 chip wasn't first rate, not second rate not even third rate and they were only selling it to China to get them addicted to it so they could have some leverage later (or words to that effect). This infuriated the Chinese and the government has been actively dissuading companies from using it.

So that's why my electric bill suddenly cranked up! 🤬

And no, I sure as hell won't pay for AI. I can barely pay for my tracfone. Not to mention my heat.