Bullets:

Reports that Ukraine will pledge its vast reserves of rare earth metals and other strategic minerals in exchange for hundreds of billions of dollars worth of loan forgiveness and additional aid have supply chain managers perplexed.

No honest assessment of Ukraine's mineral assets comes anywhere close to the numbers that top government officials claim.

The US Geological Survey, and even publications from Ukraine's ministries report only trace amounts of rare earth metals anywhere in the country.

Even were we only to consider non-rare earths, other problems become apparent. Many of those reserves are in Russian hands, and much of the rest can not be commercially mined at current market prices.

The situation in Ukraine is alarmingly similar to Afghanistan, where Pentagon assessments of Afghan mineral reserves dramatically overstated their actual size and market value, while giving war planners additional time and resources to prosecute what was ultimately a losing war effort.

Report:

Good morning. Minerals experts and supply chain managers and even military historians are now in good company, in that we are deeply skeptical of the latest developments in Ukraine, and their promise to pledge $500 billion worth of rare earth metals as some kind of guarantee on the aid they’ve been given. The reason we’re skeptical is that we’ve seen this movie before, in Afghanistan.

War planners and politicians who support the wars are looking for solid reasons to keep them going, and pretend that wars can pay for themselves. In the case of Afghanistan, it was a giant trove of mineral deposits, including lithium. That went nowhere—“a complete fantasy”, as this Bloomberg writer here puts it. And now we’re doing it again in Ukraine.

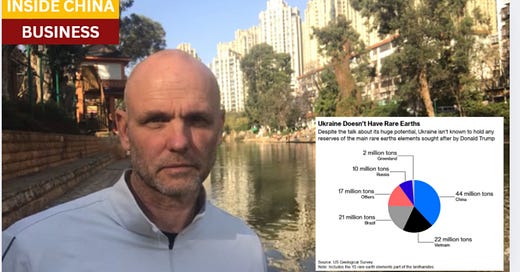

Simply put, Ukraine doesn’t have any rare earth metals. Here’s a chart that explains why we would love to find some in friendly countries: China, Vietnam, Brazil, Russia, Greenland—which is part of Denmark but this chart explains a lot of the rhetoric on Greenland.

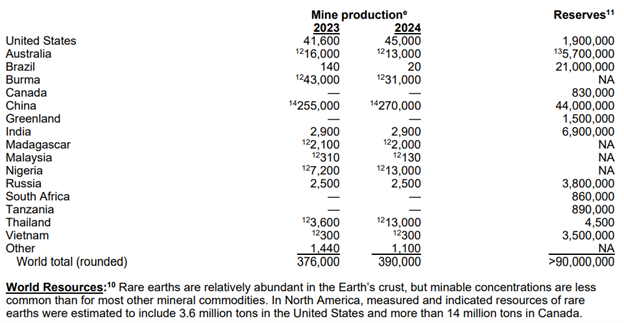

Here is the actual report from the US Geological Survey. And this one is very different from others we’ve done lately, because the United States does have significant rare earth mining production. 45,000 tons, through 2024. China is 270,000 tons and is more than the rest of the world, combined, but at least the US is on the board, for a change, in the #2 spot. Proven reserves are a problem for the US, however, with just 1.9 million tons of reserves, which puts us far below the BRICS countries. Still, we have 50 years’ worth of production at current rates though. But Ukraine doesn’t show up on this list, either as a producing country, or one with significant reserves.

So where does it come from, this idea that Ukraine is the answer to the problems posed by the BRICS countries on this chart? China and their closest allies do dominate the worldwide production and reserves of rare earths, and that’s the argument that is being used, here.

And this is where the story gets weird. It was the Ukrainians, first, who went to Europe, and later to the US, with the idea that Ukraine had vast, untapped raw materials reserves of gigantic value, including rare earth metals. The Ukrainian Geological Survey and the Ministry of Mining published this report, a critical minerals assessment. This was presented to the EU, and promotes investment and mining opportunities for Europeans who don’t have their own sources of Titanium, Lithium, graphite, nickel and cobalt, and rare earth metals.

But in their own report, the rare earth metals section only shows proven reserves of 15 thousand tons. They lump that tiny number in, though, with some other raw materials to get this graphic, that suggests 100 million tons of materials for electronics and phosphates.

Back to Washington then, where nobody in the mining industry, and even in the mining industry in the Ukraine, believes that Ukraine has huge reserves of rare earths. So industry insiders are perplexed with this $500 billion number that is thrown around now, and that Ukraine will sign a deal to pledge these vast reserves – which don’t exist – in exchange for debt forgiveness for everything up to now, and a blank check going forward. Ukraine doesn’t have it.

But let’s pretend they did. All the rare-earth production on the planet totals $15 billion per year. And let’s pretend, further, that Ukraine magically created 20% of the world’s rare earths and could be pulling them out of the ground starting right now. Ukraine’s output would be $3 billion a year, which divided into $500 billion is 166 years. Compared to oil and copper, rare earth mining barely shows up on a line chart. It’s not even fair to present the data this way.

Now Ukraine does have other materials, besides trace amounts of rare earths. Problem is that many of those are in Russian-controlled areas, and Ukraine’s commercial mines for titanium and gallium also don’t get us anywhere close to $500 billion. And it’s here where we find a common theme—it’s not a mistake, because it’s deliberately confusing—it’s using proven reserves to formulate policy, deliberately misleading investors and policymakers into believing that we’re just a few dollars away from having commercially viable mines. It doesn’t work that way in the real world. The Soviets discovered these deposits decades ago, but nobody bothered going after them. The Ukrainians themselves said that the recovery would cost much more than the market value for them.

But here things get weird again. Bloomberg refers us to this report, from December, from the NATO Energy Security Center of Excellence. This is the webpage for the report, and it seems to be an official NATO assessment of Ukraine’s critical raw materials, and how important they would be to the security of Europe.

This is the PDF of the report, and the image at the top right corner has the NATO logo on it. And the report is declarative, the Ukraine is a key potential supplier of rare earths, listed here:

But none of those materials in that paragraph are rare earth metals. What’s more, this report did not really come from NATO. A NATO spokesman says that it’s an opinion piece, instead of an official NATO document, but the document doesn’t disclose that. Bloomberg concludes here that if these are not the kinds of assessments should be guiding the White House. It’s cut-and-paste diplomacy. Kafkaesque.

And all of this is disturbingly familiar to people who remember Afghanistan, where the Pentagon claimed to have discovered over a trillion dollars worth of minerals there. This is the New York Times’ account from over a decade ago, and let’s see if any of this sounds like the same playbook they’re running now, in Ukraine.

The mineral discoveries in Afghanistan are “far beyond any previously known reserves”—that should make us nervous—nobody had any idea there were there at all until the US Army showed up. (Paraphrase follows) But it would transform the Afghan economy and the war. Huge veins of iron, copper, cobalt, gold, and lithium—the reserves are so big and include so many different minerals that Afghanistan would become one of the most important mining centers in the world. It could be the “Saudi Arabia of Lithium”, according to an internal defense memo.

It will take a long time to develop the mining industry in Afghanistan, but the potential is so enormous that big investments would be made anyway. Afghan minerals will dwarf everything Afghanistan is doing now, and will be the new backbone of the Afghan economy.

How familiar does this part sound? The mineral discoveries come at a difficult time in the war. The American offensive is going nowhere, the Afghan government is being accused of corruption, and the White House is desperate for any good news they can bring home to keep the wheels turning a while longer. On the downside, these discoveries might encourage the Taliban to fight even harder, and lead to even greater levels of corruption that Afghanistan is already world-famous for.

Next, the Pentagon of course had to spend millions of dollars with their friends on Wall Street and consultants, just to get contracts written and investment circulars printed up.

This is what got everyone excited back in 2010, and this sounds familiar too. They found some old charts that the Soviets put together, decades ago. Then we put some gravity and magnetic measuring equipment on an old P3 that flew over Afghanistan. The results of that made everyone happy, so we took an even older British bomber and installed equipment that shows a 3-D profile of mineral deposits below the earth’s surface. It was the most comprehensive geological survey of Afghanistan ever conducted.

Now. If you’ve never heard of this technology, this capability to fly over a place and do a 3-D map of underground geology, it’s because it doesn’t exist. There was a brief time period where we thought it might work. But it doesn’t. I was pulling articles that explain why, but a New York Times subscriber did that work for me, thankfully, and wrote up a comment for the article:

Airborne gravity surveys work only for surface basins, not for anything underground, and unless the aircraft was zipping around Afghan mountain ranges at low altitude—dangerously low—it would have been useless. And the 3D profile idea that the Pentagon ran with doesn’t exist at all. This whole thing sounds like political hype and is generally untrue, the part about the lithium possibly excepted. The US Geological Survey is solid for doing the maps and estimates, but not terrific at estimating commercial viability of mines. Thank you, Doodlebugger, you saved me 3 hours.

We know how this all ended in Afghanistan—it went nowhere, the Taliban took over the whole country. And China did go in, but China didn’t stay long. One of our concerns was that China would snap up Afghanistan and all these giant reserves, but that also went nowhere. Chinese companies have strong relationships with countries that are far more stable and less corrupt than Afghanistan, and China’s also got plenty of rare earth metals of their own. Inner Mongolia is a province here, different from the country, and they have over 48 million tons just there, in Nei Mogu. In contrast, the biggest reserve in Afghanistan might have 1.3 million.

Lithium is a different matter, and China’s got big investments in South America, in their Lithium Triangle. But China’s investments in Argentina, Chile, and Bolivia were already well established and in heavy production, and Chinese companies didn’t bother with the Afghanistan lithium.

One Chinese company spent $371 million, as the first installment on a $2.8 billion deal for a copper mine, but gave up before investing the rest. “Numerous allegations of corruption.” So the Chinese company cut their losses and went home. They got off cheap, compared to us.

There’s a lesson in there for us somewhere, that China does everything faster and cheaper than we do these days, including figuring out there’s no point in trying to make a go of Afghanistan. And that’s the lesson for Ukraine too. If Ukraine did have vast deposits of rare earth metals that were commercially viable, they would be already under production, and China would already be buying the ores and bringing them back here to be refined. They’re not doing that, because there’s nothing there.

Resources and links:

US Geological Survey, Mineral Commodity Summaries 2025

https://pubs.usgs.gov/periodicals/mcs2025/mcs2025-rare-earths.pdf

Afghanistan Is No Treasure Trove for China

https://foreignpolicy.com/2021/09/28/afghanistan-china-rare-earth-minerals-latin-america-lithium/

Rare Earths in Ukraine? No, Only Scorched Earth.

Ukrainian Geological Survey, The EU-Ukrainian Strategic Partnership on Critical Minerals

https://www.geo.gov.ua/wp-content/uploads/presentations/en/critical-minerals-portfolio.pdf

Ukraine’s resources. Critical raw materials

https://www.enseccoe.org/publications/ukraines-resources/

U.S. Identifies Vast Mineral Riches in Afghanistan

https://www.nytimes.com/2010/06/14/world/asia/14minerals.html

A 2nd rate comedian turned dictator is full of deceit up his sleeves. I doubt such amount exist. My take this clown who is not the elected leader of the country is playing the USA 😁

Great article, it pays to be skeptical!

This could be a geopolitical red herring for us to take a strategic position in Ukraine.

The do have metals other than the 17 rare earths, oil and gas, and fertile land.

You may like:

Redux - Putin's KGB Masterstroke: Fracking Banned in Europe

Europe and Ukraine have massive reserves and more recoverable shale gas than the U.S.

https://tucoschild.substack.com/p/redux-putins-kgb-masterstroke-fracking